Bitcoin’s Historical Pattern Suggests $110,000 Floor is Imminent

Bitcoin's price trajectory echoes past cycles—suggesting a formidable support level at $110,000 that may defy downward pressure.

Market analysts point to recurring historical behavior where Bitcoin establishes strong psychological and technical barriers during bull runs. This time appears no different.

The $110,000 mark represents more than just a number—it's becoming the line in the sand where institutional accumulation meets retail conviction.

While traditional finance pundits scratch their heads about 'digital gold,' Bitcoin continues doing what it does best: making conservative portfolios look painfully outdated.

Bitcoin Risk Is Reducing

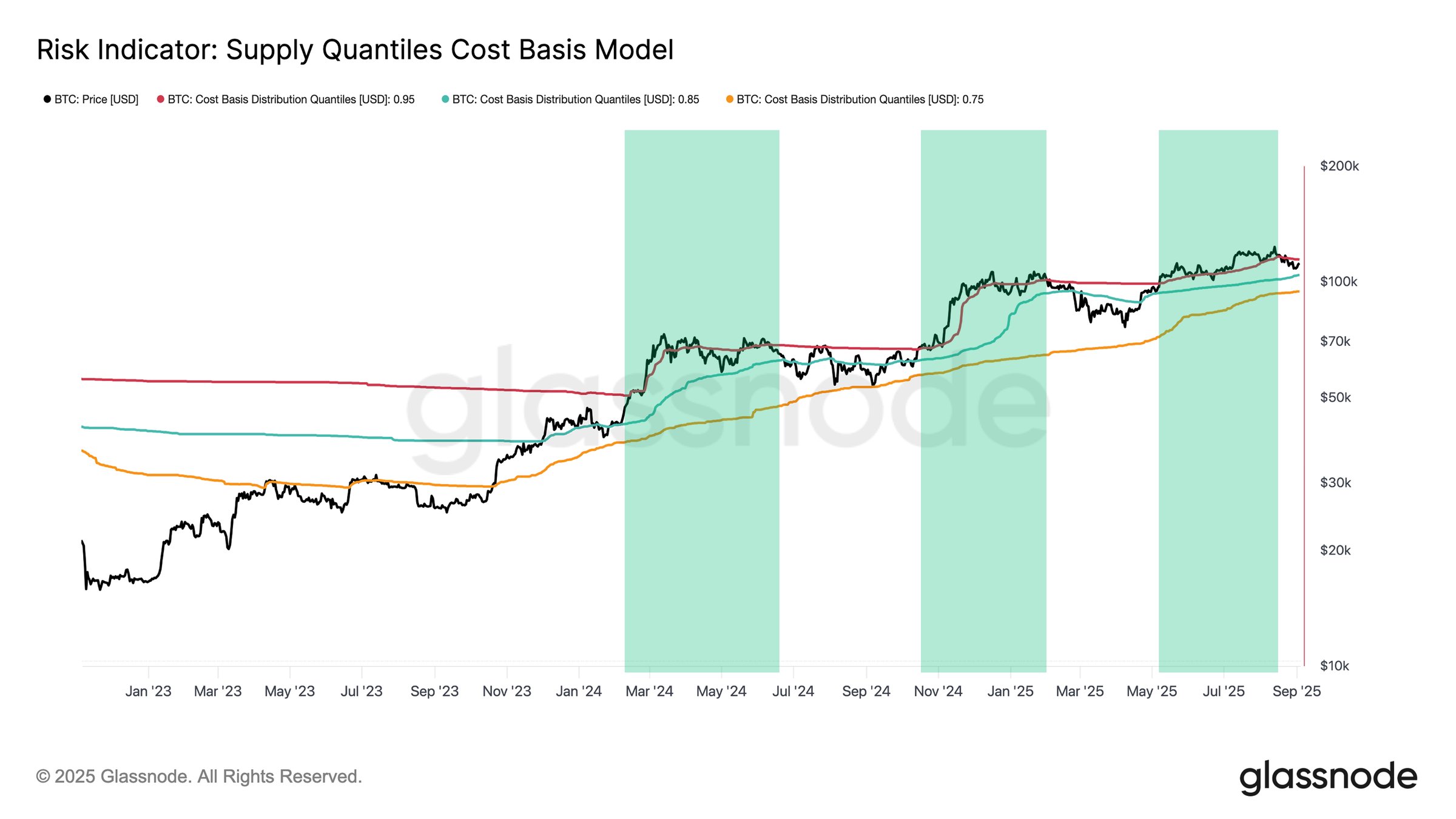

The supply quantiles risk indicator highlights this development. Bitcoin’s mid-August rally to new highs marked the third multi-month euphoric phase of this cycle, defined by surging momentum that placed nearly all supply in profit. This behavior is reflected by the 0.95 quantile cost basis, where 95% of supply holds unrealized gains.

The latest euphoric phase lasted about 3.5 months before demand showed exhaustion. At present, bitcoin trades between the 0.85 and 0.95 quantile cost basis, or roughly $104,100 to $114,300. Historically, this range has functioned as a consolidation corridor following euphoric peaks, producing sideways action as buyers and sellers balance.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

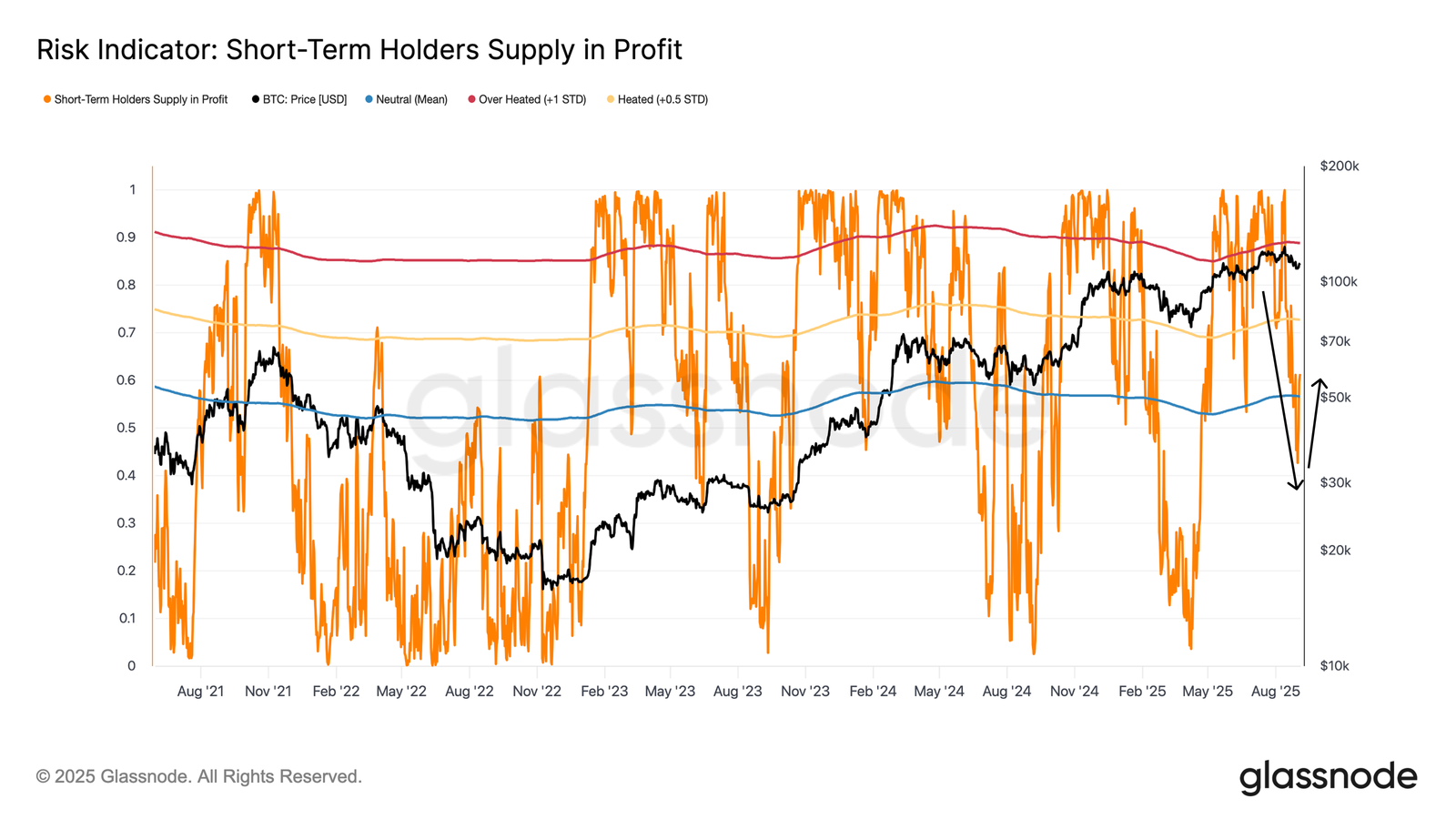

The percentage of short-term holder supply in profit offers further clarity. As Bitcoin slipped to $108,000, the share of short-term supply in profit collapsed from above 90% to just 42%. This sharp reversal reflected fear-driven selling, a common feature of overheated markets.

Following that drawdown, exhausted sellers fueled a rebound to $112,000. Currently, more than 60% of short-term holders are back in profit, a neutral condition compared to recent extremes. However, confidence remains fragile.

A sustained recovery above $114,000–$116,000, where over 75% of short-term holder supply WOULD be profitable, is needed to restore stronger demand.

BTC Price May Witness Extended Consolidation

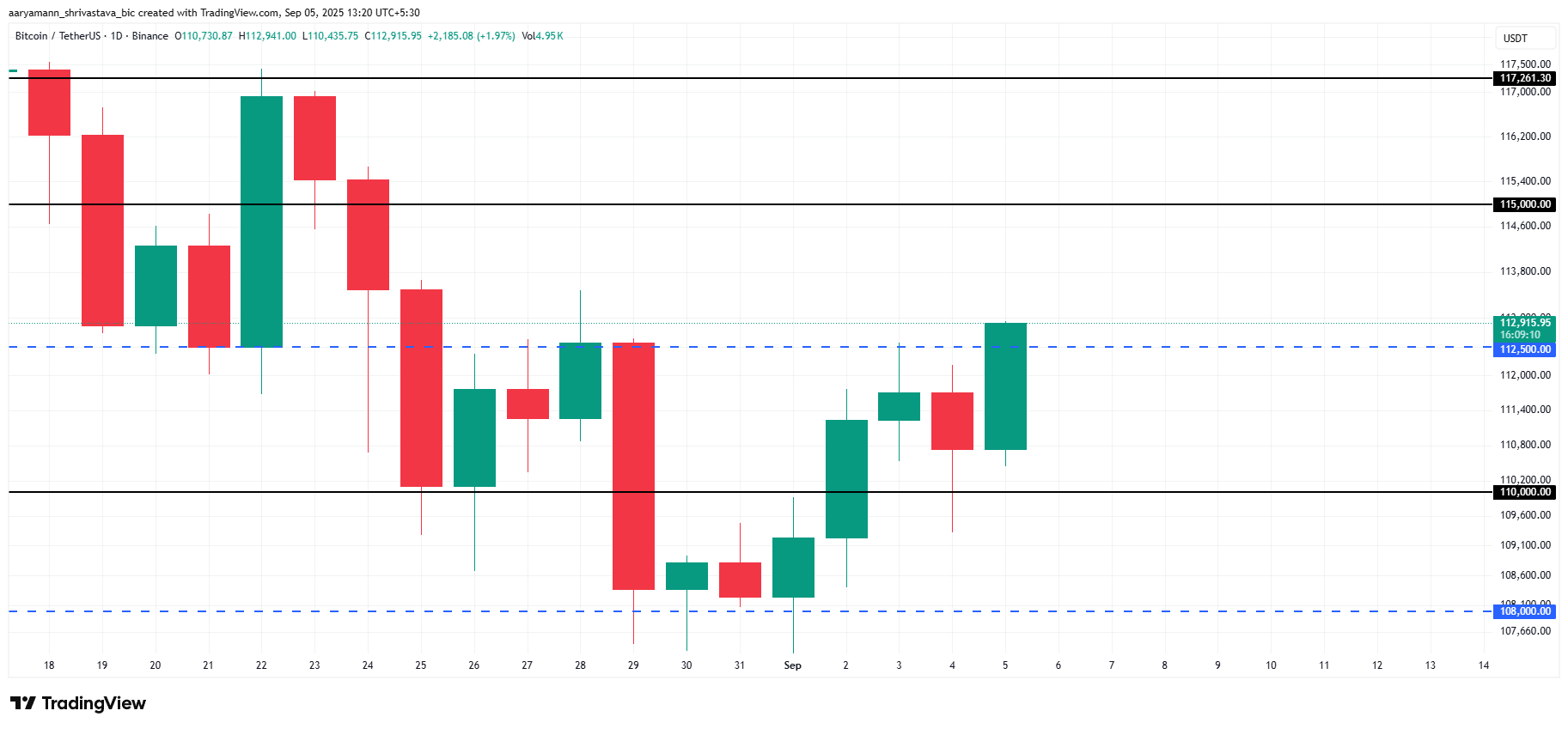

Bitcoin crossing the $112,500 resistance is encouraging, providing a path toward $115,000. This level is crucial for attracting new capital inflows, which would validate the recovery and increase the likelihood of sustained upward momentum.

However, historical patterns suggest consolidation remains likely. Bitcoin may settle under $115,000 or slip below $112,500, with sideways price action dominating the short term as the market absorbs recent volatility.

If profit-taking accelerates, Bitcoin could face sharper declines. A drop back to $110,000, or even a loss of this support, would weaken sentiment and invalidate the bullish thesis, leaving BTC vulnerable to extended consolidation or further downside.