Crypto Analysts Split as Bitcoin Dominance Disrupts Altcoin Hopes

Bitcoin's relentless grip tightens—altcoin dreams crumble as analysts wage war over the king's next move.

The Great Divide

Market watchers fracture into opposing camps while BTC's dominance metric punches through resistance levels. Some scream rotation play, others see altseason cancellation.

Institutional tidal wave fuels Bitcoin's ascent—ETF flows smash records while altcoins gasp for oxygen. Retail traders pile into blue-chip crypto as smaller projects bleed out.

Technical signals flash warning signs for ETH, SOL, and other majors. Correlation patterns break down as Bitcoin eats the entire market's lunch.

Meanwhile, crypto funds reposition portfolios—dumping alts for Bitcoin exposure. The 'digital gold' narrative strengthens while utility tokens face existential reckoning.

Seasoned traders shrug—they've seen this movie before. But newcomers learn the hard way: in crypto, even diversification can't save you from poor timing.

Wall Street's latest crypto play? Buying Bitcoin and shorting everything else—because why bet on the horses when you can own the racetrack?

Bitcoin Dominance Signals Trouble for Altcoins

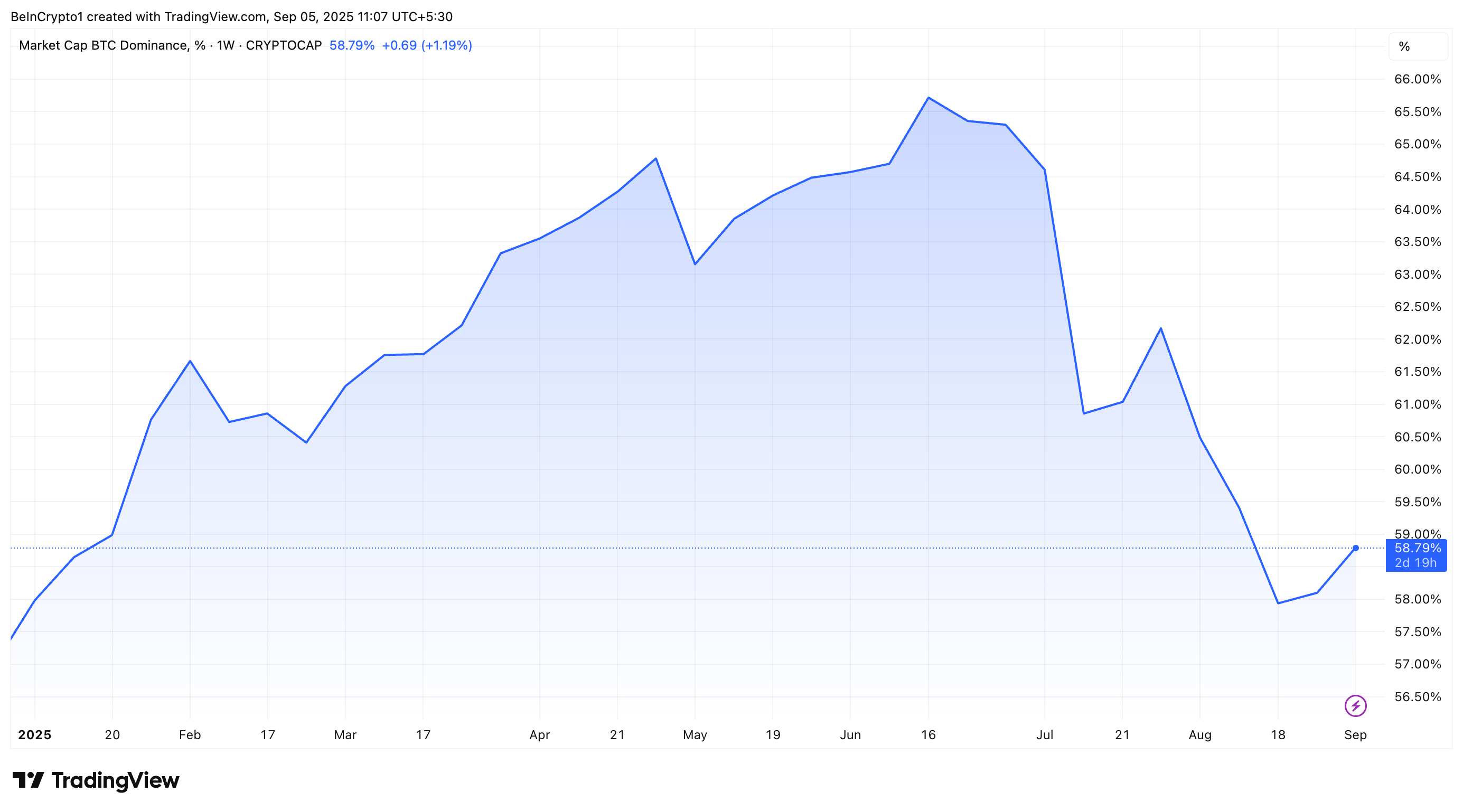

BeInCrypto reported previously that BTC.D broke a three-year uptrend in late July. Since then, the metric has been plunging continuously to multi-month lows, fueling Optimism among altcoin investors.

But markets rarely MOVE in straight lines. Recently, BTC.D has rebounded slightly, catching many traders off guard.

This reversal has reignited a critical question: Are the altcoin season prospects over? The answer could depend on how Bitcoin dominance behaves in the coming weeks, something that has the market divided.

According to Benjamin Cowen, CEO of Into The Cryptoverse, the rebound could mark the start of a larger trend. He projects BTC.D will continue climbing into early November, reversing earlier expectations that it WOULD steadily decline.

If Cowen’s outlook proves correct, the shift could spell trouble for altcoins, which rely on sustained inflows during Bitcoin’s quieter phases. However, the outlook is far from unanimous

Trader and analyst Crypto Rover noted that September has historically been a period when bitcoin dominance strengthens — a pattern that appears to be repeating this year. He suggested this could be the last major rotation before a true altcoin season takes off.

“If you have the majority of your portfolio in alts, this is the only chart you need to look at. ‘Bitcoin Dominance.’ It peaked for this cycle, and now a final dead cat bounce will happen this month. As Q4 starts, Bitcoin dominance will start going down again, leading to the much-awaited alts rally,” Cas Abbé added.

This is a possible scenario for Bitcoin dominance IMO.

A pump towards 60%-61% level followed by a dump in Q4 to new lows.

This'll be the perfect opportunity to accumulate alts before a big rally. pic.twitter.com/CLym3bpORk

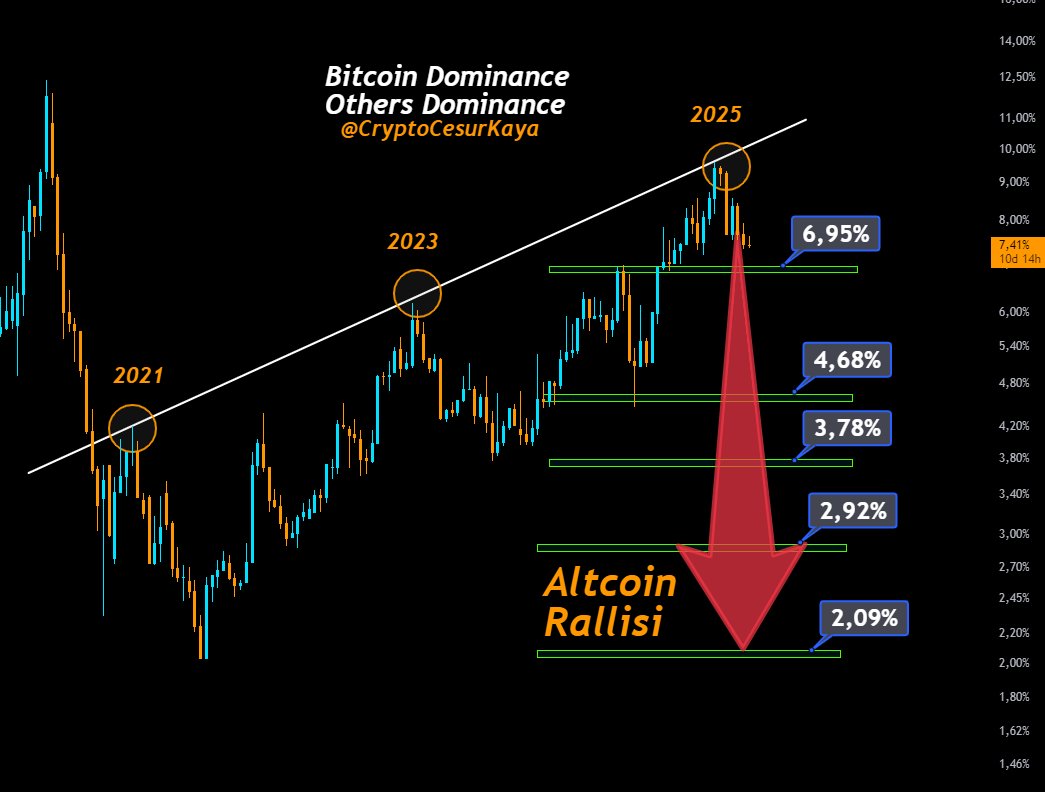

Another analyst pointed to chart patterns, arguing that Bitcoin dominance is on the verge of a sharp decline. He compared the current setup to cycles seen in 2021 and 2023, suggesting that once the drop begins, the impact of an altcoin rally will be unmistakable.

Merlijn The Trader also agreed with this perspective.

“BITCOIN DOMINANCE IS PLAYING OUT THE SCRIPT. Final altcoin shakeouts always look the same: brutal, violent, designed to trick you. And every time… the reward is altseason. The next phase isn’t about survival. It’s about positioning for vertical expansion,” he said.

Thus, all this paints a bullish picture for the altcoin season. But optimism alone doesn’t drive rallies; it needs to be backed by real buying power.

A CryptoQuant analyst highlighted that Tether (USDT) just minted $2 billion and sent it to Binance, which now has record-breaking USDT reserves. This is a strong signal that fresh liquidity is entering crypto markets.

“Stablecoin mints signal fresh liquidity entering the market, and that’s rarely a coincidence. To meet user demand, Binance must hold sufficient reserves to support this inflow, with liquidity clearly choosing the security and scale of the exchange as its preferred deployment hub,” Darkfost noted.

With dominance metrics and liquidity now pulling in, the coming weeks could prove decisive. Whether Bitcoin extends its resurgence or altcoins seize the spotlight remains to be seen.