Hyperliquid Explodes as Crypto’s ’Killer App’ With Stunning Growth Trajectory

Move over, traditional finance—Hyperliquid just rewrote the rulebook. This decentralized exchange isn't just growing; it's eating the competition alive while Wall Street still tries to figure out what 'decentralized' means.

Speed Meets Scale

Hyperliquid's architecture bypasses legacy bottlenecks that plague conventional exchanges. No more waiting for settlement times that feel like geological eras. Trades execute faster than a hedge fund manager's excuse for underperformance.

The Killer App Reality

User adoption isn't just climbing—it's vertical. The platform's intuitive interface turns complex derivatives trading into something approaching simplicity. Finally, crypto natives get sophisticated tools without needing a PhD in rocket science.

Why Traders Are Flocking

Zero self-custody risks. Institutional-grade liquidity. Fees that won't make your eyes water. It's the trifecta that's pulling volume from established players who've been resting on their laurels—and their fee structures.

Market Impact Unleashed

Hyperliquid's surge isn't happening in a vacuum. It's forcing the entire sector to level up or get left behind. Competitors are scrambling to match features that users now expect as standard.

The bottom line? Hyperliquid proves that when you build something genuinely better, the market notices—even if traditional finance is still trying to mint physical NFTs.

Hyperliquid Surges

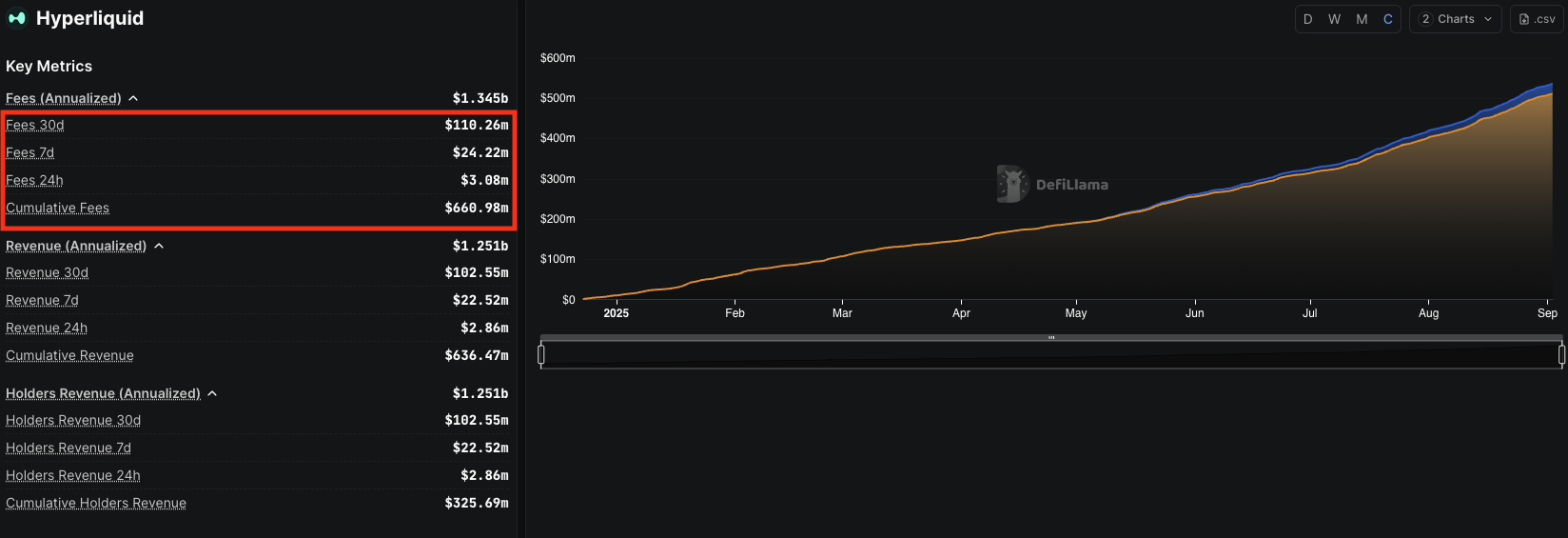

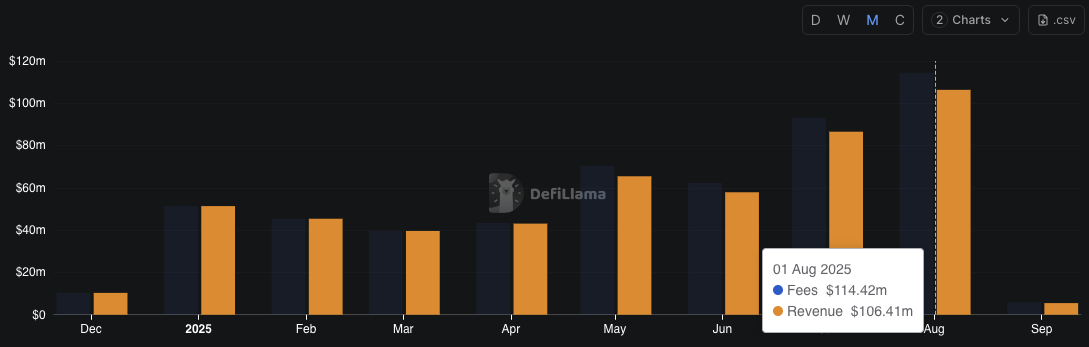

In the past 30 days, Hyperliquid’s revenue exceeded $110 million, bringing its cumulative revenue to nearly $661 million. This is a rare growth trajectory for a non-custodial perp DEX. Data from DefiLlama shows that the protocol’s fee generation continues to rise steadily despite the market’s “slow summer.”

According to DefiLlama, in August alone, Hyperliquid’s revenue and fees reached $106 million and $114 million, respectively. These numbers were higher than July’s $86 million and $93 million. In July, Hyperliquid accounted for as much as 35% of the total revenue across the blockchain sector.

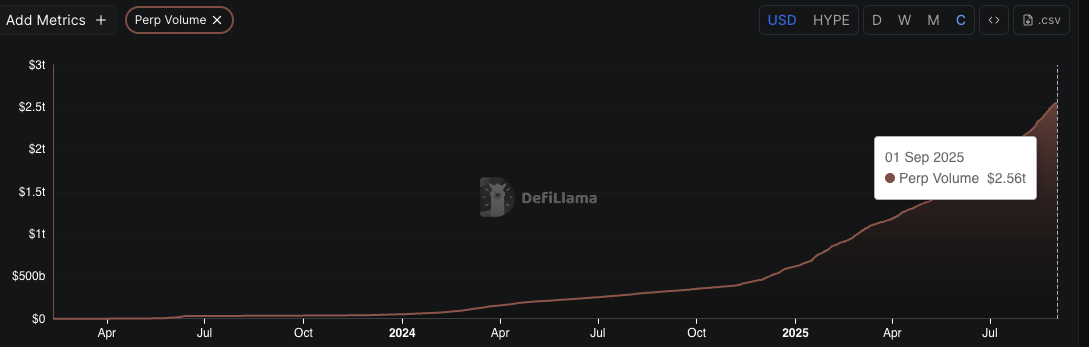

Beyond revenue and fees, Hyperliquid’s perpetual volume has surpassed $2.5 trillion. In fact, according to a user on X, even during the so-called “slow summer,” the platform still recorded more than $1 trillion in trading activity.

This growth highlights a stark contrast to DEX activity on Solana. According to Will Clemente, while Solana-based DEXs have declined in activity since the memecoin frenzy earlier this year, Hyperliquid’s users and volumes have been “trending up and to the right all year pretty much.”

The Next Potential App?

Hyperliquid’s recent surge has also sparked mixed reactions. With its simple product, CEX-like experience, and ability to expand its ecosystem quickly, Hyperliquid has the potential to become crypto’s new “killer app.”

However, from another perspective, some users argue that Hyperliquid still faces structural risks such as admin control and potential downtime. In fact, Hyperliquid faced a brief frontend outage that prevented users from placing, closing, or withdrawing orders, although backend operations continued unaffected.

“If Hyperliquid goes down can users withdraw funds? (e.g., submit proofs). If Hyperliquid turned evil, can they steal user funds?” X user Ryan questioned.

Meanwhile, competition in the perp DEX race is heating up with new entrants like Lighter. With features such as order match/liquidation verification and unified yield–margining, Lighter is considered a “formidable competitor.”

Hyperliquid’s scale advantage and current user base remain dominant, especially as revenue and trading volumes maintain momentum. If the execution milestones in its roadmap are carried out, Hyperliquid has the foundation to continue shaping crypto’s next major momentum shift.

Despite this, HYPE is showing signs of retracement, currently trading at $44.63 USD. Technicals showed $50–$51 as key resistance turned support, with targets at $55, $58, and $73 if bullish momentum sustains.