Bitcoin Whale Dumps $3.4 Billion: Market Tremors or Strategic Shift? | Weekly Whale Watch

Massive Bitcoin Exodus Rocks Crypto Markets

The Whale's Move

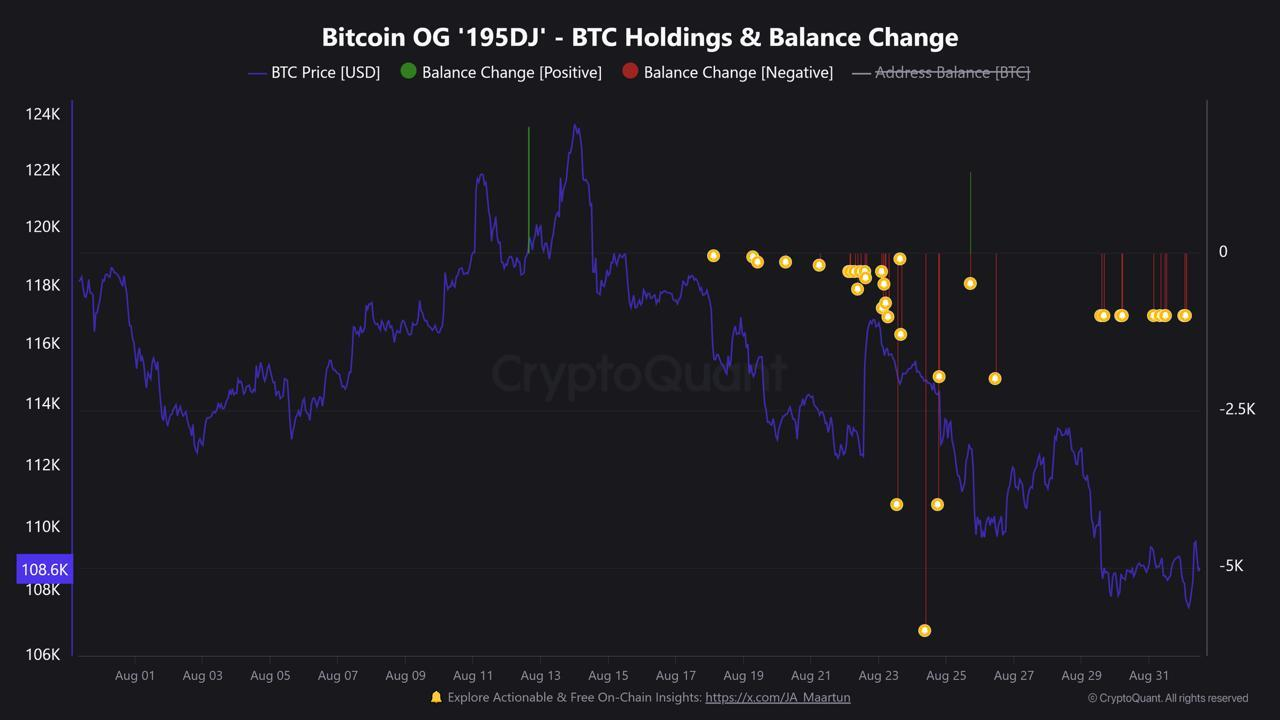

A single entity just unloaded $3.4 billion worth of Bitcoin—triggering instant volatility across exchanges. This isn't just another sell-off; it's one of the largest single transactions in recent memory.

Market Impact

Traders scrambled as BTC prices dipped momentarily before showing resilient recovery patterns. The move highlights how concentrated wealth remains in crypto—and how one player can still sway entire markets.

Behind the Numbers

Whale activity often signals strategic positioning rather than panic selling. This dump could indicate profit-taking after recent rallies or portfolio rebalancing ahead of anticipated regulatory shifts.

Finance's Ironic Twist

Meanwhile, traditional hedge funds continue charging 2% management fees for underperforming the S&P 500—while crypto whales move billions with a few clicks. The irony isn't lost on anyone paying attention.

Bottom Line: Whale movements create waves, but Bitcoin's ecosystem has never been more liquid or resilient. This isn't 2017 anymore.

OG Bitcoin Whale’s Shift Into Ethereum

According to CryptoQuant analyst JA Maartunn, the whale sent Bitcoin to Hyperliquid instead of holding stablecoins and converted it into Ethereum. This rotation stands out because the address is an old and well-known holder.

Whales typically sell into rallies and park assets in cash. A switch from Bitcoin to ethereum suggests a different view that ETH could outperform in the short term.

Large sales often affect market liquidity and price stability. bitcoin has already lost key support at $111,500, hitting lows near $107,000 last week.

Analysts note that big moves like this also influence sentiment. Seeing a long-term whale shift to Ethereum may prompt other traders to follow.

Historical Context Of Similar Whale Actions

Past cycles show similar whale behavior. In 2017 and 2021, gradual sales marked distribution phases that capped rallies.

In 2020, some whales rotated into ETH before its DeFi boom, while Bitcoin consolidated.

This pattern suggests Bitcoin may underperform while Ethereum gains traction. However, the whale still holds almost 50,000 BTC, underlining continued conviction in Bitcoin’s long-term role.

Macro factors are amplifying the pressure. Gold has hit record highs, attracting capital as a safer hedge. Meanwhile, uncertainty over US monetary policy is keeping risk sentiment fragile.

Bitcoin’s technical charts show a golden cross signal, often read as bullish. But heavy whale selling may mute that signal for now.

![]() End of the peak?

End of the peak?

New Bitcoin Treasury Companies:

• July ’25: 21

• August ’25: 15

Is the HYPE fading, or just catching its breath?![]() pic.twitter.com/KbMGjOKZya

pic.twitter.com/KbMGjOKZya

The whale’s ETH rotation reinforces caution in the short term. Bitcoin’s support around $107,000 remains fragile, while Ethereum could benefit from relative inflows.

Longer term, this is not an exit from Bitcoin but a hedge. Whales diversifying into ETH may highlight a temporary shift in momentum rather than a structural change.