Correction, Not Capitulation: Bitcoin’s Path to $115,000 Recovery Looks Inevitable

Bitcoin bounces back—bulls eye six-figure targets as market shakes off temporary weakness.

The pullback? Just noise. Traders who panicked during the recent dip are now scrambling to re-enter as momentum rebuilds.

Why $115,000 isn’t a fantasy

Market structure favors upside resets. Key support held, liquidity flushed, and large wallets are accumulating—not distributing. This isn’t retail behavior; it’s smart money repositioning.

Institutional flows haven’t slowed. If anything, the dip attracted more bids from funds that missed the first leg up. Because nothing brings out FOMO like a 10% discount on fear.

Technical breakout incoming

Charts suggest consolidation is ending. Resistance levels near all-time highs look fragile. A clean break above $72k could trigger a momentum cascade—classic bullish continuation.

Macro tailwinds help, too. Rate cuts, weakening dollar, political uncertainty—all fuel the “digital gold” thesis. Even traditional finance skeptics are quietly allocating.

Just don’t call it a safe haven. Not yet, anyway.

So—correction or capitulation? The market’s answered: a brief scare, not a trend reversal. And if Wall Street’s latest “Bitcoin fund” prospectus is any indicator—they still don’t get it, but they want in.

Time to reload. $115k isn’t a question of if, but when.

Bitcoin Is Secure

Risk signals in the Bitcoin market are easing. According to Bitcoin Vector, the Risk-Off Signal is retreating, moving toward a low-risk regime. This shift suggests that market conditions are stabilizing after weeks of volatility.

At the same time, bitcoin has broken free from a price compression that had been in place since the $124,500 all-time high. Reclaiming $110,000 confirmed the end of this compression zone. With resistance weakened, BTC now has room to move higher, increasing the chances of recovery in the coming weeks.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

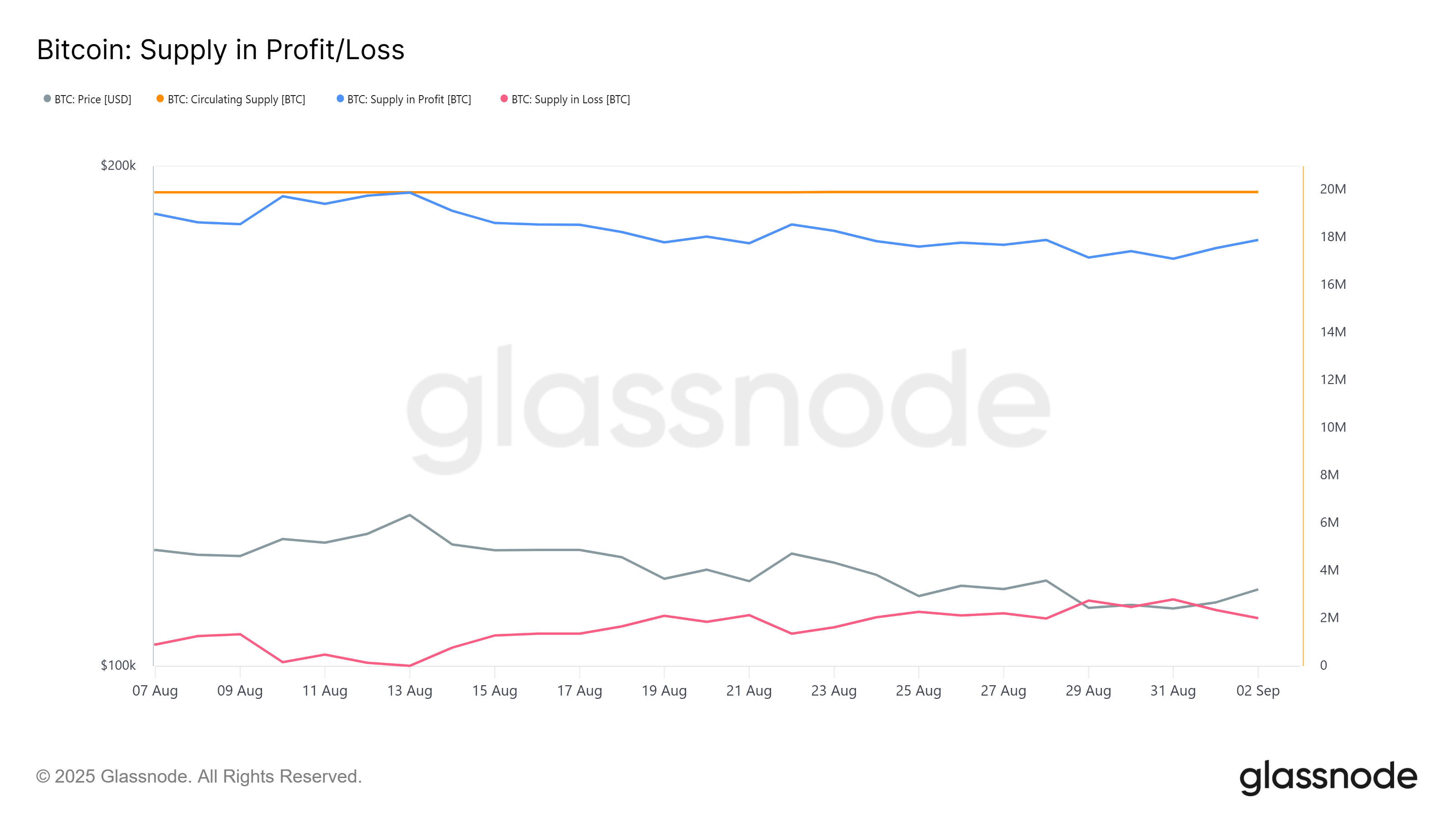

On-chain data supports this outlook. Of the 19.91 million BTC in circulation, only about 2.73 million coins are currently lost. This represents just 13.71% of supply, well below the threshold historically associated with bear markets, where losses typically extend above 50% of circulating Bitcoin.

This indicates Bitcoin is far from capitulation territory. Despite recent price dips, the vast majority of holders remain in profit, showing resilience. The limited supply in loss reflects strong investor conviction, suggesting BTC has a solid foundation to withstand selling pressure and sustain upward momentum in the NEAR term.

BTC Price To Continue Its Rise

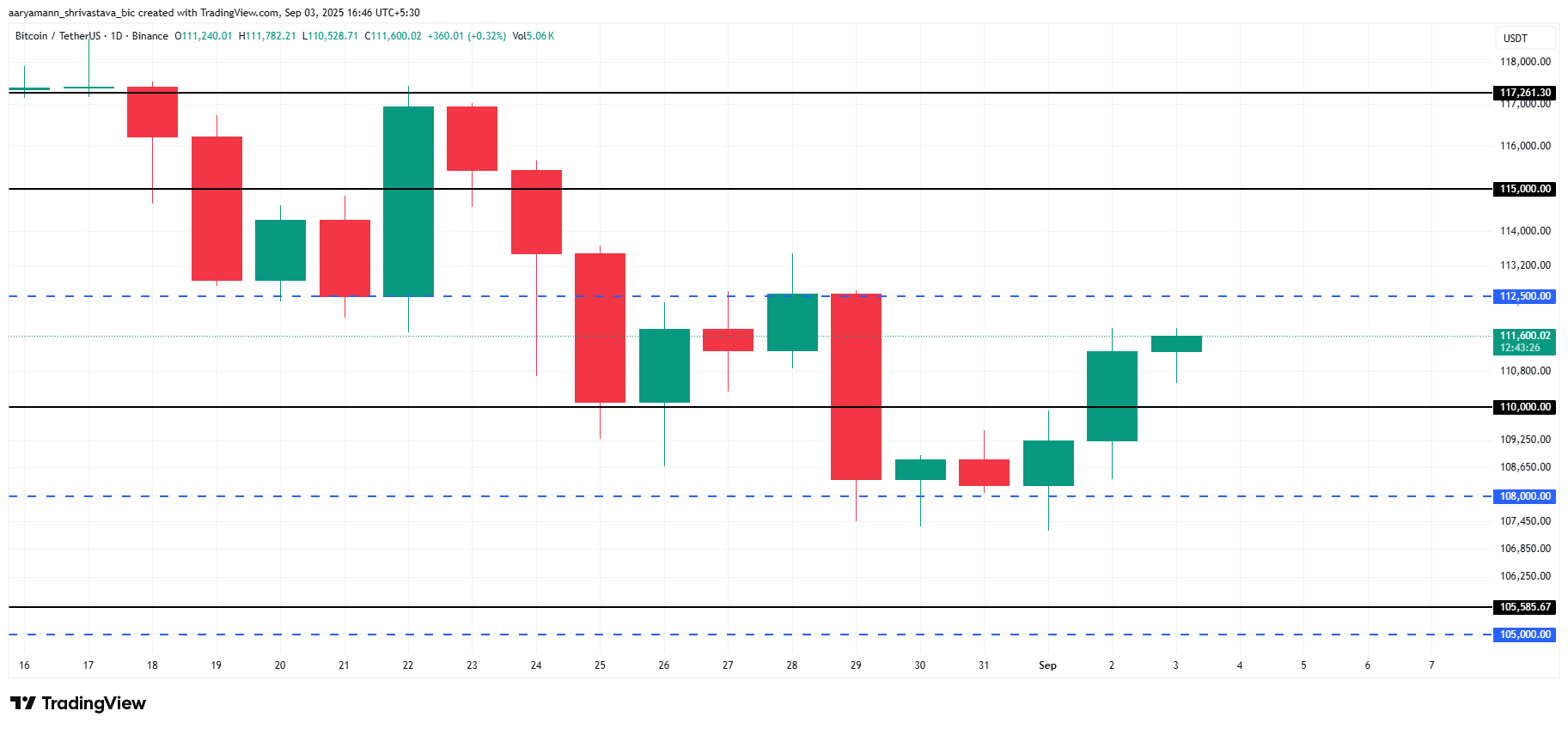

Bitcoin trades at $111,600 at the time of writing, just under the $112,500 resistance. The asset bounced back from $108,000 earlier this week, showing renewed strength. Holding above $110,000 provides stability, giving BTC the base it needs to attempt further recovery against prevailing market pressures.

If current momentum holds, Bitcoin is likely to continue climbing. A breakout above $112,500 could open the path toward $115,000, reinforcing bullish sentiment. This move WOULD confirm the improvement of the market structure and signal a renewed attempt at recovery.

However, risks remain if selling pressure reemerges. Should Bitcoin fail to maintain momentum, a decline back to $110,000 is possible. In a deeper correction, the price could revisit $108,000, raising concerns among investors about potential short-term weakness.