Cronos (CRO) Explodes on Trump Media Frenzy—But Watch Those Liquidation Traps

CRO rockets upward as Trump-themed hype sends traders scrambling—another day, another narrative pump.

Liquidity Crunch Ahead?

Massive long positions pile in as retail FOMO meets leveraged optimism. Sound familiar? It should—this playbook rarely ends well for the overexposed.

When the music stops, somebody’s getting liquidated. Probably the same folks who still think 'buy the rumor, sell the news' is original advice.

CRO Rockets on $6.42 Billion Trump Media Buzz

CRO has surged nearly 50% in the past 24 hours, with much of the rally tied to reports linking TRUMP Media to a large-scale CRO acquisition.

BeInCrypto reported that earlier news suggested Trump Media was preparing to purchase $6.42 billion worth of CRO tokens, which fueled market speculation and spurred bullish sentiment.

However, new disclosures now indicate that the plan is more measured. Rather than an immediate $6.42 billion buyout, the company will begin with approximately $200 million in cash and a token position equal to around 19% of CRO’s market cap.

Traders Pile Into Longs, Raising Liquidation Risks

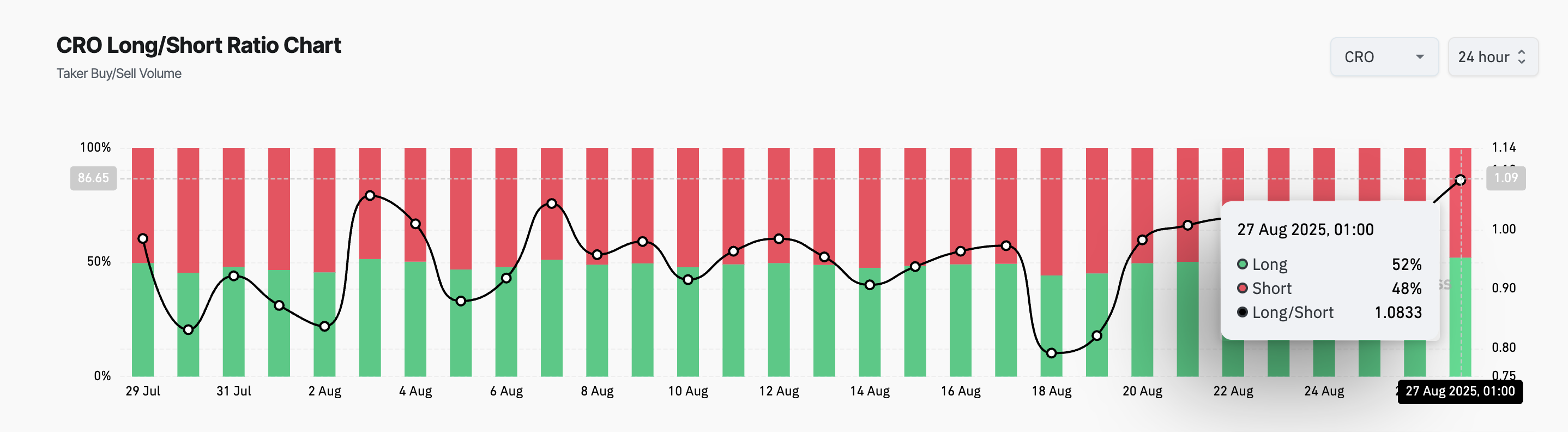

As CRO surged, its futures traders have rushed into long positions, pushing the token’s long/short ratio to a 30-day high. As of this writing, this stands at $1.08, per Coinglass.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The long/short ratio measures the balance between traders betting on price increases versus those anticipating declines. A reading above 1 indicates that more traders are taking long positions, signaling strong bullish conviction, while values below one indicate a high demand for shorts.

While CRO’s long/short ratio suggests confidence in its upward momentum, it also exposes the market to greater liquidation risks. If its price faces a reversal, the heavy concentration of longs could trigger many forced sell-offs, worsening market volatility.

CRO Enters Overbought Zone

Readings from CRO’s Relative Strength Index (RSI) on the daily chart show that the altcoin has entered overbought territory, a classic indicator that it may be due for a dip. At press time, this indicator stands at 80.77.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 80.15, CRO’s RSI suggests the likelihood of a correction in the NEAR term, with buyer exhaustion worsening. Any reversal in CRO’s current trend could trigger a drop to $0.195, its next major support floor.

On the other hand, if buyers continue accumulating CRO, it could reclaim $0.23 and rally to $0.27, a high last seen in May 2022.