WLFI Ignites Market Frenzy with Treasury-Backed Buyback and Burn Launch

WLFI just dropped a deflationary bomb—and the market's feeling the shockwaves.

Treasury-powered token annihilation kicks into high gear

The protocol's war chest opens fire on circulating supply, permanently removing WLFI tokens from existence. No gentle retirement—this is outright destruction. Treasury reserves get deployed like strategic missiles targeting inflation.

Deflation mechanics on steroids

Every burned token tightens supply while theoretically boosting scarcity. It's basic economics—fewer tokens chasing same demand equals upward pressure. Traditional finance would call this stock buyback 2.0, but with blockchain's trademark transparency.

Market reacts with typical crypto volatility

Traders pile in anticipating price pumps, while skeptics eye the treasury's sustainability. Because nothing says 'sound monetary policy' like artificially inflating value through controlled supply shocks—Wall Street would be proud.

One thing's clear: WLFI isn't playing gentle. They're burning tokens like there's no tomorrow—and betting everything that tomorrow will cost more.

Catalyst: ‘Buyback & Burn’ on WLFI

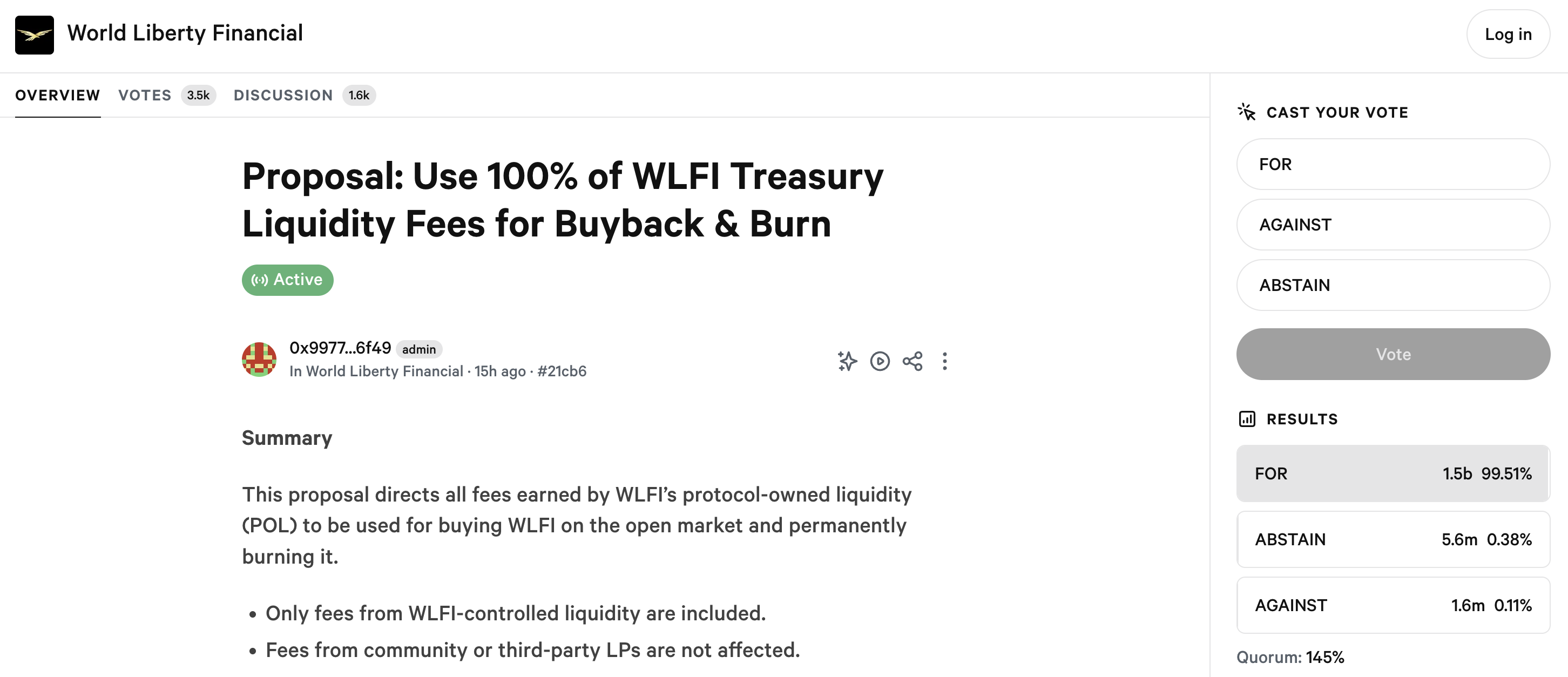

World Liberty Financial (WLFI) has just launched a key proposal: redirect 100% of treasury liquidity fees to market-buy WLFI tokens and permanently burn them across multiple chains. In fact, this route fees – market-buy – permanent burn approach is a well-known catalyst used by projects like HYPE, PUMP, and TON.

From an economic perspective, buyback & burn is an effective deflationary mechanism. The “automatic” demand generated by protocol activity (liquidity fees) will purchase tokens on the spot market, and burning will permanently reduce the total supply. As a result, assuming demand remains stable or increases, prices could re-rate upward.

However, its full impact depends on two key factors: the amount of fees collected by the treasury and the frequency/timeline of the buybacks. The buyback impact will be limited if daily/weekly fees are still small relative to market liquidity. Conversely, the mechanism can deliver a significant effect if the treasury generates large and consistent fee flows.

If approved and executed transparently, this buyback-and-burn mechanism could help revive WLFI’s price, which has been severely depressed following governance risks and centralization concerns. Since launch, the controversy surrounding Justin SUN has sharply lowered WLFI’s price. At the time of writing, WLFI is trading at $0.1996, down 40% from its previous ATH.

However, implementing a buyback mechanism will not help boost token prices. Some analysts argue that crypto buybacks are seen as value-destroying rather than value-creating. They burn revenue that could have fueled growth through product development and user acquisition.

With emerging regulatory dynamics and a maturing industry, the focus should be on building transparent, efficient tokens for long-term investors. These tokens should act as on-chain equity, driving sustainable value over time.

“The market doesn’t need more buybacks. It needs productive tokens and patience.” The Moonrock’s founder commented.

Technical View

From a technical analysis perspective, several analysts on X note that WLFI is currently in a falling wedge pattern and may be nearing its bottom. Price action suggests a sharp reversal may be imminent, with upside potential of up to 50%, targeting $0.26.

In another analysis, a user on X observed that WLFI is testing the Point of Control (PoC) value zone after breaking out of a descending bearish channel on lower timeframes.

“A strong breakout above this PoC could spark a 30–40% short-term rally, with rising volume confirming momentum — one to watch closely!” CryptoBull stated.

These observations all suggest that a reversal may be very close. However, WLFI must still secure a confirmed close above key resistance and sustained trading volume to validate this move.

Moreover, while the burn mechanism is attractive, market confidence in governance (who controls the treasury, who signs buyback transactions, and how transparently burn reports are published) will largely determine its long-term effectiveness.