3 Altcoins Set to Explode as World Liberty Financial (WLFI) Investor Interest Soars

Investors chasing WLFI's momentum are flooding into these three altcoin plays—and the smart money's already positioning.

BNB: The Exchange Giant's Silent Surge

Binance Coin isn’t just trading fuel—it’s a regulatory shield play. As traditional finance dabbles in crypto, BNB’s ecosystem offers a one-stop-shop that even your grandfather’s broker might finally understand (though he’ll still call it ‘risky’).

ETH: The Blue Chip That Actually Earns Its Keep

Ethereum doesn’t need hype—it prints revenue. With staking yields outperforming most bonds and network activity ticking up, it’s the boring bet that keeps winning. Sometimes the ‘safe’ play is the most aggressive move you can make.

SOL: The Speed Demon Eating Everyone’s Lunch

Solana’s throughput isn’t just tech spec porn—it’s a business model. While other chains debate decentralization, SOL quietly onboards the next million users. Retail doesn’t care about validator counts—they care if their NFT mint doesn’t fail.

Let’s be real: most ‘financial innovation’ is just repackaged FOMO. But occasionally—just occasionally—the hype aligns with actual value. These three tokens are positioned to capture that convergence while Wall Street still tries to pronounce ‘decentralization’.

Why BNB, LINK, and BONK Could Benefit from WLFI Adoption

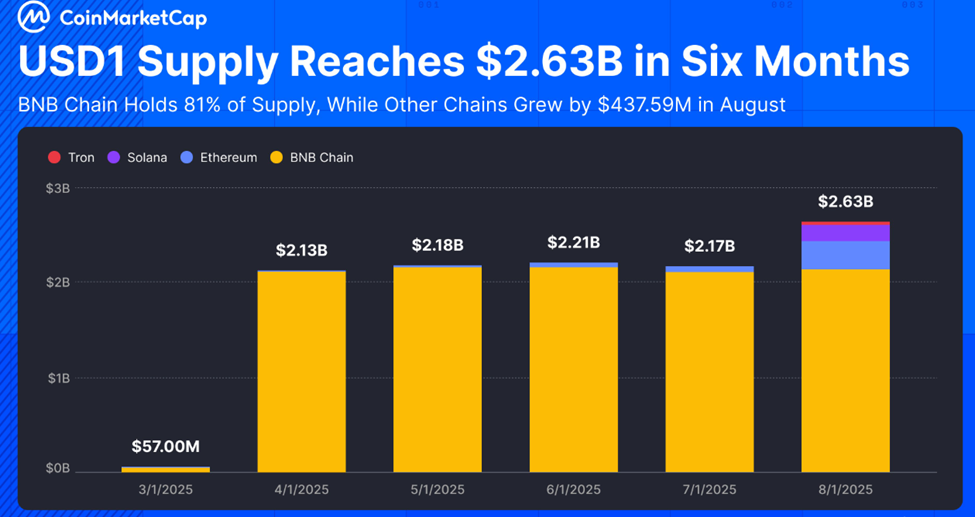

The BNB Chain has quickly become the backbone of USD1’s expansion. According to CoinMarketCap, 81% of the USD1 supply is currently held on BNB Chain, making it the dominant network for WLFI’s stablecoin.

While the USD1 stablecoin supply on other chains grew by $437.59 million in August, BNB Chain remains far ahead.

This concentration suggests BNB’s central role in WLFI’s ecosystem. As USD1 issuance continues to climb, demand for BNB Chain block space and liquidity provisioning is likely to follow.

For BNB holders, the network effect could translate into sustained utility and increased transaction volumes. This could bode well for the BNB price.

Chainlink (LINK) is the second potential beneficiary, whose Cross-Chain Interoperability Protocol (CCIP) has become a critical infrastructure LAYER for WLFI’s operations.

Zach Rynes, Chainlink’s community liaison, revealed that CCIP processed over $130 million in cross-chain transfer volume in a single day. Of this, $106 million, or 81.5%, is reportedly tied directly to WLFI transfers.

Chainlink CCIP processed $130M+ in cross-chain transfer volume today![]()

$106M+ came from $WLFI transfers, which adopted the Cross-Chain Token (CCT) standard for seamless interoperability https://t.co/rpO7Oss6si pic.twitter.com/RwhYgYlTl4

WLFI has also adopted Chainlink’s Cross-Chain Token (CCT) standard, making LINK’s oracle and interoperability services indispensable to its expansion strategy.

With more than 80% of CCIP volume linked to WLFI, the partnership places LINK at the heart of a growing multi-chain ecosystem.

Rising WLFI activity could therefore translate into stronger fundamentals for the LINK price.

A third but no less promising altcoin is Bonk (BONK), Solana’s leading meme token. WLFI recently tapped Bonk.fun as the official launchpad for USD1 on Solana, a MOVE hailed as transformative for both ecosystems.

“We’re proud to announce that we’ve partnered with World Liberty Finance to become the official USD1 launchpad on Solana… bringing the next wave of users onto Solana,” Bonk.fun announced.

Analysts like Unipcs argue that the deal could unlock a surge in liquidity for the Bonk ecosystem. They point out that USD1 drove $30 billion in trading volume to BNB Chain in its first month alone.

many continue to take for granted how big of a deal the $WLFI partnership with BonkFun is

USD1 drove $30 billion in volume to BNB chain the first month it went live on the chain

that's several times more volume than we see in the trenches on solana monthly, despite Solana being… https://t.co/xa29spNs0k

![]()

As WLFI replicates its success on Solana, BONK and its associated ecosystem could see significant inflows of liquidity and attention.

Short-Term Headwinds, Long-Term Opportunity for WLFI Ecosystem

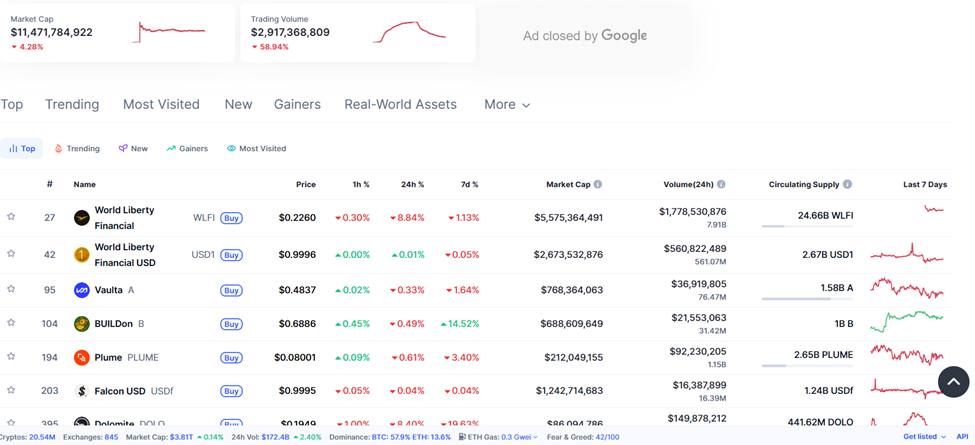

Despite these bullish signals, the broader WLFI sector faces short-term headwinds. CoinMarketCap data shows the ecosystem’s market cap fell 4.28% to $11.47 billion, while trading volume has dropped nearly 60%.

Analysts suggest early exits may weigh WLFI’s price action, though sentiment could shift as new partnerships like Bonk.fun’s go live.

Ultimately, BNB, LINK, and BONK stand out as the top altcoins poised to benefit from WLFI’s expanding footprint.

These projects could be the forefront of the next wave of liquidity, interoperability, and stablecoin-driven growth across the crypto markets. However, this is contingent on WLFI adoption accelerating.