Bitcoin Price Could Plunge Below $95,000 in September—Bitfinex Analysts Sound Alarm

Bitcoin's bull run hits a potential roadblock as Bitfinex analysts project a September dip below the $95,000 threshold.

Market Jitters Intensify

Traders brace for volatility as institutional flows slow and leveraged positions unwind. The crypto king isn't crashing—just catching its breath after a relentless rally.

Timing the Bottom

History suggests these pullbacks fuel the next leg up. Smart money accumulates during fear cycles—while retail panics over temporary corrections.

Long-Term Unshaken

Macro adoption trends remain bullish. Regulatory clarity advances globally, and corporate treasuries keep stacking sats—because apparently, holding cash is so 2020.

September's dip might just be the discount event serious investors need. After all, Wall Street still buys the dip even when they're the ones selling it.

Will Bitcoin Hit a Price Floor Soon?

Despite a prolonged bull run throughout the summer, Bitcoin has seemingly hit a roadblock. Although the asset reached an all-time high early last month, its performance has been historically weak since.

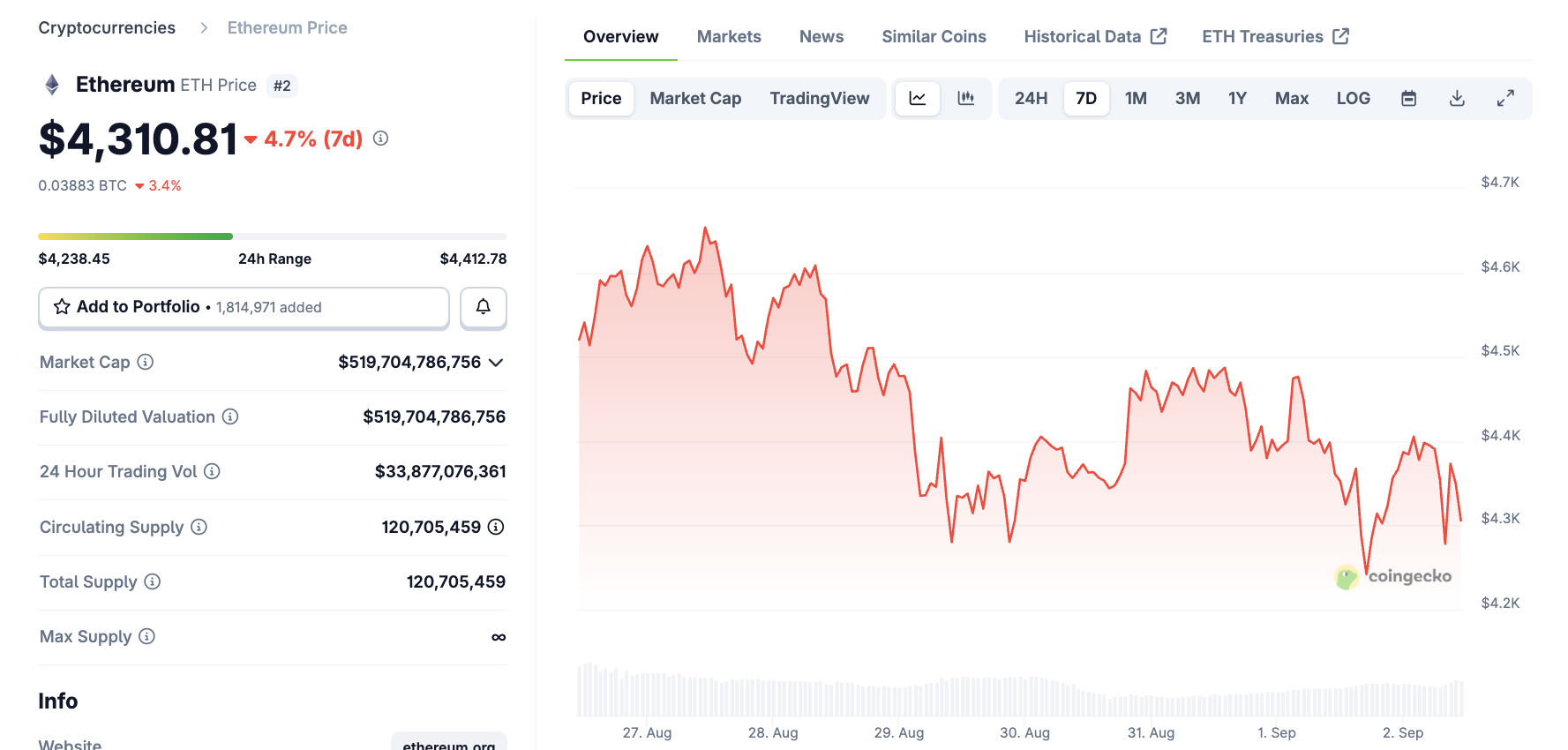

For the past week, bitcoin has remained below the $112,000 support level, as whales continue to rotate to altcoins, specifically Ethereum. These large-scale rotations support the Bitfinex analysis.

“Major cryptocurrency assets endured a difficult week as macro jitters and the post-PPI sell-off weighed heavily on price action. This pullback is in line with our thesis that in the summer months BTC is likely to be prone to retracements and range trading…We believe the market is nearing the bottom of this downturn as we move into September,” Bitfinex claimed.

Some of these “macro jitters” are fairly easy to explain: bearish PPI reports caused massive liquidations all across the industry, and Trump’s belligerent trade policies are causing further downturns.

These and other factors, like low trade volumes, led Bitcoin to drop 13%, but the floor isn’t here yet.

Key Altcoin Indicators

Overall, the altcoin market has been attracting a lot of attention, with ethereum outpacing BTC on several recent occasions. However, only a few altcoins replicated this success, which gives telltale signs about broader health:

“With [altcoins], the majors surrendered recent gains, while targeted rotations into mid-caps and sector plays created sharp divergences — producing both standout winners and heavy laggards. The Altcoin market seeing sharp rotations is one of the signs however that might result in the majors seeing capital eventually flowing back in, particularly if the overall market declines further from current levels,” Bitfinex’s analysts added.

Essentially, even these altcoin leaders have been posting recent losses. These suggest that the whole market is in a period of decline, which supports the September Bitcoin floor theory.

ETFs Could Power Q4 Inflows

However, Bitfinex’s analysts don’t believe that this downward trend will continue for long. They posit that Bitcoin’s price floor will be around $93,000, at which point institutional ETF investors could start buying the dip. BTC, in turn, could substantially benefit from this.

Although Ethereum ETFs have received a lot of attention lately, Bitcoin products remain a formidable force. These products have huge advantages in institutional buy-in; after all, they represented more than 90% of crypto fund investments a few short months ago.

Any broader crypto ETF rally will almost certainly lift Bitcoin off its price floor.

In short, this read implies a profitable run for BTC in Q4 2025. To be clear, this is just one interpretation of the available data. Some have suggested a quicker recovery, or claimed that Bitcoin’s floor might be higher than $93,000.