Stellar (XLM) Price Plummets: Relentless Outflows Signal Deepening Downtrend

XLM's bleeding continues—no bottom in sight as capital flees the embattled asset.

Technical Breakdown

Stellar's chart paints a grim picture. Each rally gets smacked down harder than the last. Resistance levels aren't just holding—they're acting like concrete ceilings.

Market Realities

Traders are voting with their wallets, and the verdict is brutal. Outflow patterns suggest this isn't panic selling—it's a calculated exodus. The smart money already left the building.

Broader Context

While some altcoins show signs of life, XLM keeps digging its grave deeper. It's becoming the poster child for 'when good projects go bad' in this cycle. Another reminder that in crypto, even established names aren't safe from brutal corrections—but then again, when has traditional finance ever been this entertaining?

Stellar Investors Are Uncertain

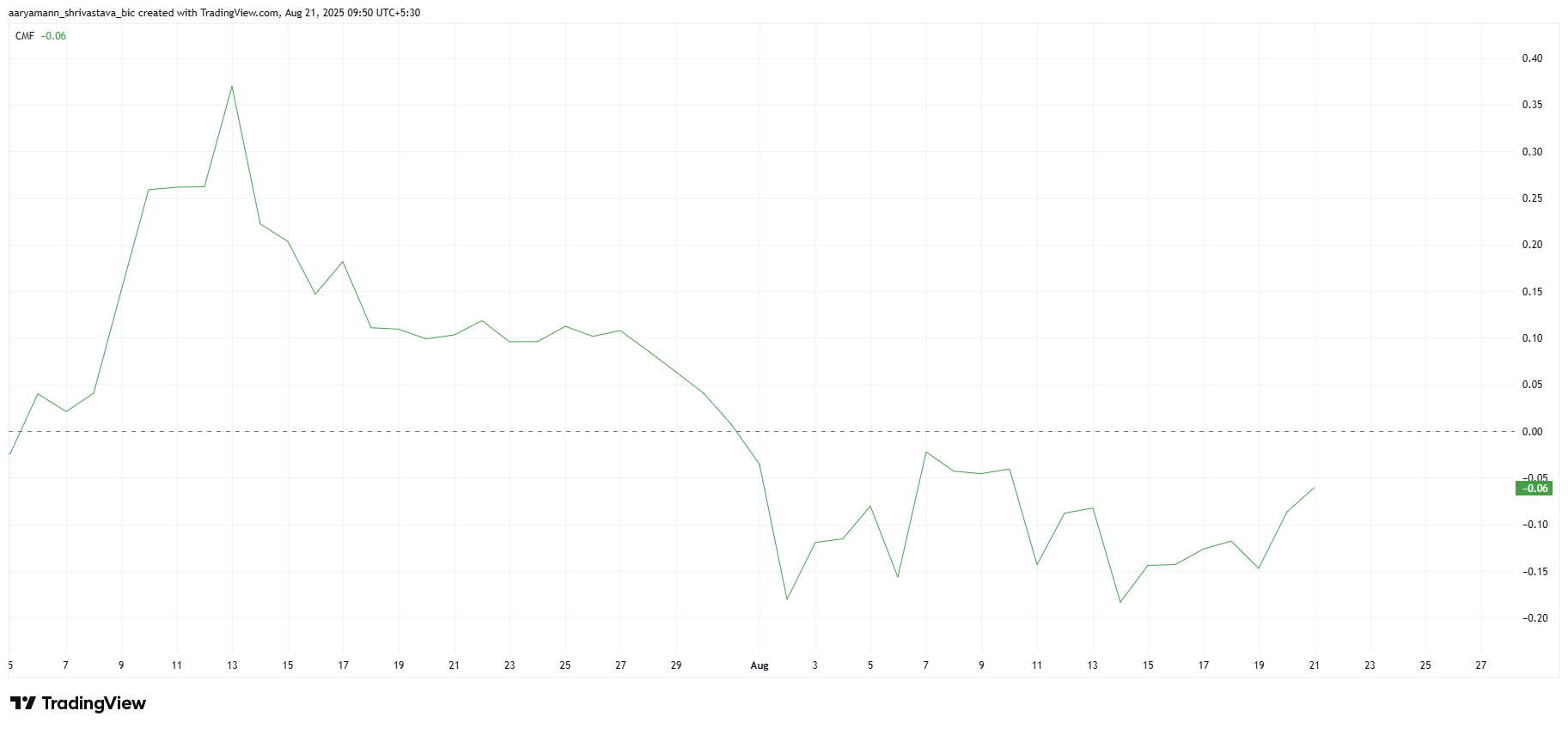

The Chaikin Money FLOW (CMF) has been stuck below the zero line since the start of the month, signaling strong outflows from XLM. This indicates that investor uncertainty is hindering new inflows into the asset.

As the CMF stays negative, it reflects a lack of confidence in XLM’s short-term prospects. Investors appear to be pulling out their funds, leading to a sustained bearish sentiment in the market.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

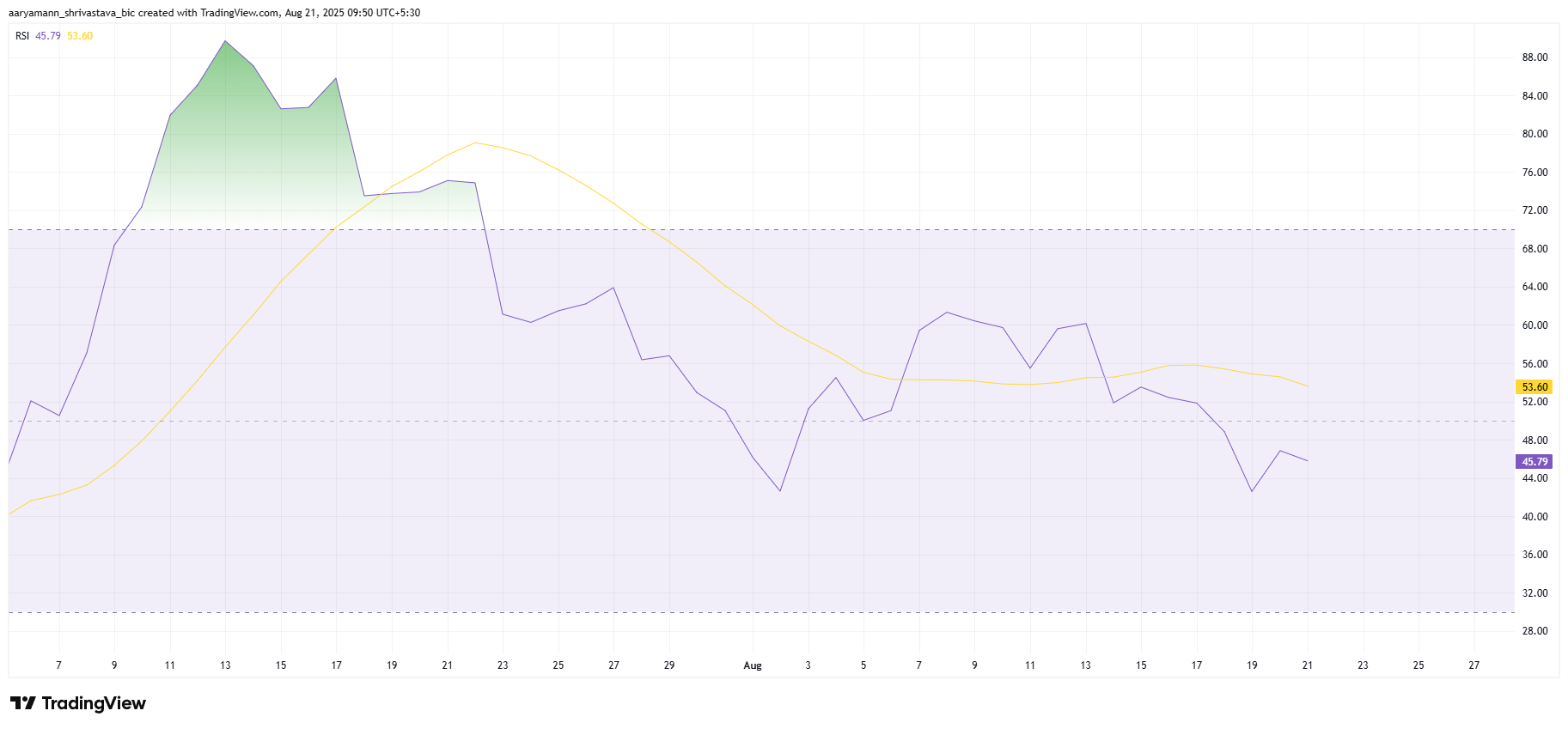

The Relative Strength Index (RSI) for XLM has also slipped below the neutral line, reinforcing the bearish outlook. The RSI is a critical indicator that tracks momentum and market conditions, and its current position shows growing weakness for XLM.

With the RSI trending downward, the broader market environment for XLM remains unfavorable. This further supports the notion that, for the time being, the altcoin is under significant selling pressure, and any potential recovery seems distant.

XLM Price Is Not Noticing A Downtrend

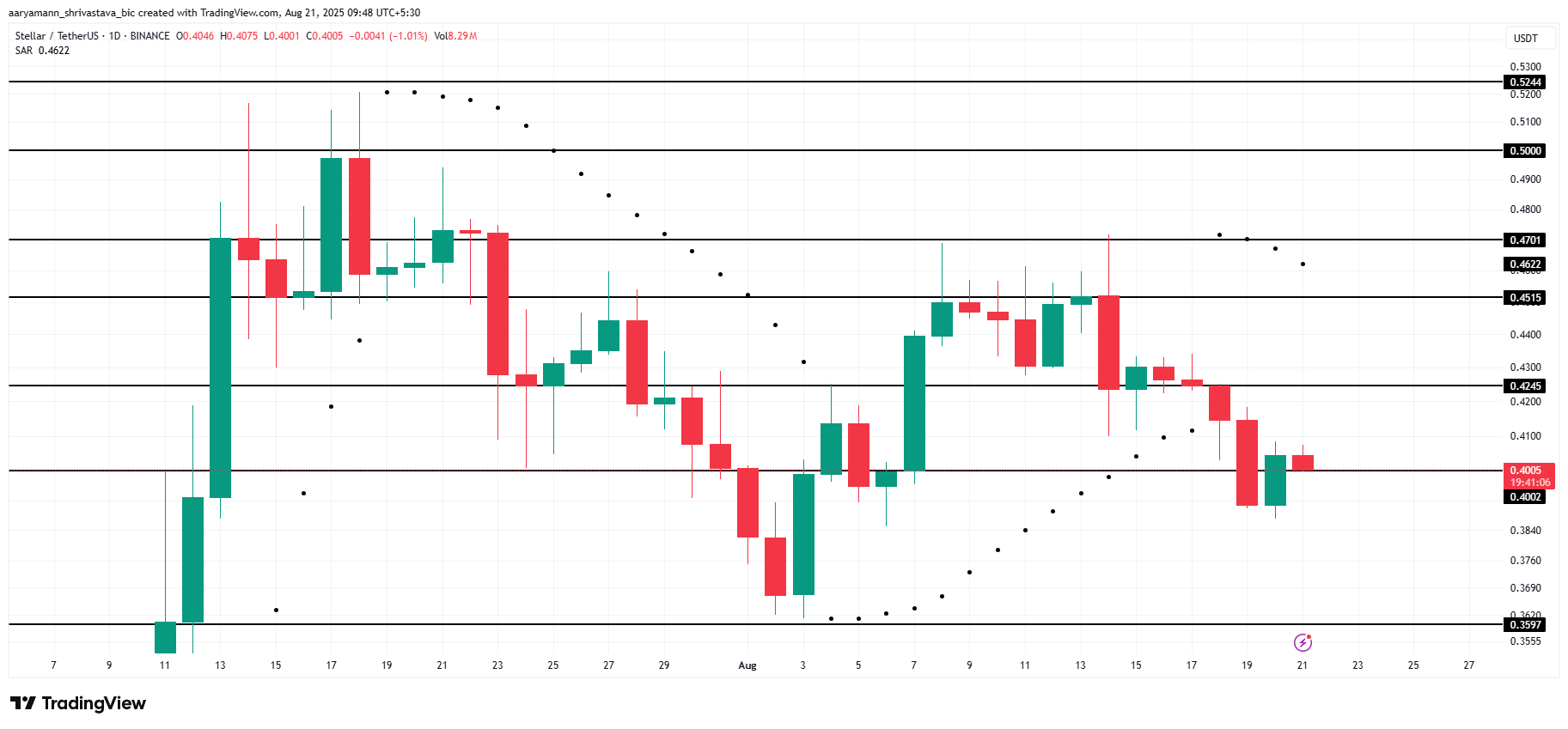

XLM’s price is currently at $0.40, and they are attempting to hold this level as support. However, given the current market conditions and the indicators mentioned above, it seems unlikely that XLM will recover its losses in the short term. The Parabolic SAR above the candlesticks confirms the ongoing downtrend, making it difficult for the altcoin to reverse its trajectory.

The next significant support level for XLM is at $0.35, which it last visited over a month ago. If the downtrend continues, the price could fall to this level, triggering further selling from investors. This WOULD reinforce the bearish market sentiment and could prolong the period of weak price action.

However, if XLM manages to bounce off the $0.40 support level, it could see a recovery toward $0.42 or even $0.45, provided investors shift their sentiment and re-enter the market. A successful rebound would invalidate the bearish thesis.