How OKB’s Token Burn Strategy Ignited the CEX Sector in August 2025

Token burns aren't just hype—they're proving to be the rocket fuel for centralized exchange tokens.

OKB's aggressive deflationary move sent shockwaves through the crypto market, demonstrating how strategic tokenomics can create tangible value.

The August burn mechanism triggered a supply squeeze that propelled OKB to new heights while lifting the entire CEX sector.

Market analysts noted the burn's psychological impact—traders love scarcity, even when it's mathematically engineered.

Competing exchanges watched closely as OKB's price action validated the burn-and-appreciate model that's become the industry's favorite financial alchemy.

Because nothing makes crypto traders happier than watching digital assets disappear—unless it's watching their portfolio value appear.

CEX Tokens Correlated With OKB in August

A recent report from BeInCrypto highlighted key differences in the latest OKB token burn that helped its price performance outpace other altcoins last month.

The plan included cutting the supply to a fixed 21 million, while expanding OKB’s utility through the X Layer. The strategy has delivered stronger results than many investors expected. OKB has now surpassed $200, marking a 350% increase.

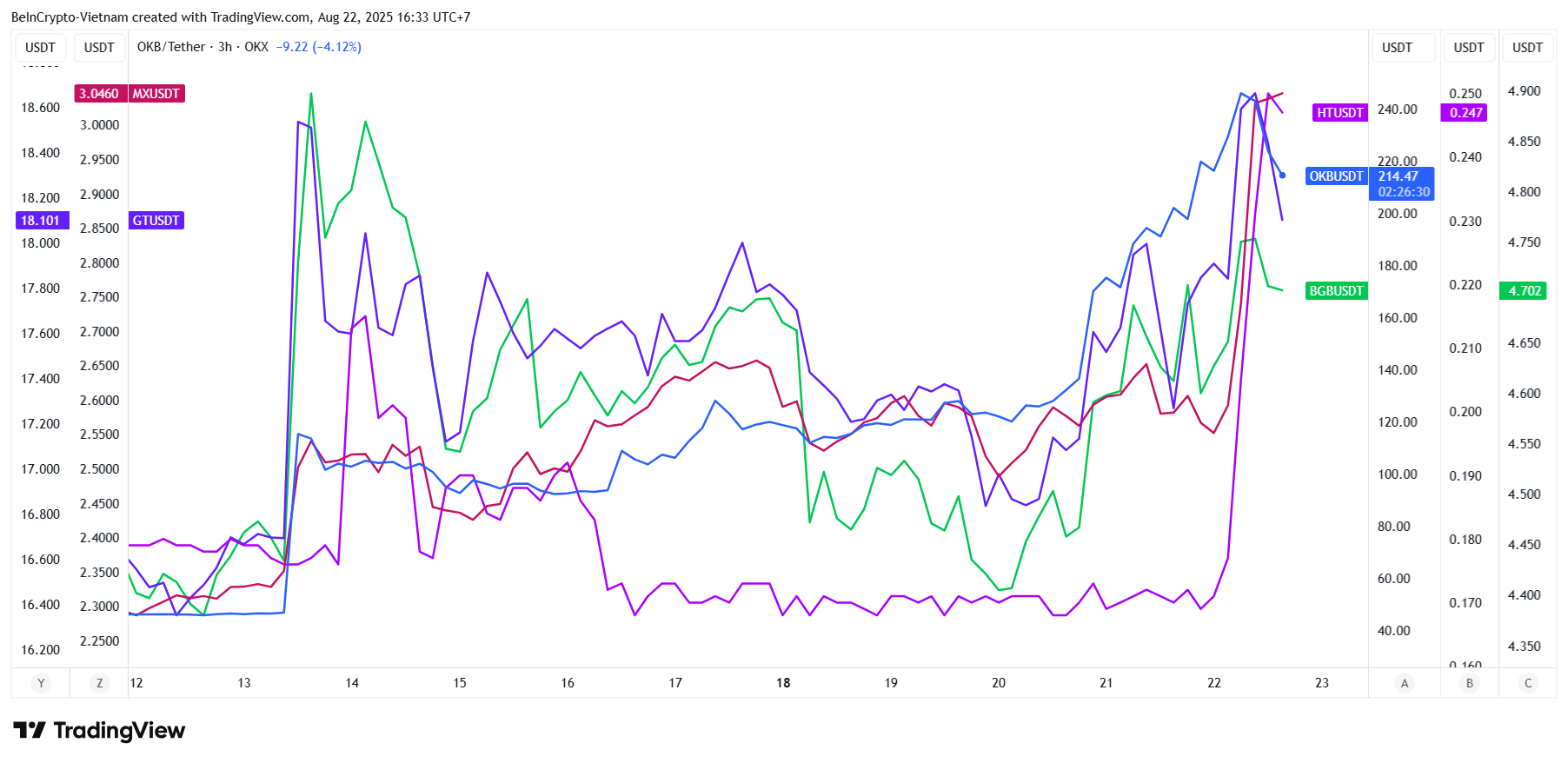

Looking at the price action of other CEX tokens, they showed a strong correlation with OKB. They all started their rallies on August 13, when OKB announced its burn plan. They later corrected and bounced back on August 22.

Huobi Token (HT) Followed OKB

The most notable case is Huobi Token (HT), which surged fivefold in August 2025, rising from $0.30 to a peak of $1.50. According to BeInCrypto data, HT is currently trading at approximately $1.

The puzzling part is that Huobi rebranded as HTX in 2023. By 2024, HTX urged users to swap old HT tokens for the new HTX token. Today, the old HT token remains listed only on a few small exchanges, while HTX trades on HTX and other major platforms such as Bybit and Bitfinex.

Yet, the token rallying is not HTX, but HT. This shows a contagion-like psychological effect that disregards fundamentals—something often seen in crypto markets.

“After OKB yesterday… today it’s HT’s turn,” crypto KOL Wise Advice said.

MEXC, Gate, and Bitget

Other tokens also benefited. MX Token (MX) from MEXC ROSE 40% in August.

MX has a supply model similar to OKB, drawing traders’ attention. MEXC commits 40% of its quarterly profits to buy back and burn MX tokens, keeping the circulating supply capped at 100 million. In Q2 2025, MEXC burned 2,398,000 MX tokens.

Bitget has also burned 860 million BGB ($5.25 billion) over the past eight months, cutting total supply by 43%. Although BGB’s price only rose 10% in August, on-chain data shows whales accumulating the token recently, signaling expectations for further gains.

Gate Token (GT) also saw a surge in activity. Its 24-hour trading volume hit $24 million, doubling from its previous daily average.

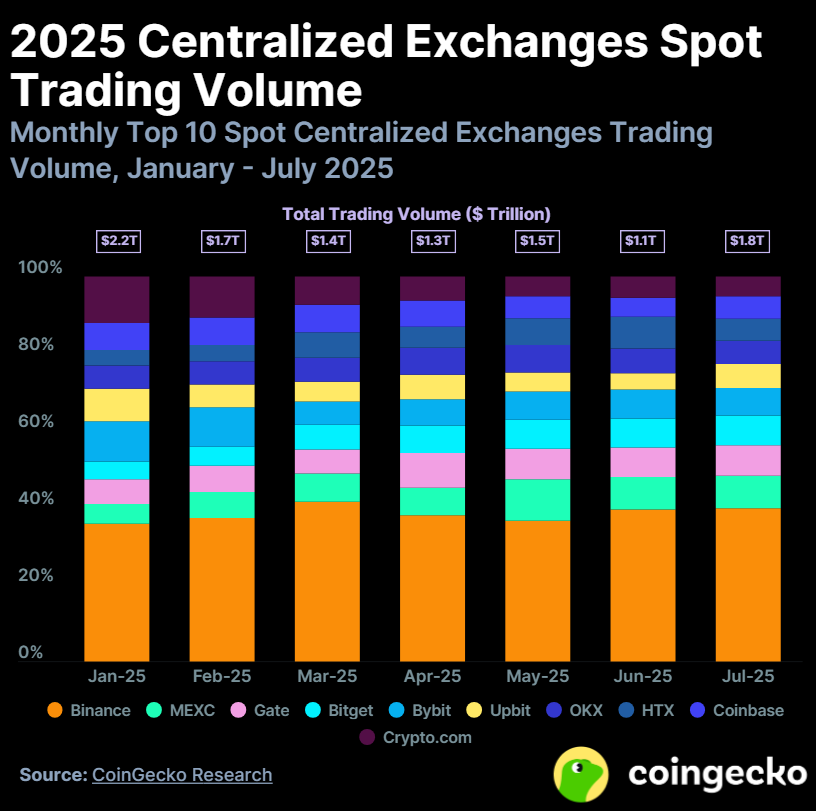

MEXC, Gate, and Bitget’s tokens are not simply rising due to OKB’s momentum. A recent Coingecko report showed these three exchanges ranked just behind Binance in trading volume market share last month, at 8.6%, 7.8%, and 7.6% respectively.

However, the spillover effect can fade quickly without fundamental support, such as the tokens’ utility within their exchange ecosystems.