Bitcoin Targets $100,000–$107,000 Support Zone As Massive Liquidations Rock Markets

Bitcoin's brutal selloff triggers carnage across derivatives markets—now all eyes lock onto that critical $100,000–$107,000 support band.

Heavy Leverage Meets Heavy Consequences

Traders betting big got burned. Liquidations ripped through over-leveraged positions as BTC wobbled—classic case of greed meeting gravity. The market doesn’t care about your margin.

Where Bitcoin Stands Now

That $100,000–$107,000 zone isn’t just a number—it’s a psychological and technical floor. Break below, and things could get messy. Hold, and bulls might just catch their breath. Either way, volatility’s back on the menu.

Finance pros—who totally saw this coming, by the way—are now nodding gravely. Because nothing says 'I told you so' like a crash everyone pretended wasn’t possible.

Mass Liquidations for Bitcoin

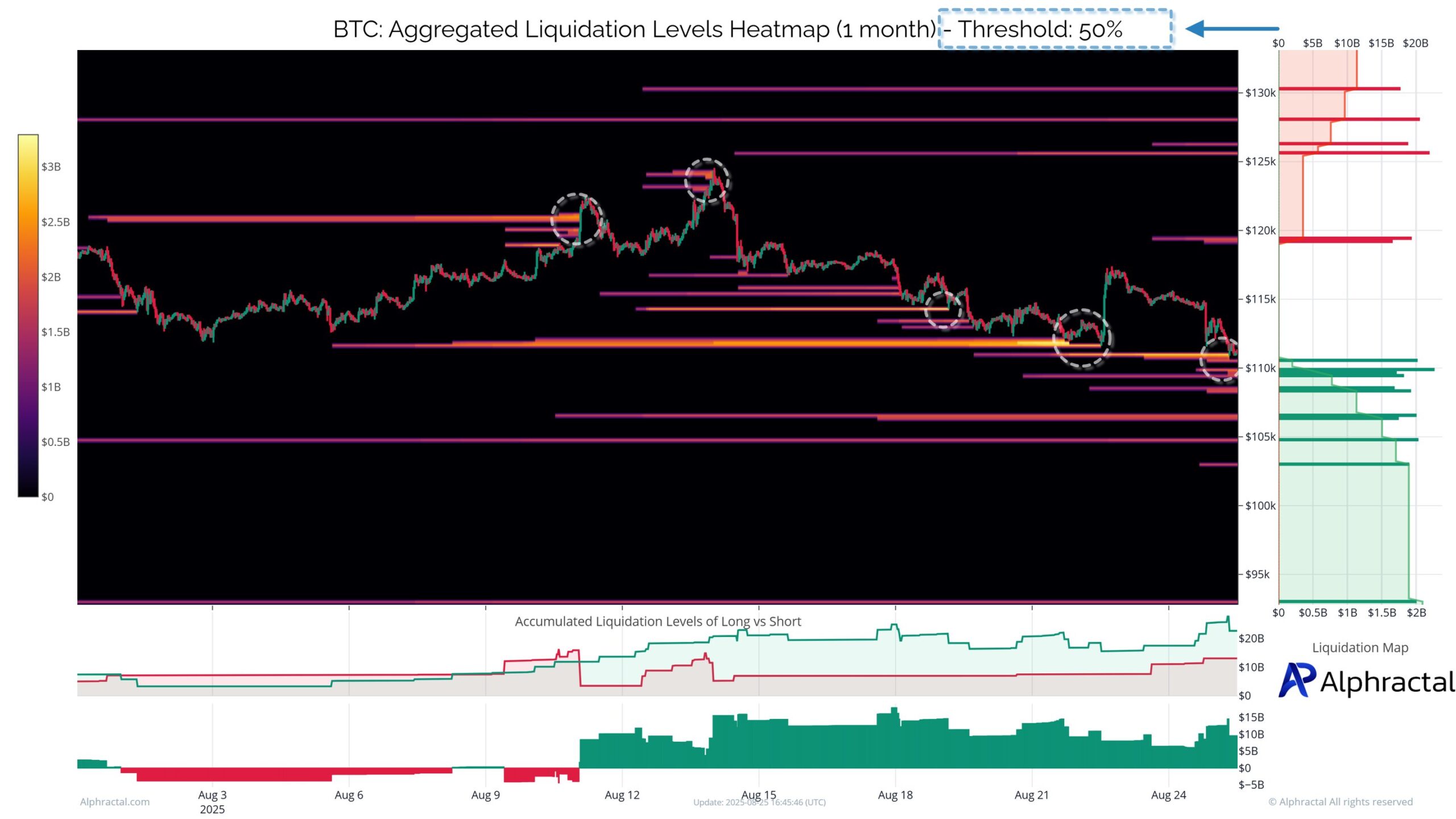

According to data from Alphractal, 94% of traders were liquidated during this period. When applying a 50% Liquidity Threshold filter, only densely concentrated liquidity zones remain. This indicates that price has actively “sought out” large order clusters to clear positions.

Ethereum has experienced a similar scenario, with both long and short positions heavily impacted over the past 30 days.

For Bitcoin, the most prominent feature is the formation of a massive long cluster around $104,000–$107,000. This concentrated liquidity zone aligns with the $100,000–$107,000 support zone, which Analyst Axel Adler Jr. identified based on on-chain data.

Specifically, this level marks the intersection of the Short-Term Holder Realized Price (the average cost basis for short-term investors) and the 200-day SMA. This factor bolsters the reliability of this support zone’s “defensive” role. Many experts predict that if this zone is breached, a deeper retreat to the $92,000–$93,000 range will occur.

“The nearest strong support zone is the 100K–107K range, where the STH Realized Price and SMA 200D intersect. Below that is additional support around 92–93K, a deeper support level reflecting the cost basis of short-term investors who held coins for 3 to 6 months. This will become a key second line of defense if the market loses the 100K–107K level.” Axel Adler Jr stated.

As BeInCrypto reported, Bitcoin’s spot taker activity has turned sell-dominant, highlighting fading buy-side demand and risk of a drop toward $107,557 support.

Conversely, the $108,800 level is the short-term dividing line between a bull and bear market. According to Murphy Chen, this represents the short-term cost basis for investors.

A stable close above this threshold signals a significant reduction in selling pressure. However, losing this level could trigger a short-term sell-off.

In other words, the $108,800 zone is the “gateway” that determines whether Bitcoin sustains its upward momentum or enters a deeper correction phase.

“Currently, at $108,000, it’s a 13% drop from the high. If STH-RP is breached, theoretically there WOULD still be 10-15% downside space. Without the cooperation of negative events of the same magnitude, the correction amplitude may not exceed the previous two instances,” Murphy Chen stated.

The market has liquidated 94% of accounts over the past three months. This highlights the dangers of high-leverage trading during a market dominated by liquidity hunts.

As the 50% filter highlights, trading NEAR large liquidity clusters often carries high risk. This makes defensive strategies, stop-loss placement, and position management more critical.