Hong Kong’s Stablecoin Licensing vs Mainland China’s Regulatory Guardrails: The Crypto Divide Deepens

Hong Kong throws open its doors to licensed stablecoin issuers while mainland China maintains its fortress of restrictions—creating the ultimate regulatory paradox in Asian crypto markets.

The Licensing Gambit

Hong Kong's financial authorities now welcome applications from stablecoin operators seeking formal approval—a stark contrast to Beijing's continued prohibition of private digital currency ventures. The special administrative region positions itself as Asia's compliant crypto gateway while the mainland reinforces its firewall against decentralized finance.

The Compliance Tightrope

Approved issuers must demonstrate robust reserve backing and undergo rigorous stress testing—requirements that would make most mainland fintech firms balk. Hong Kong's framework demands quarterly attestations and full transparency while Chinese regulators simply block access to cryptocurrency trading platforms altogether.

The Institutional Divide

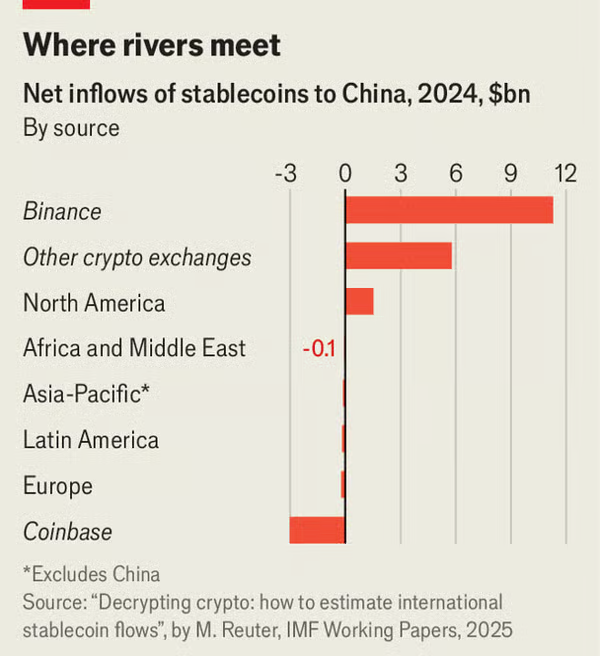

Global asset managers eye Hong Kong's licensed stablecoins for portfolio diversification—meanwhile mainland investors resort to underground USDT channels despite government surveillance. The regulatory split creates arbitrage opportunities that would make even traditional finance brokers blush—if they understood how blockchain works.

As Hong Kong builds bridges and mainland China reinforces walls, the stablecoin revolution continues finding paths of least resistance—because money flows where regulation fears to tread.

Hong Kong Opens While Mainland China Tightens

The Hong Kong Monetary Authority requires issuers to hold HK$25 million in capital, maintain segregated liquid reserves, and follow anti-money-laundering standards. No licenses have been granted yet.

On the mainland, the People’s Bank of China reiterated that digital yuan pilots remain its priority. Beijing has cracked down on Tether-linked transfers and banned firms from holding crypto directly, limiting exposure to offshore subsidiaries or Hong Kong-listed products.

“The broader challenge… is the conservative culture of its finance industry.” Emil Chan, Hong Kong Digital Finance Association, said in a CNN interview.

Tokenization and Infrastructure Push

Hong Kong has paired stablecoin rules with broader tokenization efforts. On August 7, regulators launched the world’s first real-world asset (RWA) registry to standardize data and valuations. Officials are also consulting on custody and OTC rules.

“It puts Hong Kong ahead of almost any other Asian jurisdiction… It’s going to be a blueprint for others.” — Yat Siu, Animoca Brands, in CNN.

Private activity reflects the momentum. HSBC has rolled out blockchain settlement for trade finance, while China Asset Management (Hong Kong) introduced Asia’s first tokenized retail money market fund. Tokenized Gold and green bonds add to the ecosystem.

Analysts say yuan-backed stablecoins remain unlikely. Offshore CNH deposits total under 1 trillion yuan, versus more than 300 trillion onshore, leaving reserves too thin for large issuers. Pegs to the Hong Kong dollar or US dollar are more viable.

Dollar-linked stablecoins already absorb vast amounts of US Treasuries. HKD-backed tokens WOULD also tie demand to the city’s dollar peg, paradoxically strengthening the greenback.

![]() China is launching $YUAN stablecoin in 2025

China is launching $YUAN stablecoin in 2025

It will inject TRILLIONS and trigger a Chinese Bull Run

Every $450 portfolio now ≈$85K by the end of October

Here’s what’s next and list of Chinese alts with 100x upside![]()

![]() pic.twitter.com/Q0mdj9IsmD

pic.twitter.com/Q0mdj9IsmD

![]()

![]()

Regional Competition For Stablecoin Edge

Hong Kong’s cautious openness contrasts with Beijing’s ban-and-control approach. Early stablecoin licenses are expected to go to major banks and tech groups, with first approvals targeted by year-end.

Regional voices are calling for a multi-currency stablecoin alliance, led by Singapore and the UAE, to reduce reliance on the dollar and boost cross-border liquidity.

For now, Hong Kong’s licensing regime and tokenization drive put it ahead of Asian rivals.

However, high compliance costs and conservative finance culture may slow adoption, leaving USD-pegged tokens dominant in the region.