Ethereum Shatters All-Time High as Powell’s Speech Ignites Crypto Frenzy

Powell's words just lit the fuse—and Ethereum's rocket is soaring.

The Catalyst: Fed Signals

Jerome Powell’s latest speech didn’t just hint at dovish policy—it screamed it. Markets reacted instantly. Traders piled into risk assets, and Ethereum led the charge. No vague promises, no bureaucratic jargon—just pure momentum.

The Aftermath: ATH Breached

Ethereum blasted past previous resistance like it wasn’t even there. The surge wasn’t gradual; it was violent, decisive. Volume spiked, liquidity tightened, and shorts got obliterated. Classic crypto—brutal for the unprepared, euphoric for the believers.

The Irony: Traditional Finance Watches

Meanwhile, Wall Street analysts scrambled to justify the move—as if fundamentals ever mattered during a melt-up. Some things never change: crypto moves first, legacy finance rationalizes later. A timeless dance, really.

So here we are—another all-time high, another round of euphoria. Will it hold? Who knows. But for now, Ethereum’s not asking for permission.

Ethereum’s New All-Time High

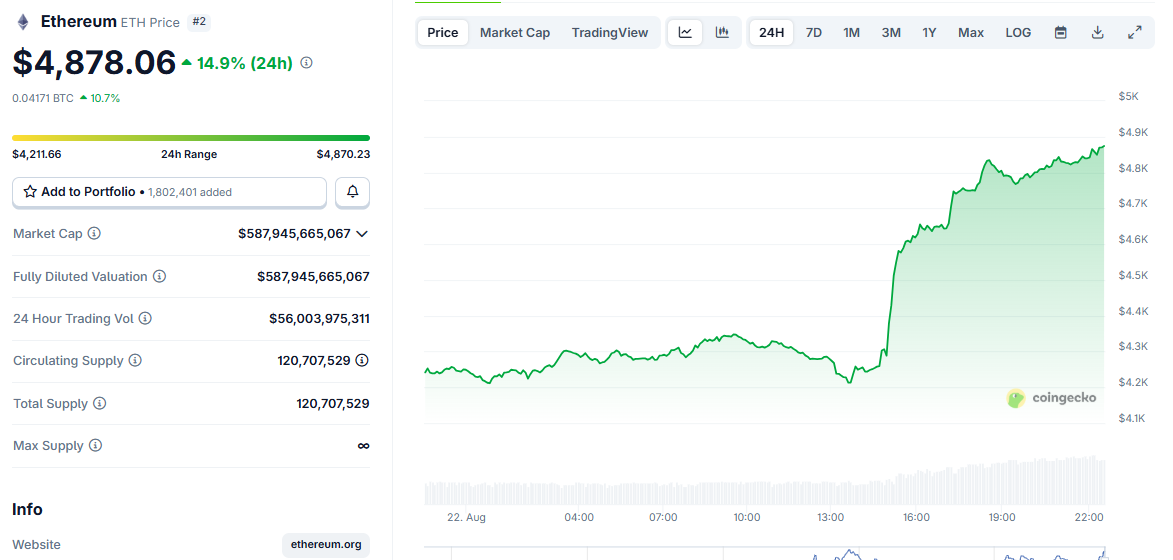

Ethereum’s price has gone up and down lately, balancing rampant institutional inflows on one hand with massive trader liquidations on the other. Still, today, the token began a substantial price spike after Jerome Powell’s Jackson Hole speech. This was a big boost for Ethereum, which just reached a new all-time high:

A few factors can help explain Ethereum’s recent performance. $5 billion in ETH and BTC options were set to expire during or before Powell’s speech, and ethereum is seriously contesting Bitcoin’s market dominance right now. $245 million worth of ETH short positions were liquidated today as Ethereum reached this all-time high.

Moreover, CoinMarketCap is predicting that an altcoin season may be imminent, and ETH is a clear favorite to lead it. Between these factors, Ethereum has a lot of things supporting it, and it could keep growing past this all-time high.