Solana Soars to 6-Month Peak, Shrugs Off Massive $432 Million Sell-Off

Solana rockets past resistance levels as institutional selling fails to dent bullish momentum.

The Unstoppable Ascent

While traditional markets fret over whale movements, SOL's price action tells a different story—one where network strength outweighs temporary sell pressure. The $432 million exit barely registered as a speed bump.

Market Mechanics Defying Logic

Liquidity absorbed the sell-off like a sponge, proving once again that crypto markets operate on a different set of rules than traditional finance. Who needs fundamentals when you've got memecoins and degens?

Institutional 'Wisdom' Meets Crypto Reality

Wall Street analysts would call this irrational—but then again, they also thought subprime mortgages were AAA-rated. Meanwhile, SOL keeps climbing while shorts get rekt.

Solana Holders Move To Sell

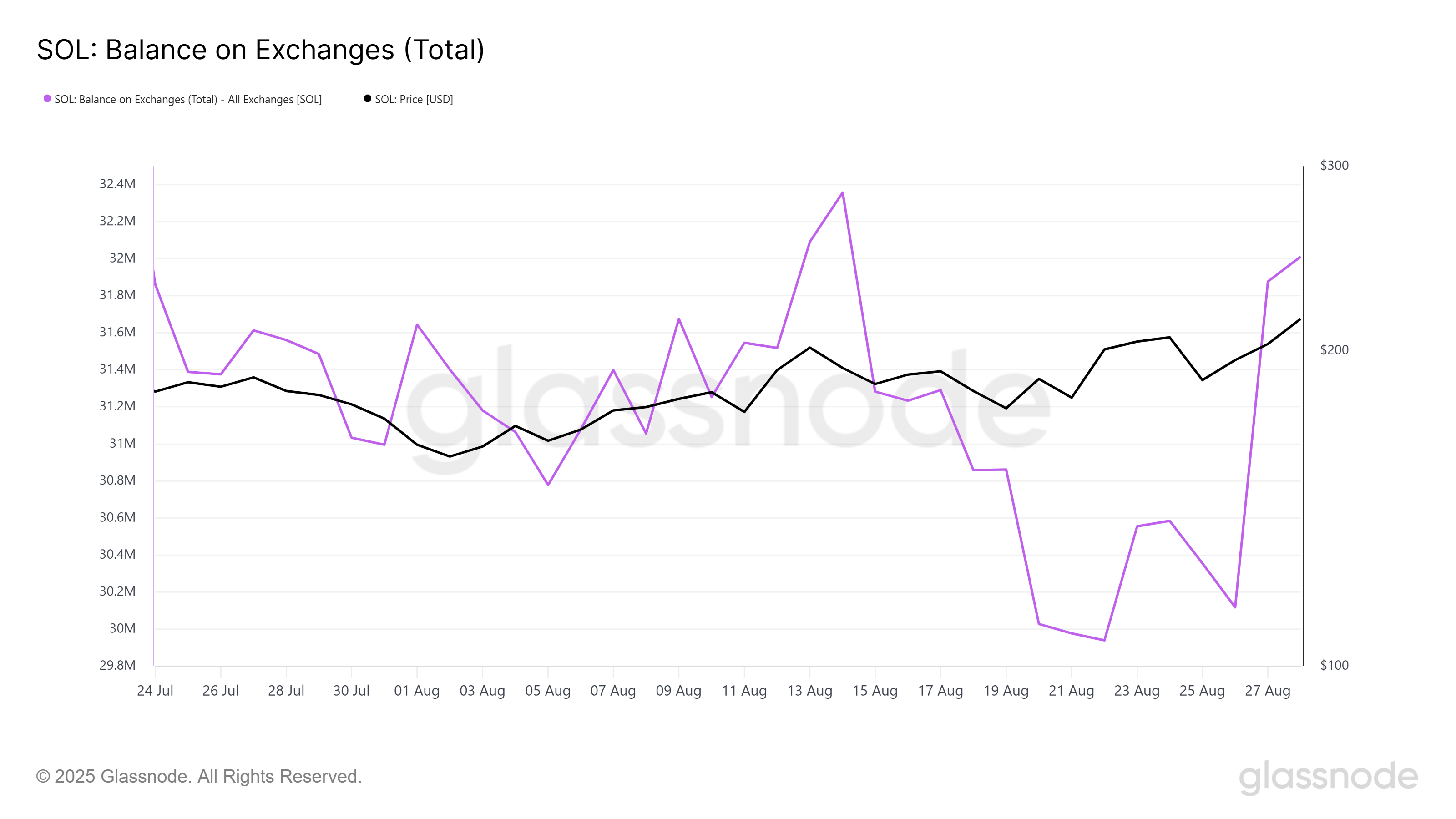

Exchange balances for solana have jumped sharply over the past three days. More than 2 million SOL, worth over $432 million, has been deposited into exchanges. This trend reflects investors taking advantage of the rally, with many choosing to secure profits rather than extend exposure to volatile conditions.

The influx highlights short-term caution among holders despite the strong price performance. Such behavior often emerges during rapid uptrends, where investors seek to capture gains before potential corrections. The heightened selling pressure places additional strain on Solana’s ability to sustain momentum above recent resistance levels.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

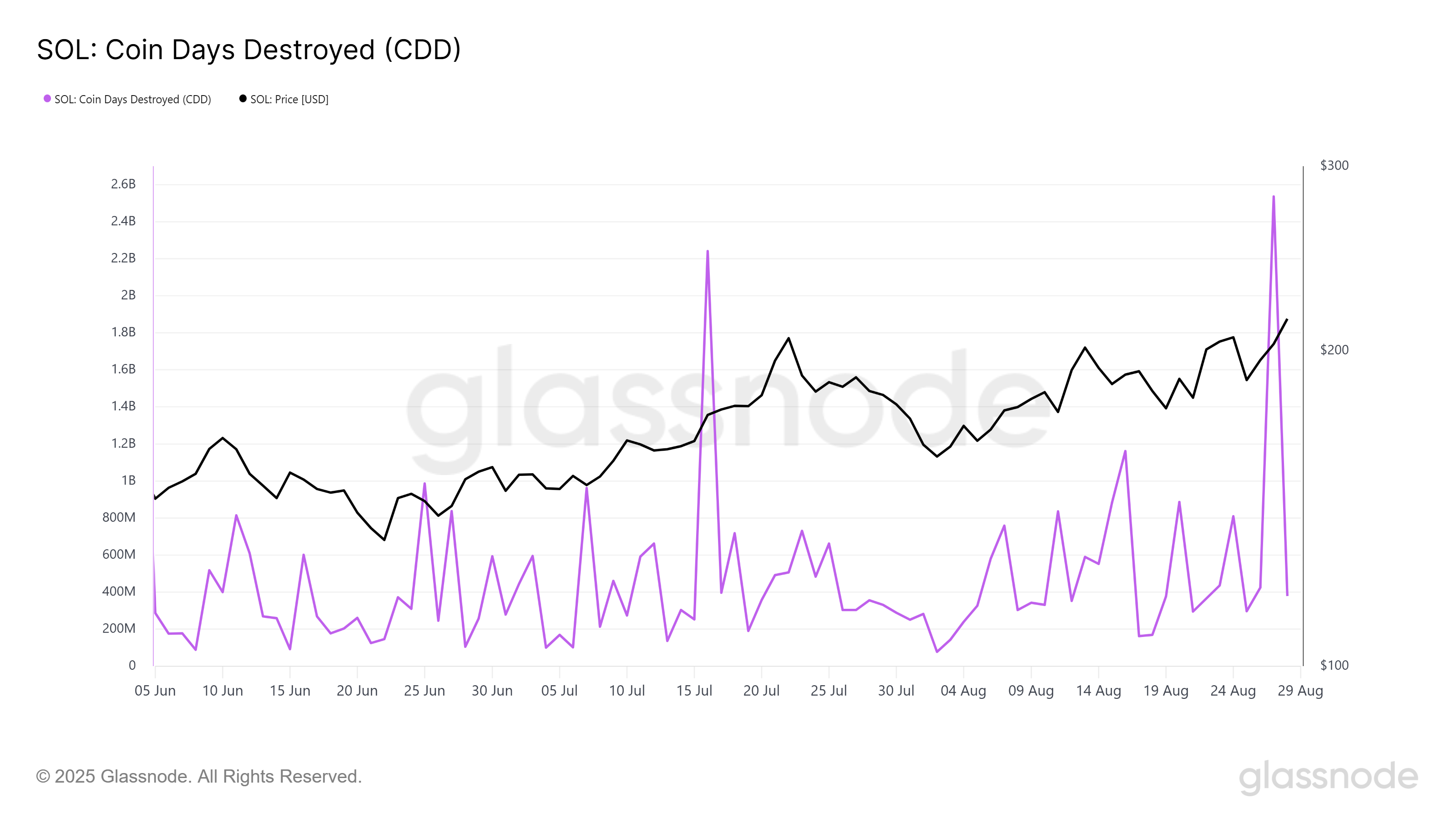

The Coin Days Destroyed (CDD) indicator has spiked to its highest level in three months, reinforcing concerns about investor activity. This metric tracks the movement of coins held by long-term holders, who are historically influential in shaping Solana’s price direction through sustained accumulation or distribution.

A spike in CDD suggests these long-term investors are shifting to selling rather than holding. Their distribution contributes heavily to the rising exchange balances. While Solana’s price has remained resilient so far, continued selling from this cohort could pressure the market and weigh on the sustainability of the current rally.

SOL Price Is Doing Well

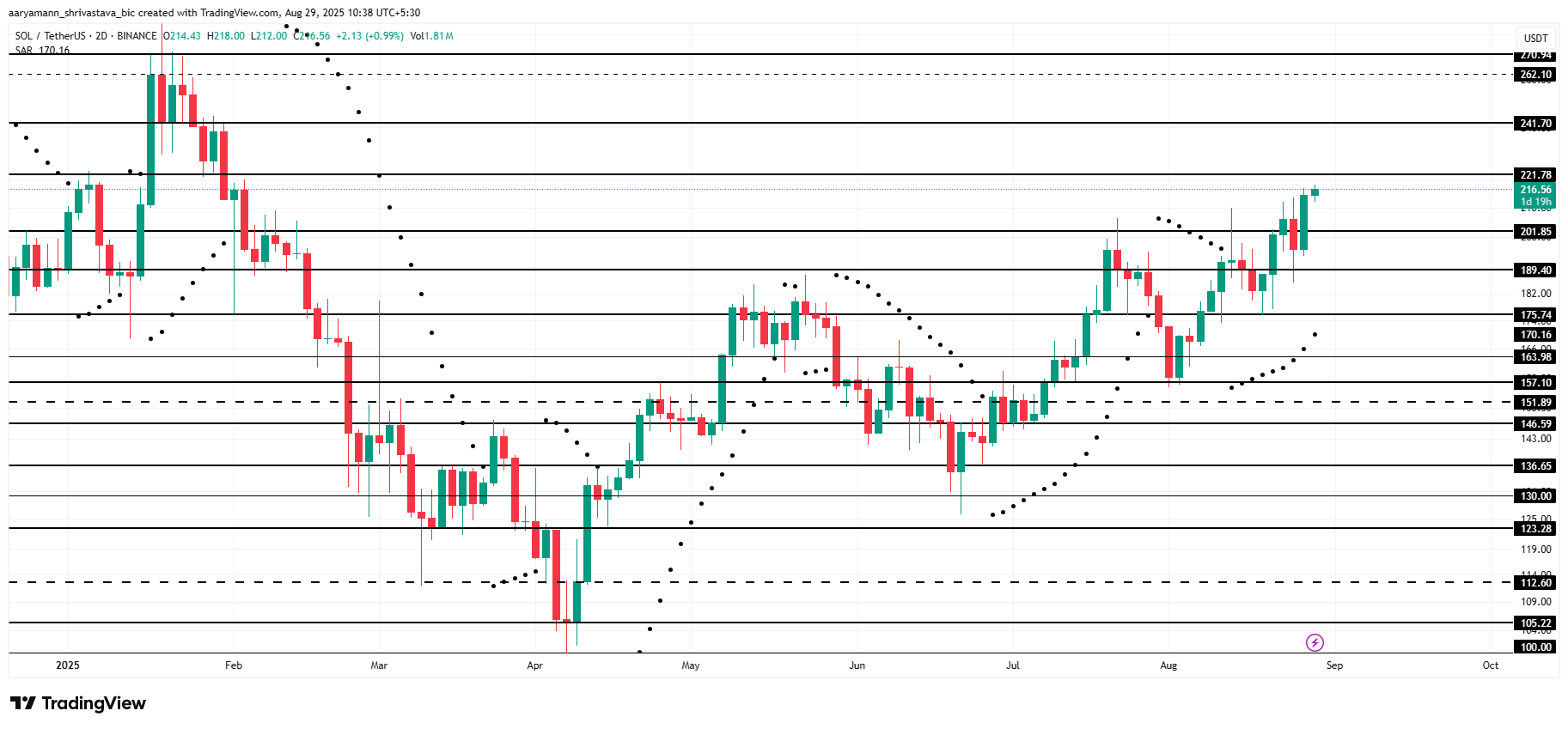

Solana trades at $216 at the time of writing, just below resistance at $221. The latest surge brought the altcoin to its six-month high. Breaking through this level remains critical for establishing further momentum and validating the continuation of its ongoing upward trend.

The Parabolic SAR indicator sits beneath the candlesticks, confirming the presence of an active uptrend. If Solana breaches $221 and flips it into support, SOL could strengthen its rally. This move would secure recent gains despite the selling pressure.

If Solana fails to withstand the current selling, the price could fall through $201 support. Continued weakness may push the altcoin toward $189 or even $175, erasing the rally’s progress. Such a decline WOULD expose vulnerabilities in Solana’s price structure and temporarily invalidate the short-term bullish setup.