BNB Shatters Records: $133B Market Cap Surge as ATH Rally Ignites FOMO

Binance's native token goes supernova—again. The crypto that just won't quit smashes through its all-time high, dragging a $133 billion valuation into orbit. Traders pile in as breakout hype reaches deafening levels.

Anatomy of a parabolic move

No fancy derivatives or obscure catalysts here—just pure, unfiltered market mania. BNB's relentless climb leaves skeptics scrambling (and bagholders from 2021 finally breaking even). The 'blue chip' altcoin now flirts with a market cap that'd make some small nations blush.

Wall Street analysts, caught off-guard as usual, rush to slap new price targets on what was already their 'top pick' last quarter. Meanwhile, decentralized rivals watch through clenched teeth—their 'ETH killer' narratives gathering dust.

Warning lights flash

Liquidity pools swell to dangerous levels, exchanges report record leverage positions, and that one crypto influencer who called the bottom is now shilling merch. All the classic signs of a top? Probably. But try telling that to the degens minting six figures on perpetual swaps.

As institutional money pours in—or more likely, some hedge fund's quant bot malfunctioned—the real question emerges: When does the 'healthy correction' become a 'rug pull'? Place your bets. (Just maybe keep some dry powder for when the 'We told you so' tweets start flying.)

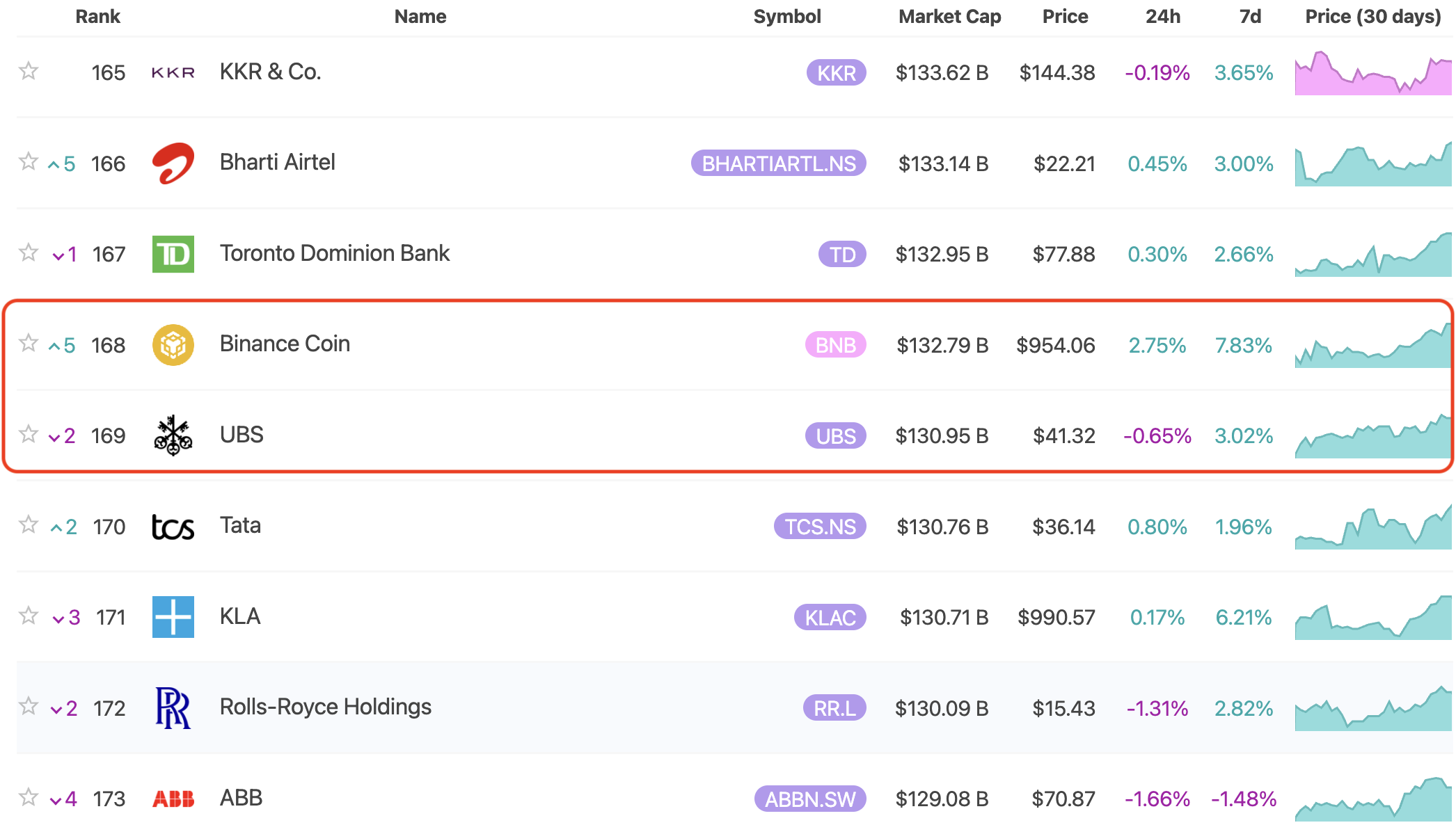

New Position for Binance

Binance Coin (BNB) has set a new all-time high (ATH) at $955, driving its market capitalization to roughly $132–133 billion. This MOVE has placed BNB among assets comparable in scale to some of the world’s largest traditional corporations and institutions. BNB’s market cap has surpassed UBS, ranking 166th in global asset market capitalization.

BNB’s new ATH may stem from Binance exiting the US Department of Justice (DOJ)’s compliance monitoring phase. Previously, the DOJ had taken several legal and supervisory actions against Binance over violations related to money laundering, lack of compliance controls, and breaches of financial security regulations. This is a major signal as it removes one of the most significant “regulatory overhangs” weighing heavily on the exchange.

At the same time, Binance’s former CEO Changpeng Zhao (CZ) updated his X profile with new information linked to Binance. This has sparked speculation about CZ returning to the company in a new role.

The partnership between Binance and Franklin Templeton further boosts credibility. It reinforces the narrative of the BNB ecosystem being recognized as infrastructure for traditional financial products. This could pave the way for more on-ramp applications and increase real-world demand for BNB within the ecosystem.

BNB Closing in on $1,000

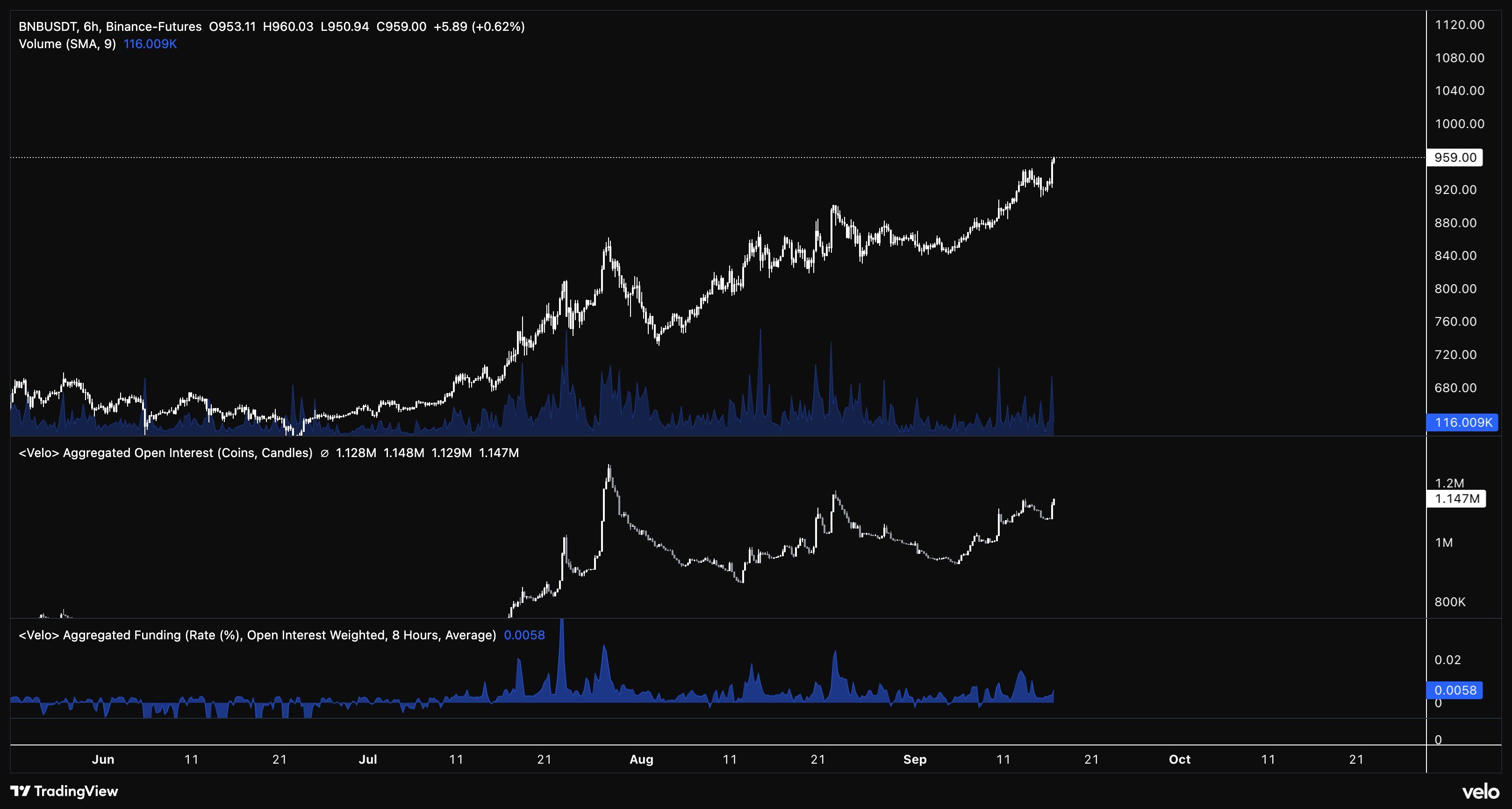

A closer look at derivatives data and market sentiment paints an interesting picture. Open Interest remains very high while funding rates have “spiked down.” This setup leads one trader to believe BNB still has room to climb. However, he also warned of a potential sharp correction over the weekend. Nevertheless, he remains confident that BNB could touch $1,000 before any significant pullback.

“I expect the market to roll over by week’s end, but it looks good for a push to ~$1k,” the trader noted.

From another perspective, analyst Kaleo observes that the BNB chart is “clean” and resembles the setup before its breakout in early 2021. If history repeats itself, a run toward $1,000 appears entirely plausible. However, investors should remember that DEEP pullbacks often follow large breakouts before the uptrend continues.

Additionally, some market participants favor L1s like SOL and BNB over ETH in the short term. The reasoning is that ETH already had a major run previously, and new capital is now flowing into “less overheated” assets. This rotation could add more buying pressure for BNB if capital flows shift as expected.