Bitcoin Miners Drain Reserves, Creating Major Headwinds for BTC Price Outlook

Bitcoin's mining giants are bleeding reserves—and the market's feeling the pressure.

The Great Sell-Off

Miners aren't just trimming positions; they're dumping coins at a pace that's rattling even seasoned traders. When the very entities that secure the network start offloading en masse, you pay attention.

Pressure Cooker Market

This isn't subtle profit-taking. It's a calculated move to cover operational costs amid squeezed margins. Every coin hitting the exchanges adds immediate sell-side pressure, making rallies harder to sustain.

Short-Term Pain, Long-Term… Question Mark

While some see this as healthy deleveraging, others fear it signals deeper miner distress. If the trend continues, it could suppress prices longer than bulls would like. Because nothing says 'decentralized future' like a handful of miners dictating market momentum—just how the Satoshi whitepaper intended, right?

BTC Miners Offload Holdings

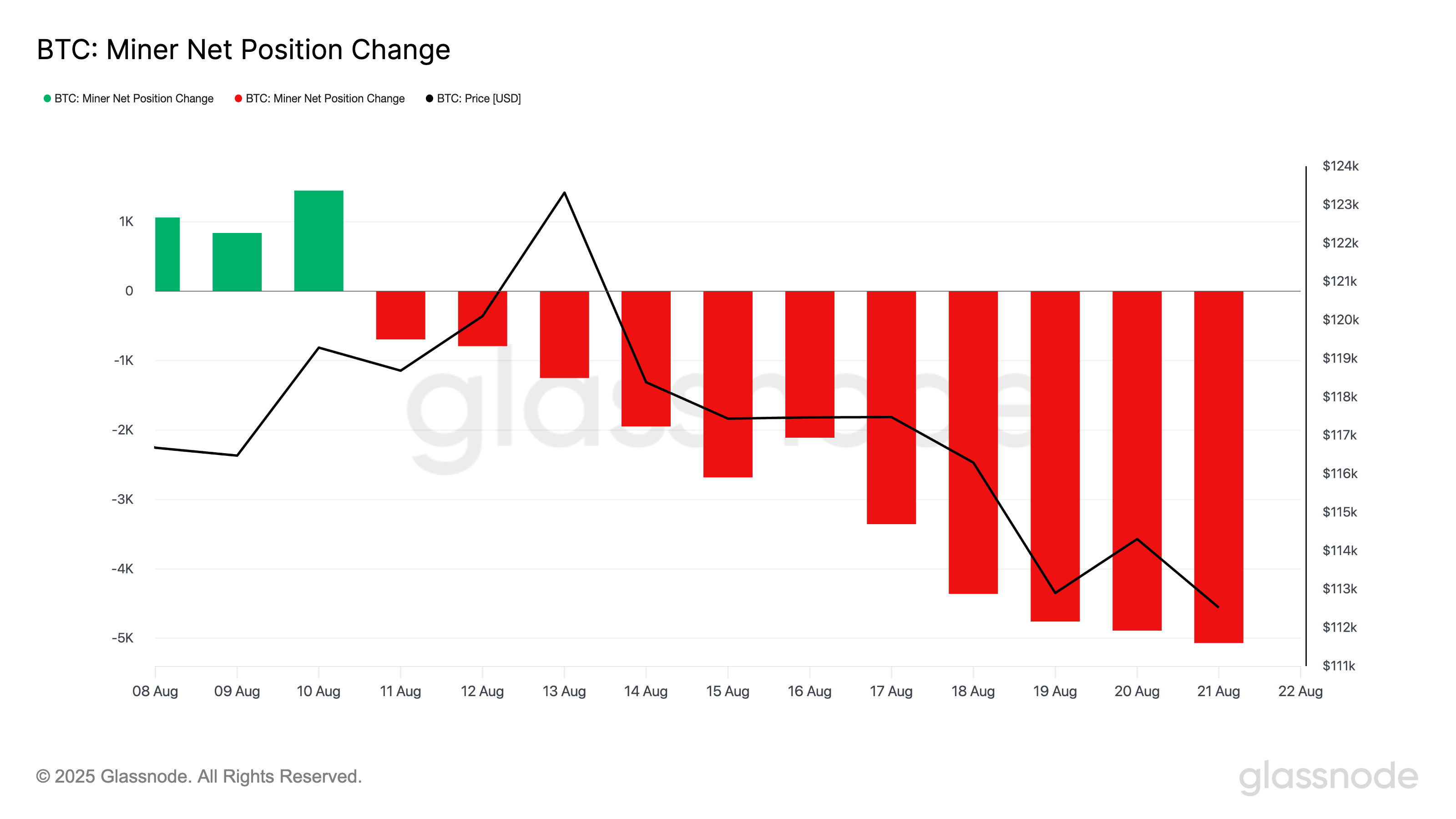

According to Glassnode, Bitcoin’s Miner Net Position Change has dropped to its lowest level of the year.

The metric, which tracks the 30-day change in BTC held in miner addresses, fell to -5,066 on August 21, its lowest reading since December 2024, signaling a notable drawdown in miner reserves.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

When this metric dips, it signals heightened selling pressure from one of the market’s most influential groups, the miners. Persistent outflows from miner wallets can weigh on prices, especially as the market struggles to absorb this additional supply.

This may worsen BTC’s downward momentum and prolong the likelihood of any significant short-term corrections.

ETF Outflows Surge to $1.5 Billion

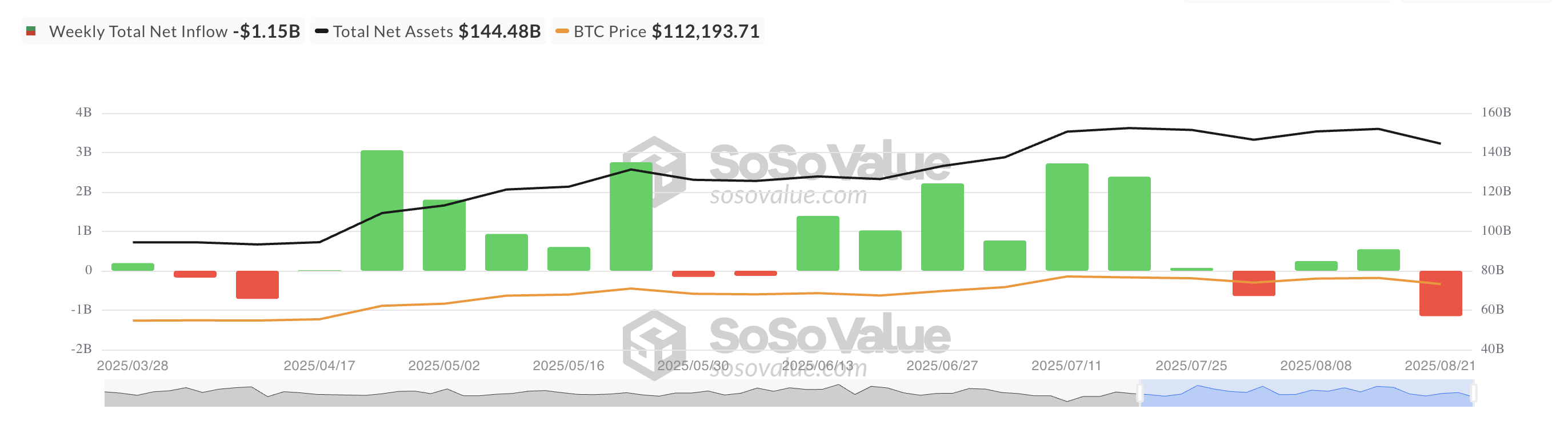

Besides miners, institutional investors gaining exposure to BTC through ETFs have also weighed on the market. According to SosoValue, weekly outflows from these funds have totaled $1.51 billion since Monday, putting them on track to record their largest weekly outflow since late February.

The decline in capital inflows from ETFs adds further headwinds for the asset. It can worsen the impact of miner sell-offs on the coin and stall any notable rebound in the near term.

BTC Faces $107,000 Downside Risk

At its current price, BTC hovers above the support formed at $111,961. If miner sell-offs continue and capital into BTC ETFs continues to reduce, the coin risks breaching this support FLOW and falling to $107,557.

However, an uptick in new demand for BTC WOULD invalidate this bearish outlook. If accumulation resumes among traders and miners on the network, reducing their distribution, the king coin could regain strength and climb toward $115,892.