Why Savvy Investors Are Ditching US CPI Data in 2025

Smart money's walking away from government inflation metrics—and they're not looking back.

The Flawed Gauge

Traditional CPI measurements miss crypto's real-world impact. They track grocery bills and rent, but ignore digital asset inflation hedges that actually protect portfolios.

Data Lag Disaster

Month-old inflation data can't compete with real-time blockchain analytics. By the time CPI drops, institutional traders have already priced in movements through on-chain metrics.

Alternative Metrics Win

Fund managers now track tokenized commodity prices, stablecoin flows, and DeFi yield rates—actual market signals instead of politically-massaged government numbers.

Trust evaporated faster than a shitcoin rug pull—when your inflation gauge ignores the fastest-growing asset class, you're not measuring the economy, you're measuring bureaucracy's comfort zone.

More CPI Prices Are Now “Best Guesses”

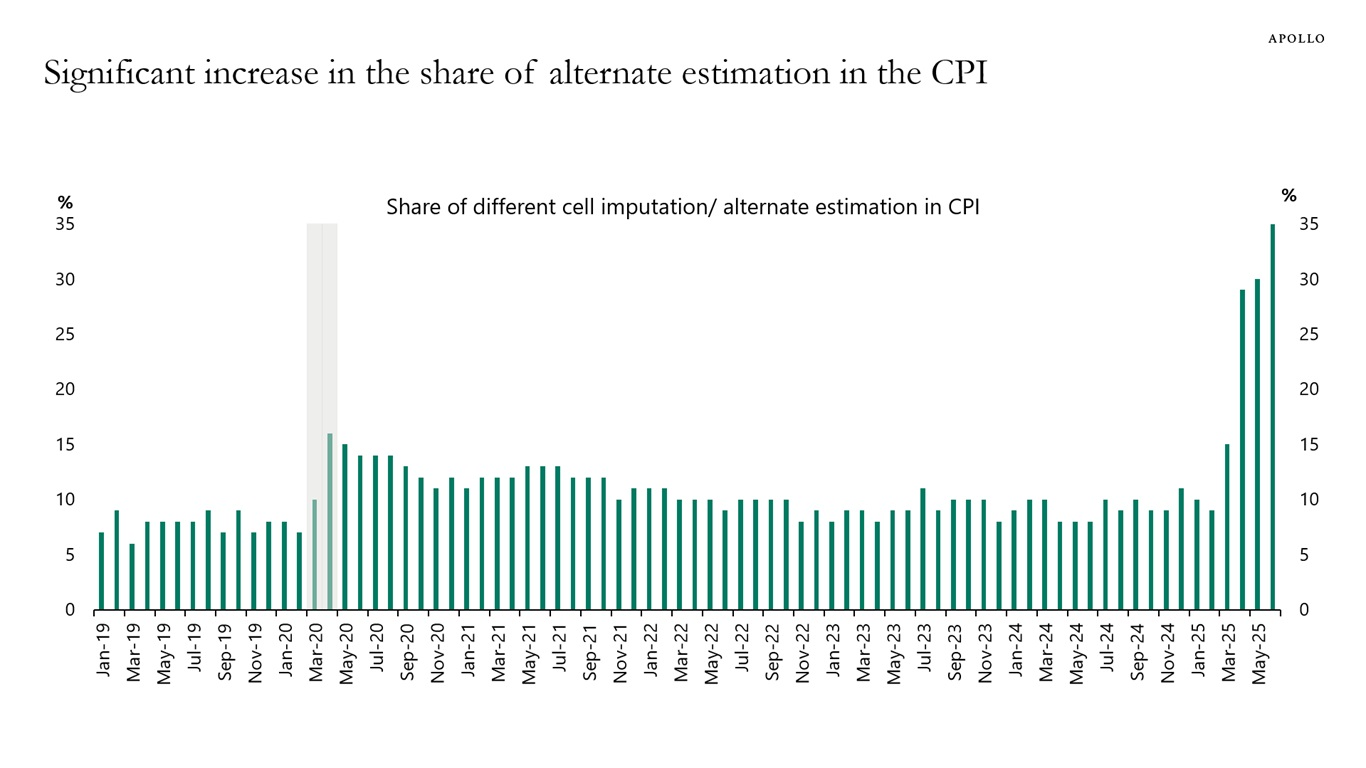

The share of estimated prices in the US CPI climbed to 36% in August 2025, according to figures highlighted by market commentary outlet The Kobeissi Letter and confirmed by Bureau of Labor Statistics (BLS) methodology. That is up from 32% in July and represents the highest proportion since the BLS began tracking the metric.

Ordinarily, the CPI is compiled from about 90,000 monthly price quotes across roughly 200 categories of goods and services collected by several hundred field staff in 75 urban areas. When price data is missing, the BLS uses a “different-cell imputation” technique to fill gaps, drawing on related categories or comparable items. Historically, only about 10% of the index required such estimation.

However, since the second half of 2024, reliance on imputation has risen sharply, surpassing 30% throughout 2025. Analysts attribute the increase to pandemic-related data collection challenges, shifting consumption patterns, and difficulty obtaining timely quotes for volatile categories like housing and medical services.

Markets Eye Fed Policy amid Data Questions

The CPI is the Federal Reserve’s primary gauge of consumer inflation and a cornerstone for interest rates and monetary policy decisions. A widening divergence between perceived household price pressures and official data could complicate the Fed’s inflation-targeting strategy and erode public confidence in its policy signals.

“Markets rely on CPI for a clear read on inflation,” said one independent economist. “If more than a third of the index is based on estimates, that introduces noise and raises questions about how accurately the data reflects real consumer costs.”

Investors already on edge over the Fed’s next moves may become more volatile if doubts about CPI accuracy persist. Bond markets, in particular, could see sharper reactions to CPI releases if traders suspect that headline figures understate actual inflationary trends.

Pressure Builds for BLS Transparency

Economists and market participants are urging the BLS to provide more detail on which CPI components rely on imputed data and how those estimates are derived. While imputation is a standard statistical practice, the scale of its current use has surprised many observers and underscores the need for robust disclosure.

For now, the BLS maintains that its procedures meet established statistical standards. Still, with the proportion of estimated prices at record levels, pressure is mounting for the agency to bolster confidence in one of the world’s most closely watched economic indicators.