Bitcoin’s Bull Run Nearing the End? Analysts Point to October as Possible Peak

Bitcoin's epic rally faces its ultimate test as analysts pinpoint October for a potential market top.

The Countdown to Correction

Market watchers are sounding alarms that Bitcoin's parabolic move might be running out of steam. After months of relentless gains, technical indicators are flashing warning signs that even the most bullish traders can't ignore.

October's Ominous Outlook

Historical patterns and on-chain metrics suggest this cycle could climax sooner than expected. While retail investors keep chasing momentum, smart money appears to be preparing exit strategies ahead of the traditional fourth-quarter volatility.

Because nothing says 'sound investment strategy' like timing the market based on calendar months—what could possibly go wrong?

Bitcoin’s Bull Run Enters Its Third Year

While many forecasts still fall short of expectations for bitcoin above $100,000, the rally has already entered its third year. Investors appear to focus more on the amplitude of the bull run rather than its duration.

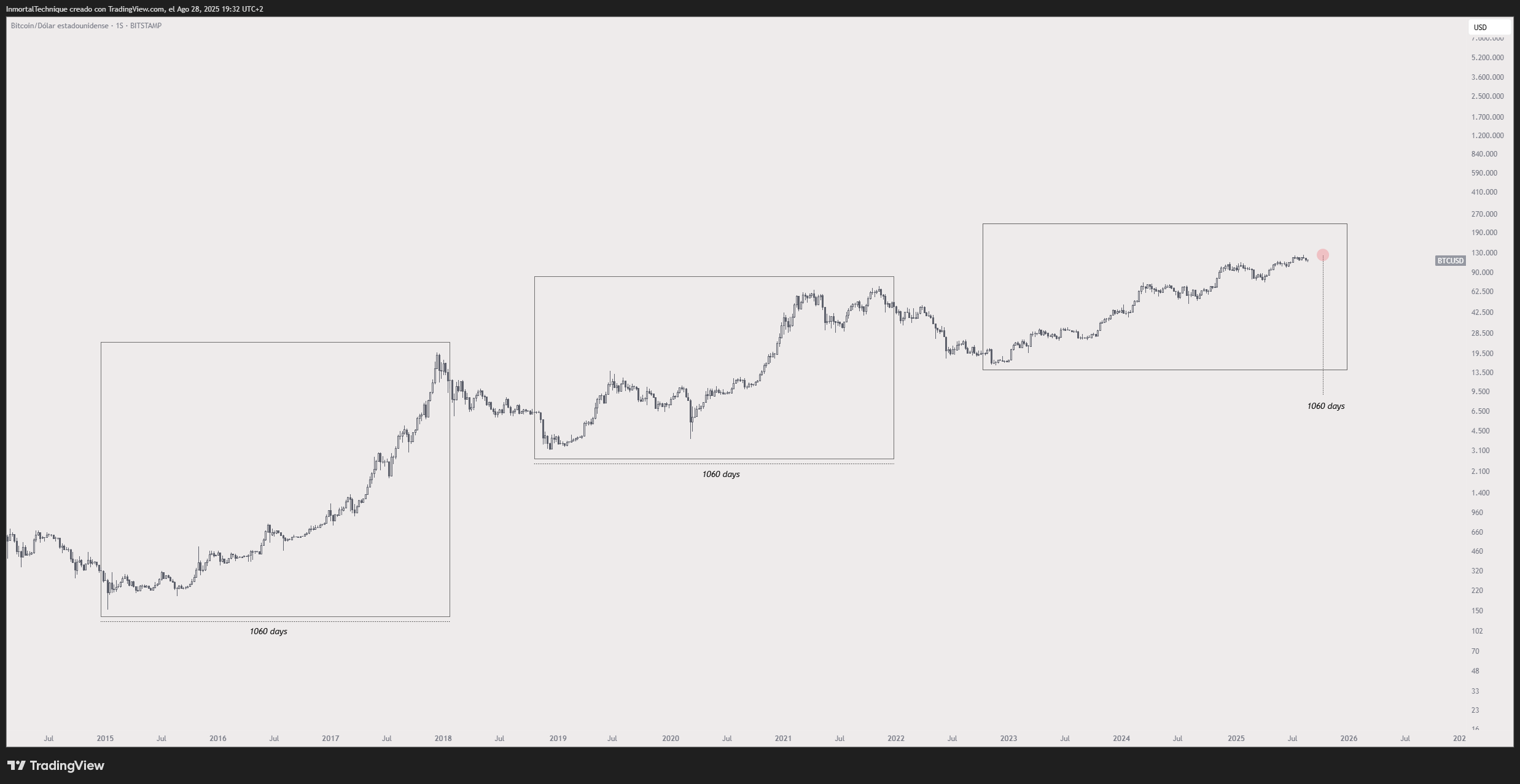

Analyst Inmortal shared on X that every previous bull cycle lasted about 1,060 days. His chart highlighted the similarities between cycles, with boxes marking 1,060-day periods from bottom to peak.

“If this happens again, the end of the cycle will be in October,” Inmortal predicted.

Analyst Jelle added that Bitcoin might have only about 55 days left in this bull cycle. In his post, Jelle explained that this forecast aligns with Solana and ethereum preparing to reach new price levels, as altcoins typically peak about a month after Bitcoin.

If history is any indication, #Bitcoin has about 55 days of bull market left in the tank.

Lines up well with $SOL and $ETH both getting ready for price discovery again – #Altcoins tend to top about a month after BTC does.

All in all, the cycle WOULD be over within 100 days if… pic.twitter.com/c8uRXsF0Bt

Analyst Ali provided additional technical evidence, highlighting a weekly RSI top divergence. This same signal previously predicted the 2021 Bitcoin bear market.

Recent analysis of Bitcoin notes that indicators like Spot Taker CVD and BTC’s Taker Buy/Sell Ratio suggested increasing selling pressure in late September.

The concern grows as Bitcoin enters September, which has historically delivered an average return of –3.77%, the lowest of the year, according to Coinglass data.

However, these forecasts rely solely on historical technical signals while ignoring present market sentiment and macroeconomic influences.

“Many think a BTC top will form in about two months. I think it’s possible too, but one element doesn’t fit: sentiment. Sentiment isn’t matching with a top. Where’s the euphoria? Sentiment is an important indicator. We’re not seeing the sentiment top form yet,” Colin Talks crypto stated.

Moreover, September volatility could also be strongly influenced by the Federal Reserve’s upcoming interest rate decision, which may shape Bitcoin’s direction for the rest of the year.