Bitcoin Risks Deeper Drop Toward $100,000 As Whales Pivot to Ethereum

Whale movements trigger seismic shifts as Bitcoin faces potential slide toward $100,000.

The Great Rotation

Major holders dump BTC positions—flooding capital into Ethereum's ecosystem. This isn't profit-taking. It's a strategic repositioning that screams institutional confidence in ETH's infrastructure play.

Market Mechanics Exposed

Liquidity vanishes faster than a hedge fund's ethics when Bitcoin tests key support levels. The $100,000 threshold isn't just psychological—it's the line where leveraged longs get vaporized.

Ethereum's Silent Rally

While headlines obsess over Bitcoin's pullback, smart money builds ETH positions through dark pools and OTC desks. They're not betting against Bitcoin—they're diversifying into the chain that actually runs financial applications.

Traders watch order books thin out as algorithmic support levels get tested. This rotation feels different—less panic, more purpose. Whales aren't fleeing crypto. They're upgrading their portfolios.

Because nothing says 'mature asset class' like a few billion dollars shifting between digital tokens based on blockchain upgrade timelines and yield farming opportunities.

Bitcoin Slips as Dormant Whale Shifts Billions Into Ethereum

On August 29, blockchain analytics firm Arkham Intelligence reported that an entity controlling more than $5 billion in Bitcoin was transferring it to Ethereum.

According to the firm, the whale moved about $1.1 billion worth of the asset into a new address before beginning a wave of ethereum purchases.

BREAKING: $5 BILLION BTC WHALE BUYING UP TO $1 BILLION $ETH

A whale holding over $5B of BTC is currently buying $ETH. He just moved $1.1 BILLION of BTC to a new wallet and has started purchasing ETH through Hyperunit/HL.

This whale bought $2.5 BILLION of ETH last week, and… pic.twitter.com/cMQWrYBmZb

Notably, Arkham said the whale had already accumulated roughly $2.5 billion in ETH last week.

Lookonchain, another blockchain analysis firm, reported that the whale had shifted 4,000 BTC—worth over $430 million—into Hyperliquid early Saturday. The move added weight to speculation that the whale was actively rotating into ETH.

Meanwhile, the whale’s aggressive repositioning quickly rippled through the broader market.

According to BeInCrypto data, Bitcoin shed about 2% in 24 hours, slipping below $108,000, while Ethereum gained a nearly identical percentage over the same window.

Crypto traders speculating on these asset prices also absorbed heavy losses.

Data from CoinGlass showed total liquidations across crypto assets exceeding $400 million in a single day. Ethereum’s long positions were hit hardest, with $133 million wiped out, while its bitcoin counterparts lost $109 million.

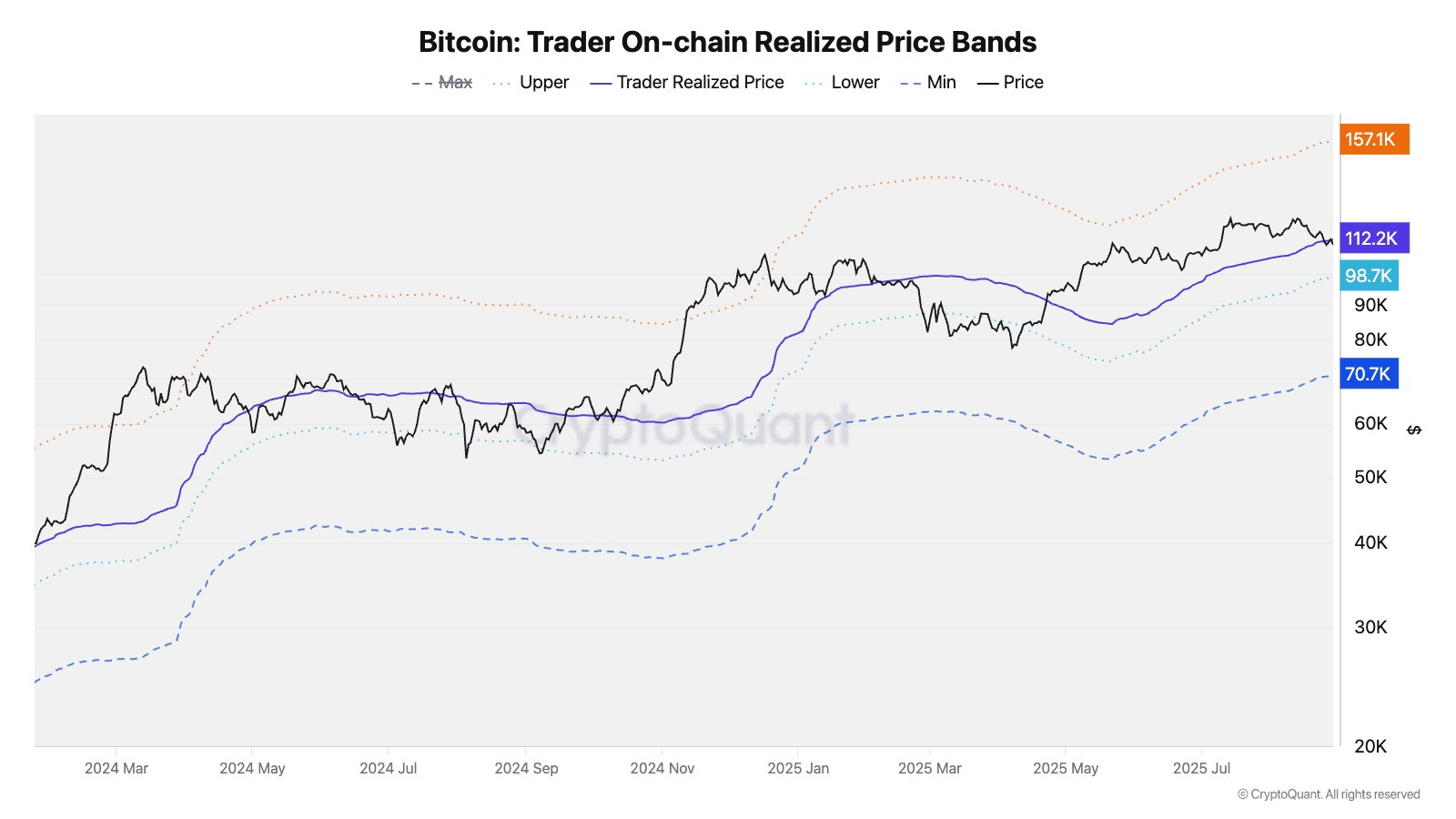

Considering this, Julio Moreno, head of research at CryptoQuant, warned that Bitcoin needs to recover the $112,000 mark to avoid deeper losses quickly. He projected that BTC could test support closer to $100,000 if momentum fails to return.

Moreno also pointed to sentiment gauges that remain firmly negative. The firm’s Bull Score index dropped to 20 earlier this week and has stayed there since—a reading that signals an “extreme bearish” environment.

So, until those metrics improve, analysts expect volatility to remain elevated.