Pi Network (PI) Confronts September Bearish Headwinds Amid Lingering Bullish Optimism

Pi Network's September Slump Defies Crypto Optimists

Market Reality Check

Pi Network faces mounting selling pressure as September opens with a distinct bearish tilt—proving once again that in crypto, 'hope' isn't an investment strategy. The token's performance contrasts sharply with the broader bullish sentiment that had many anticipating a breakout month.

Technical Resistance Intensifies

Key support levels are being tested as traders retreat from earlier positions. The network's much-hyped mainnet transition hasn't yet translated into the price momentum supporters predicted—another reminder that promised tech upgrades don't always move markets.

Community Sentiment Shifts

Early adopters who mined PI tokens are showing increased distribution activity, creating additional downward pressure. The 'hold and wait' mentality is cracking under actual market conditions—because nothing tests conviction like seeing red on the portfolio.

September's bearish opening serves as a classic finance lesson: never confuse enthusiastic Twitter threads with actual buying pressure. Pi Network now must demonstrate real utility to reverse the trend—or risk becoming just another footnote in crypto's graveyard of great ideas.

Exchange Reserves Reach a Record High Ahead of Major Unlock in September

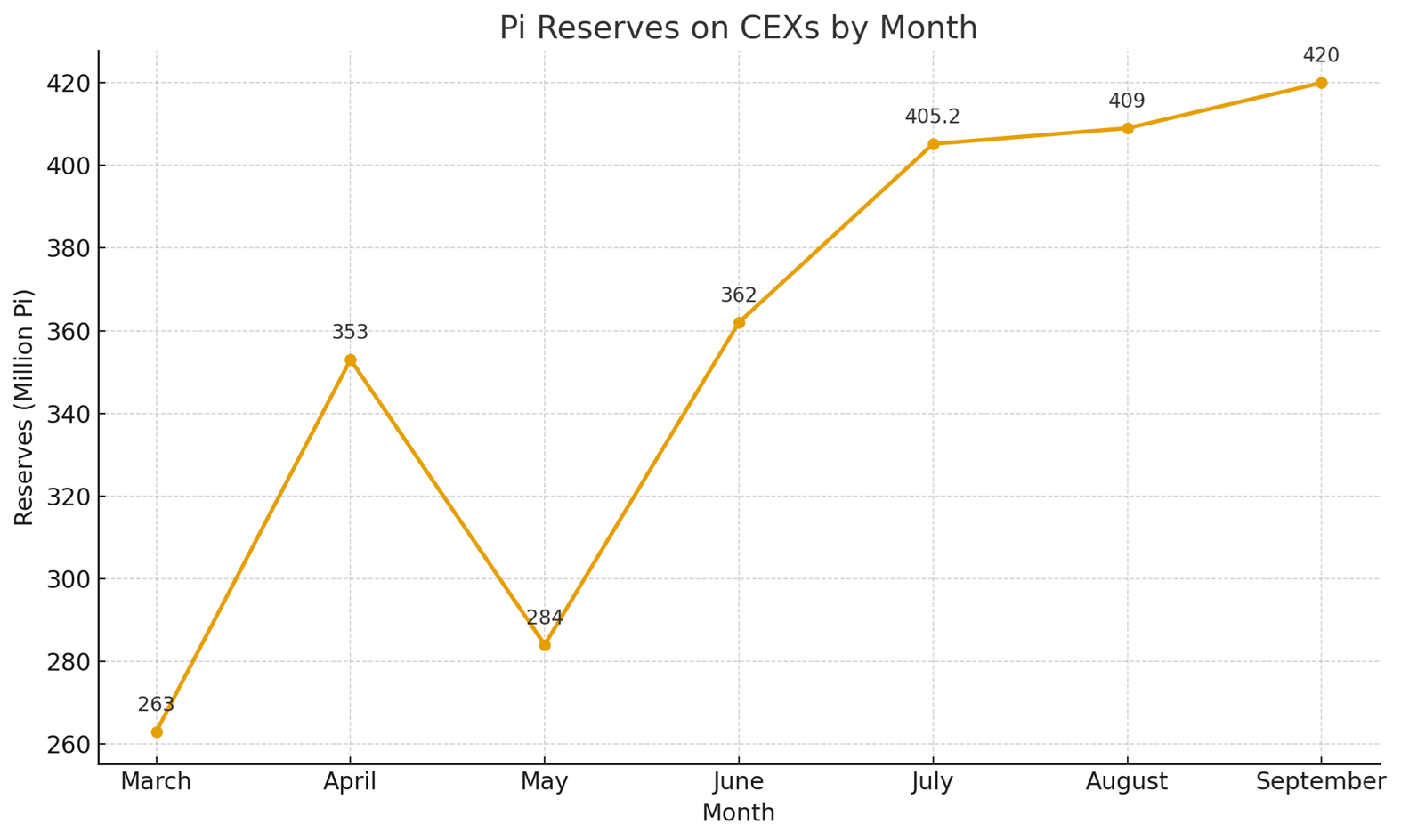

The first red flag is that PI reserves on centralized exchanges (CEXs) have hit a record high, surpassing 420 million PI, according to Piscan data. In mid-August, BeInCrypto reported 409 million PI on exchanges, meaning more than 11 million PI have been transferred onto CEXs in just two weeks.

This surge signals growing selling pressure, while Pi’s daily trading volume remains below $100 million. Low trading volume and rising supply create a perfect setup for further downside.

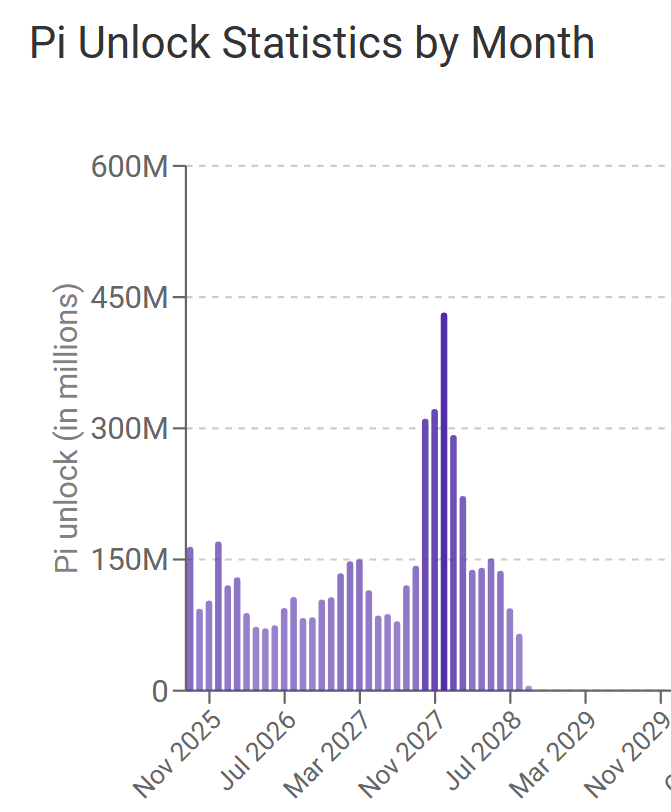

In addition, more than 164 million PI are scheduled for unlocks in September, according to Piscan’s monthly stats. These unlocks are part of the token release roadmap. However, the new supply could fuel more selling pressure in a bearish market environment, making an immediate recovery unlikely.

Moreover, two major developments recently emerged but failed to MOVE Pi’s price. First, Pi Network introduced key upgrades, including the launch of Pi Node on Linux and a protocol upgrade to version 23.

Second, European digital asset manager Valour launched eight new crypto ETPs, one of which is based on Pi Network. The ETP is listed on Sweden’s Spotlight Stock Market.

Despite these positive updates, BeInCrypto data shows Pi’s price has stayed flat at around $0.35, with no meaningful rebound.

With these factors combined, Pi’s September outlook appears gloomy. Yet, Pioneers continue to argue for a potential rebound.

What Positive Factors Could Support Pi in September?

From a bullish perspective, the question is why Pi’s price hasn’t dropped further despite all the negative signals.

Pioneers argue this is due to ongoing accumulation. While not strong enough to push the price higher, it has been sufficient to keep Pi steady around $0.35 for over a month.

“Linux node + KYC upgrades, bullish MACD & RSI bounce, Swapfone listing + whale buys. With fresh momentum, a push toward $0.64 is possible if new exchange listings and whale accumulation continue,” investor Drop Spark predicted.

From a technical standpoint, Pi’s price structure resembles an altcoin undergoing accumulation before a breakout rally.

Other Pioneers admit Pi could fall lower. Still, they remain confident in higher prices in the long term.

“[Pi on exchanges] This is a new ATH. The selling pressure continues. We might see a $0.2 before $1,” Moon Jeef forecasted.

In addition, Pi recently reappeared on CoinMarketCap’s Trendline and Bullish Sentiment lists, suggesting a revival of market interest. The positive community sentiment could act as a catalyst if the broader market recovers.