Bitcoin’s Triple ’Death Cross’ Warning: Why This September Weakness Is Actually a Historic Buying Opportunity

Bitcoin's facing its most ominous technical pattern yet—a triple 'death cross' formation that's triggering alarm bells across traditional finance circles. But seasoned crypto veterans know better than to panic at chart patterns.

The September Slump Myth

Historical data shows September typically delivers negative returns for Bitcoin—we're talking about a pattern that's held for years. Yet every seasonal dip eventually gives way to monumental rallies. Remember: institutions accumulate during fear cycles, not during euphoria.

Technical Signals Versus Fundamentals

Death crosses might spook day traders, but they ignore Bitcoin's core value proposition: decentralized digital scarcity. While technical analysts fret over moving averages, the network continues processing settlements worth billions—without asking for permission.

Why This Time Isn't Different (In The Best Way)

Market cycles repeat because human psychology remains constant. The same investors who panic-sell during technical warnings will FOMO back in at double the price—it's the oldest play in the traditional finance handbook, just with better technology this time.

Smart money uses these technical 'warnings' as accumulation opportunities—because in crypto, the only real death cross is being out of position when the next leg up begins. Traditional finance will never understand that until it's too late, as usual.

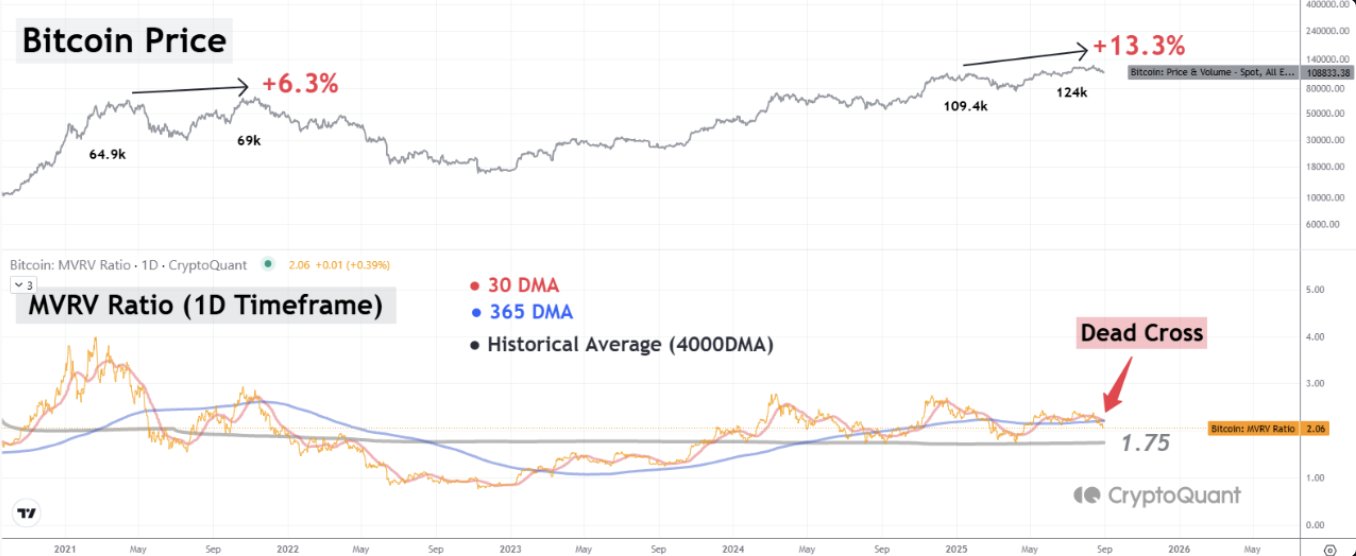

First Death Cross: MVRV Ratio

The first warning comes from the Market Value to Realized Value (MVRV) ratio, which pseudonymous analyst Yonsei_dent explained on CryptoQuant.

MVRV is an on-chain metric that compares Bitcoin’s market capitalization with its realized value — the average price at which coins last moved. A high ratio indicates potential overvaluation, while a low ratio suggests undervaluation.

In a recent CryptoQuant post, Yonsei_dent noted that MVRV has just formed a death cross. The 30-day moving average fell below the 365-day average.

Historically, such crossovers have preceded corrections. They show that short-term enthusiasm is fading relative to the long-term trend. For instance, MVRV death crosses in 2022 coincided with major pullbacks during the bear market.

“This doesn’t necessarily mean the same outcome is coming — Bitcoin ETFs have introduced more structural stability to the market. But history doesn’t repeat, it rhymes — and the signals from MVRV deserve attention,” Yonsei_dent said.

Second Death Cross: Weekly MACD

The second signal comes from Bitcoin’s weekly MACD indicator.

MACD measures momentum by tracking the difference between exponential moving averages (EMAs). A death cross occurs when the MACD line drops below the signal line. This usually indicates weakening buying pressure and downside risk.

Historically, this signal has been reliable in spotting market tops or extended corrections. Similar events in April 2024 and February 2025 marked 30% declines.

“Death cross on bitcoin $BTC weekly MACD. Historically, a warning of downside risk!” analyst Ali commented.

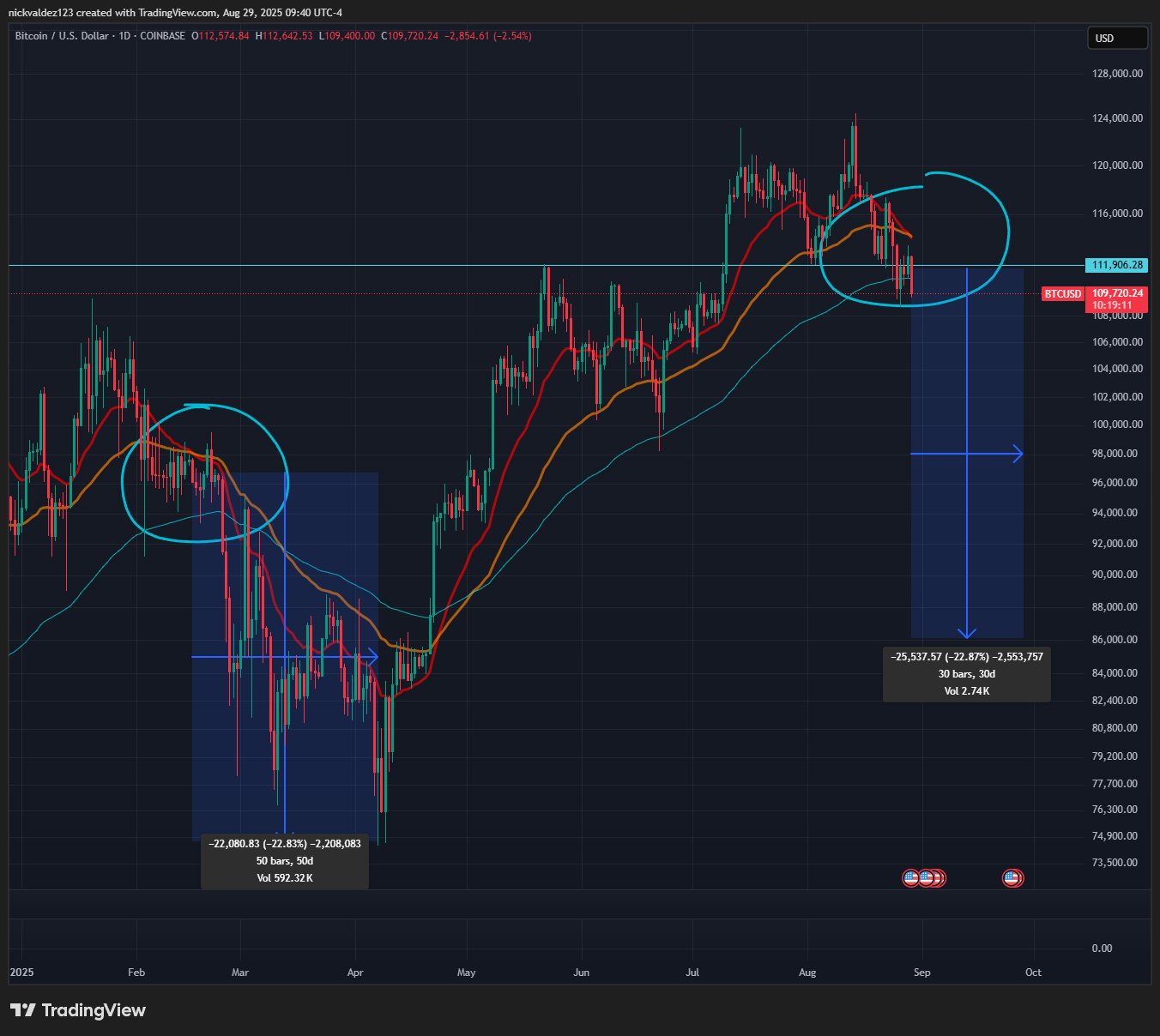

Third Death Cross: EMA

The third warning comes from analyst Deezy, focusing on Bitcoin’s exponential moving averages.

He highlighted that the 20-day EMA has just crossed below the 50-day EMA — a classic death cross pattern.

Deezy pointed to the last similar event in February 2025, when Bitcoin dropped another 23%. If history repeats, the adjustment could increase the price to $86,000.

“The last time this happened in February 2025, BTC fell another 23%. A 23% drop from here WOULD put Bitcoin at $86,000,” Deezy predicted.

Three death cross signals — MVRV, MACD, and EMA — now align in September 2025. Together, they paint a cautious outlook for Bitcoin.

History shows that death crosses often lead to volatility. However, they can also become false alarms during strong bull markets. This time, the stakes are higher as investors await the Federal Reserve’s interest rate cut decision in September — a MOVE expected to boost sentiment toward crypto.