3 Compelling Reasons PUMP’s Rally Isn’t Slowing Down—Even After Whales Dump $8 Million

Whales are cashing out millions, but PUMP's momentum keeps defying expectations. Here's why this token might just keep climbing.

Strong Retail Support Outweighs Whale Sales

Retail investors are snapping up every dip—creating a solid floor that absorbs the $8 million sell-off without breaking stride. Community-driven tokens thrive on grassroots energy, not whale whims.

Technical Breakout Signals More Upside

PUMP smashed through key resistance levels and hasn't looked back. Chart patterns suggest this rally's just getting warmed up—technical analysts are eyeing another leg higher.

Market Dynamics Favor Momentum Plays

With crypto markets heating up again, speculative assets like PUPP are catching fire. Traders are chasing momentum, and this token's got it in spades—whale sales be damned.

Sometimes the market makes no sense—which is why traditional finance hates crypto. While suits worry about 'fundamentals,' PUMP's chart keeps printing green. Guess which one pays better?

Selling Pressure Mounts, but Smart Money and Retail Flows Hold the Line

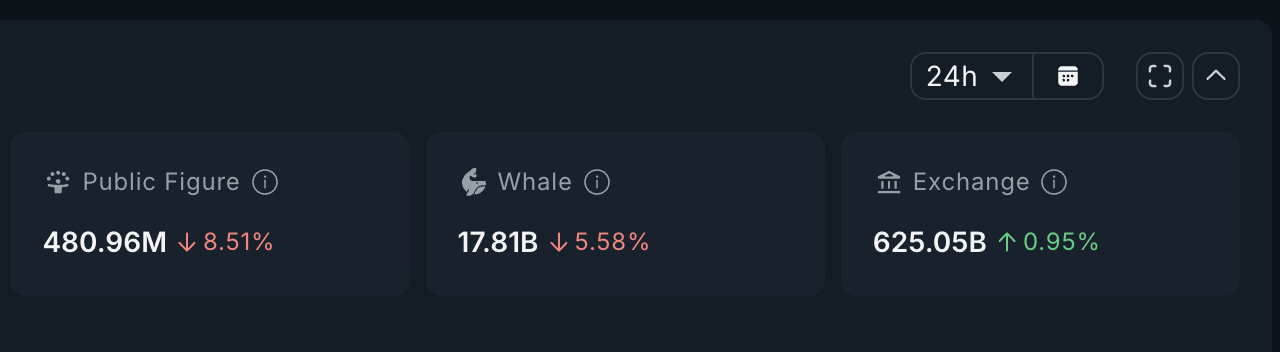

The last 24 hours saw whales cut their holdings by 5.58%, leaving 17.81 billion tokens. At current prices of $0.00775, that’s roughly $8.26 million worth sold.

Exchange balances also ROSE by about 5.88 billion to 625.05 billion, suggesting retail selling, or rather, profit booking. Even public figure wallets joined in, reducing their stash by 8.51% to 480.96 million.

In summation, PUMP recently experienced selling pressure of almost $55 million as key cohorts offloaded.

On paper, this explains the 5% dip. But two signals suggest the selling spree may not derail the bigger rally.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

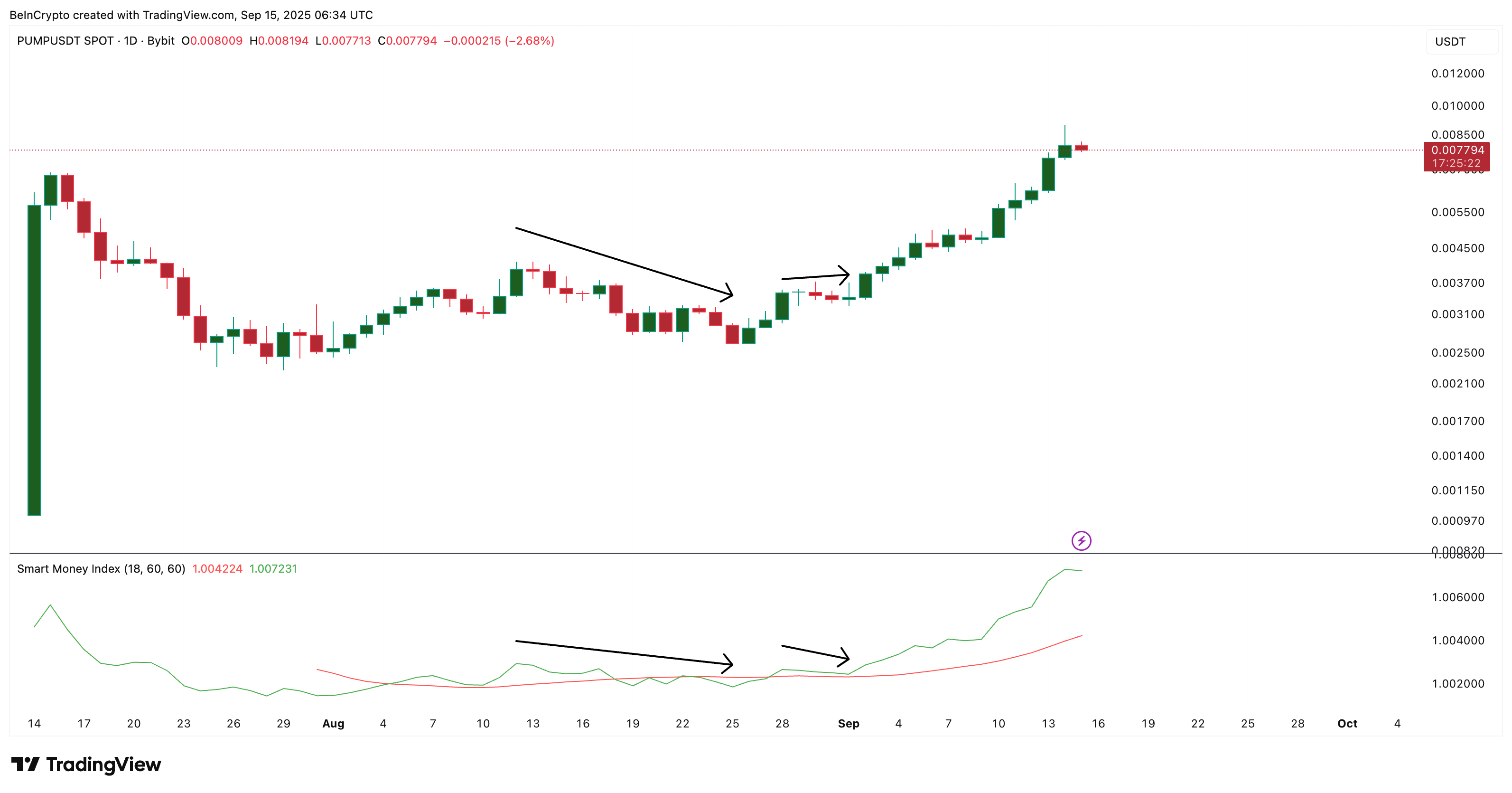

First, smart money flows have not rolled over. Wallets tagged as sharp traders are still positioned higher than earlier in September, showing that experienced players are not exiting. The recent flatlining in smart money looks similar to late August, when PUMP went sideways before resuming its climb.

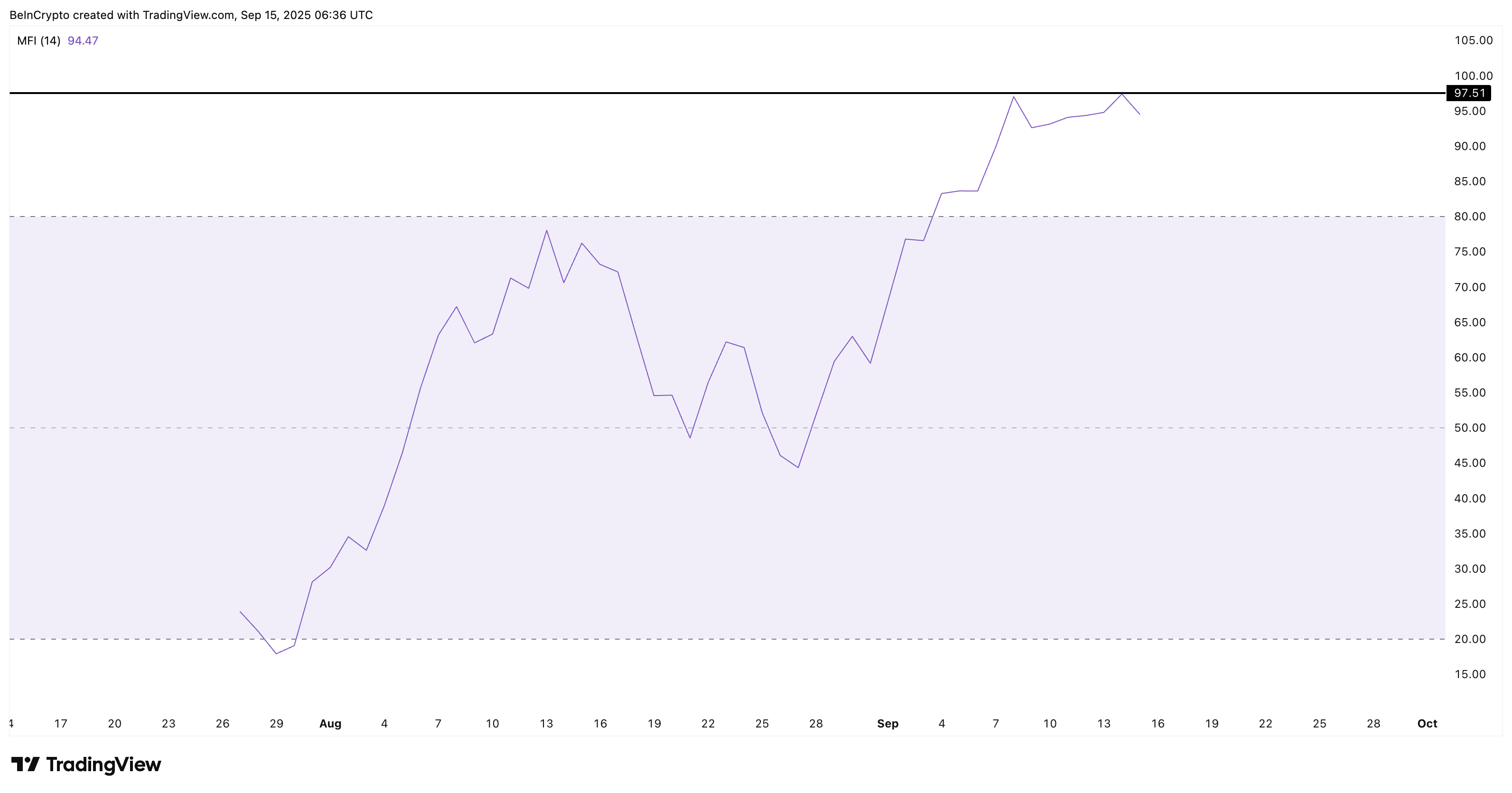

Second, retail demand is still there. The Money FLOW Index (MFI), which measures buying pressure by blending price and volume, has made a higher high at 97.5. That’s above its September 8 peak, which preceded a 65% rally.

Rising MFI even as whales sell signals that dip buyers are stepping in.

Together, this mix of whale offloading and retail absorption sets the stage for a pullback rather than a collapse.

Channel Pattern and Bull-Bear Signals Show PUMP Price Path Still Bullish

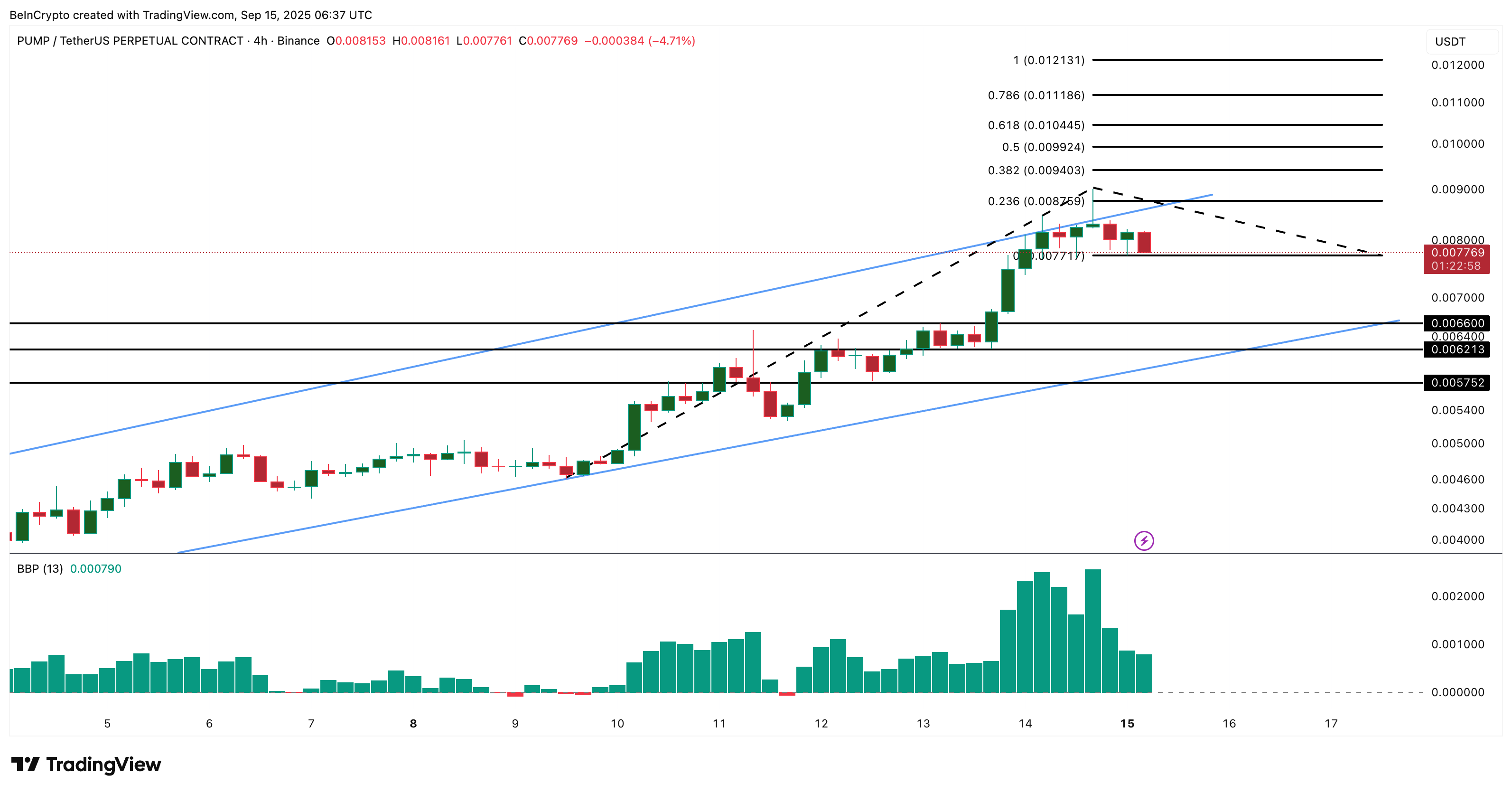

To gauge near-term strength, the 4-hour chart gives the clearest view of PUMP’s short-term levels. It captures intraday shifts that the daily chart may smooth over, making it ideal for spotting pullbacks.

Here, the bull-bear power indicator — which measures whether buyers or sellers are stronger by comparing prices to an average line — still shows bulls in control.

Even as PUMP has moved sideways and dipped slightly, buyers continue to defend the $0.00771 level, close to where it trades now. This defense is critical, as it signals that bulls are not giving up ground easily.

At the same time, the PUMP price action remains inside an ascending channel, which happens to be the third bullish reason after the SMI and MFI. If selling deepens, supports sit at $0.00660 and $0.00621. Even a pullback to those levels WOULD not break the channel, keeping the broader rally alive. Only a confirmed close below $0.00575 would flip the bias from bullish to bearish.

However, if the PUMP price reclaims $0.00876 (close to its all-time high) with a complete candle close, it would mean that the pullback has run its course.

And it would then prime the price to reach newer highs by helping break the bullish channel pattern, with the next set of targets sitting at $0.00940 and $0.009924.