Ethereum’s Massive Supply Shock Hits—So Why Isn’t the Price Exploding?

Ethereum’s supply just got squeezed harder than a Wall Street short—but the price action remains bafflingly flat.

The Burn Machine Is Running

Post-merge deflation is kicking into overdrive. Transaction burns slash ETH supply daily—yet markets yawn. Network activity surges while new issuance plummets. Classic crypto irony: fundamentals improve, traders snooze.

Institutional Apathy or Manipulation?

Whales accumulate while retail panics. Derivatives markets flash caution despite on-chain fireworks. Maybe traditional finance still prefers pumping ancient stocks over internet money that actually has utility.

The Looming Breakout

Supply shocks don’t stay quiet forever. When liquidity tightens, prices snap—often violently. History favors patient holders over reactive traders. Just ask anyone who sold Bitcoin during previous ‘boring’ phases.

So enjoy the calm while it lasts. When ETH finally wakes up, it’ll move faster than a hedge fund closing its short position.

Ethereum Supply Drains While Bitcoin’s Climbs

According to analyst Crypto Gucci, ETH reserves on centralized exchanges have fallen to fresh lows even as Bitcoin (BTC) exchange balances spike to multi-month highs.

“Investors are hoarding ETH and dumping BTC…ETH supply shock incoming,” the analyst warned.

The divergence highlights a growing conviction in Ethereum’s long-term value proposition, even as short-term price action lags.

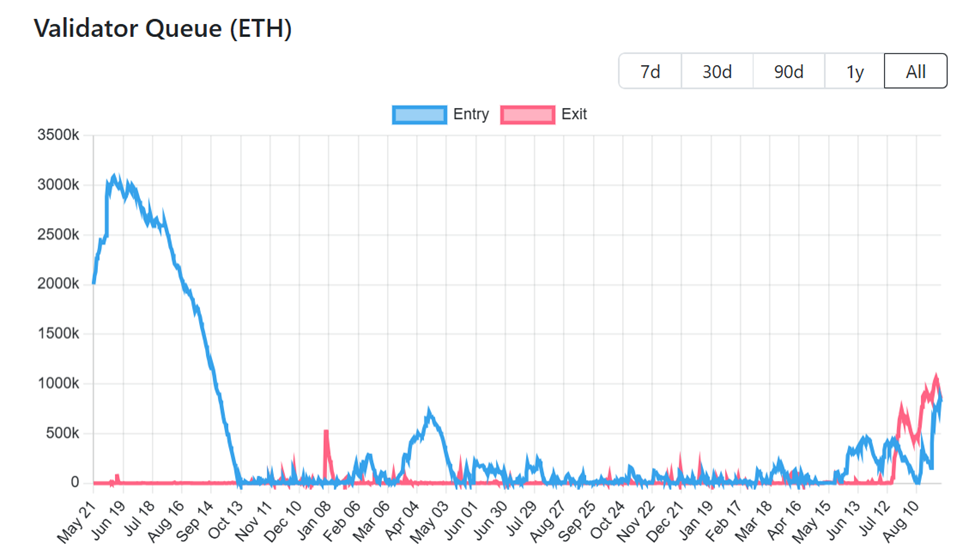

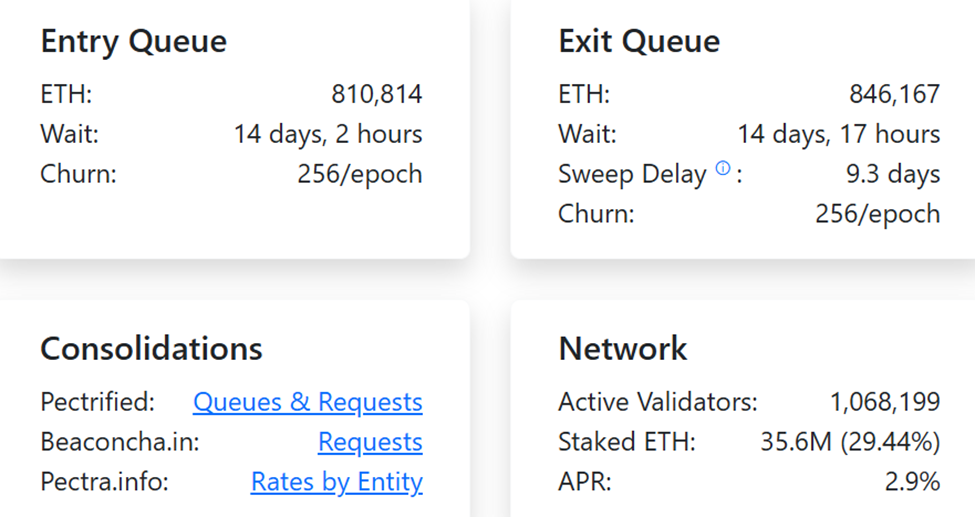

Meanwhile,on-chain data confirms that ETH is being locked up at historic rates. Specifically, Ethereum’s staking entry queue has surged to its highest level since 2023. Additionally, 860,369 ETH worth $3.7 billion are currently waiting to be staked.

Everstake, a staking protocol, noted this is the largest queue since the Shanghai upgrade enabled withdrawals two years ago.

“More people trust Ethereum’s long-term value and want to participate in securing it,” the firm stated.

Everstake also pointed to a mix of institutional participation, favorable market conditions, and growing network confidence.

At present, more than 35.6 million ETH is already staked. This portion, constituting 31% of the total supply, is worth about $162 billion.

Institutions and Treasuries Load Up on Ethereum

Meanwhile, institutional appetite is playing a central role. Analyst Hasu observed that nearly 10% of ETH’s supply is now held in publicly traded vehicles, a milestone reflecting adoption.

we're about to hit 10% of ETH supply in publicly traded vehicles pic.twitter.com/4xWRWaDLSd

— Hasu![]()

![]()

Tom Dunleavy, head of venture at Varys Capital, added that treasury companies scooped up over 3% of the total ETH supply in just two months. This highlights the rapid pace of accumulation.

“Wild that in less than 2 months, over 3% of the entire supply of ETH was scooped up by treasury companies,” wrote Dunleavy.

Corporate treasuries already hold 4.7 million ETH, or $20.4 billion, with most committed to staking strategies.

This has helped push the validator entry queue to record levels. At the same time, it has reduced the risk of a mass exodus, as the exit queue has declined 20% since August.

Retail Selling Meets Ethereum Whale Accumulation

Despite these bullish flows, ETH is trading at $4,368 as of this writing. It is down over 12% from its August 24 all-time high, with analysts saying retail selling suppresses price momentum.

Defi Ignas notes that 100–1,000 ETH holders are dumping, while whales in the 10,000–100,000 ETH range are “loading fast.” The analyst calls it the same setup seen before every major ETH rally, where supply shifts from weak to strong hands.

$ETH has large ETF inflows, DATs buying, and HL whale publicly rotating billions of BTC into ETH.

Price still flat. Why?

Retail is selling:

• 100–1k ETH holders dumping

• 10k–100k whales loading fast

Supply moving from weak to strong hands. Same setup before every big run. pic.twitter.com/uk9UGZwbma

Similarly, Sigil Fund CIO Dady Fiskantes suggested some investors may be rotating spot ETH into ethereum ETFs (exchange-traded funds) to reduce custody risks, similar to earlier Bitcoin flows.

However, Ignas questioned the timing, contradicting the notion that ETH whales operate like large holders of Bitcoin. Others hold a more bullish view.

“…retail’s exit liquidity has always been the ignition fuel. Once they’re fully flushed out, ETH rips. The flat price is the bullish signal,” analyst Tradinator remarked.

Analysts argue that the fundamentals are set for an explosive move. The Ethereum price is trapped between strong institutional accumulation and persistent retail selling, exchange reserves at record lows, and staking queues at record highs.