Avalanche’s Meteoric Rise: Dominating Stablecoins and RWA Tokenization in 2025

Avalanche isn't just competing—it's rewriting the rulebook for blockchain infrastructure. While other chains scramble for relevance, AVAX positions itself as the go-to platform for the next generation of financial assets.

Stablecoin Surge: The New Digital Dollar Haven

Major issuers flock to Avalanche's subnet architecture, drawn by its blistering transaction speeds and negligible fees. Traditional finance giants finally wake up to what crypto natives knew years ago—you can't build global payment rails on congested networks.

RWA Revolution: Tokenizing Everything That Isn't Nailed Down

Real-world assets flood onto the chain as institutional players bypass legacy settlement systems. Why wait three days for securities clearance when Avalanche delivers finality in under two seconds? The old guard's paperwork empire trembles as property deeds, corporate bonds, and even fine art find their digital twins on AVAX.

Of course, Wall Street will take credit for 'discovering' this innovation—right after finishing their fifth martini lunch. Avalanche doesn't just host the future of finance; it's building the infrastructure that makes traditional finance look like a medieval relic.

Avalanche Attracts Institutional Interest With Expanding Ecosystem

As reported by BeInCrypto, Wyoming officially launched the first state-issued stablecoin in the US. Notably, this stablecoin chose Avalanche (AVAX) as its deployment infrastructure instead of Ethereum (ETH).

Beyond the US, Avalanche has also made its mark in Japan, where a yen-pegged stablecoin has received regulatory approval and is preparing to launch on the network. The rise of stablecoins on AVAX shows that the blockchain steadily earns institutional recognition. This development highlights its expansion beyond traditional use cases.

At the same time, major corporations are beginning to explore Avalanche’s potential.

Toyota recently released a whitepaper on its Mobility Orchestration Network, highlighting efforts to build a new technology infrastructure based on Avalanche. Meanwhile, Anthony Scaramucci’s SkyBridge Capital announced plans to tokenize $300 million worth of assets on Avalanche, further strengthening the platform’s position in the RWA trend.

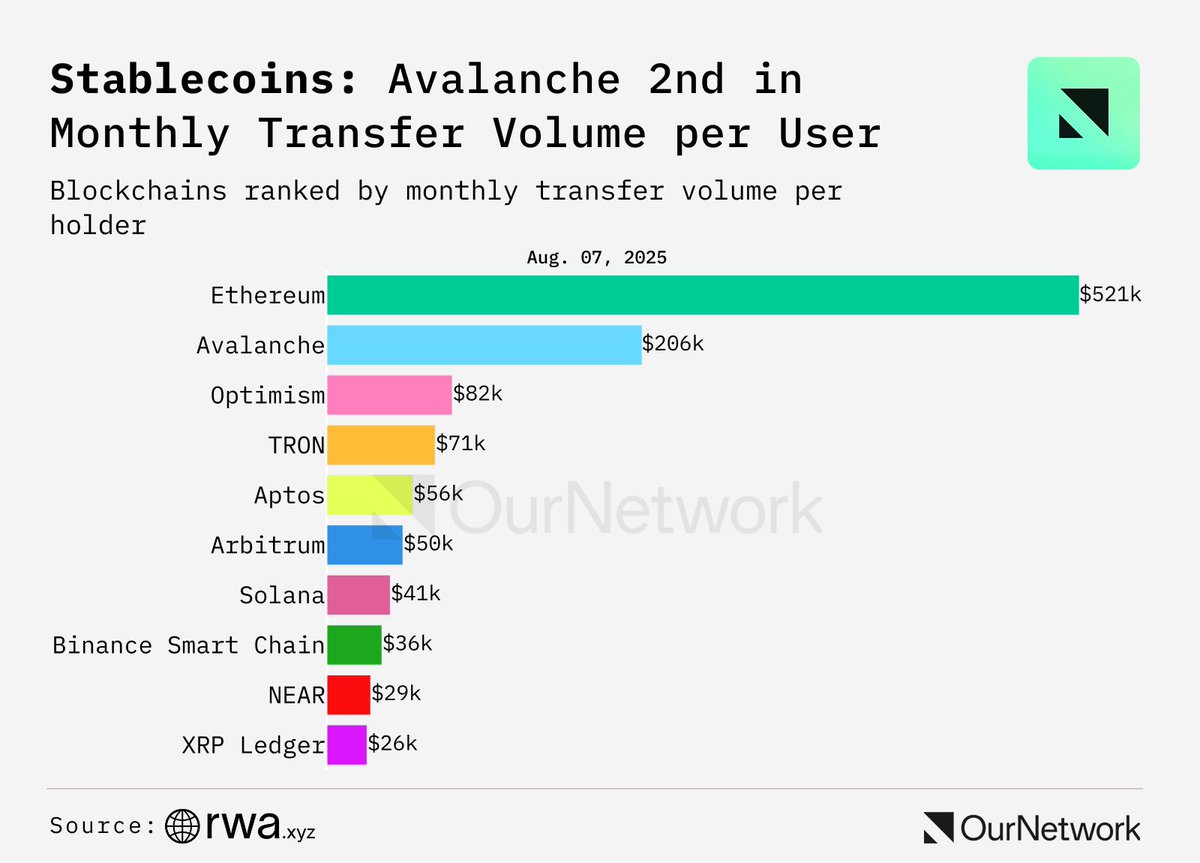

Moreover, from an on-chain perspective, Avalanche has also shown impressive growth. Statistics reveal that AVAX ranks second with an average monthly transaction volume per user of $206,000, while ethereum leads with $521,000.

In addition, the network has surpassed 50 million unique wallet addresses, reflecting its ongoing user expansion. Avalanche’s ecosystem development activity also ranks among the top in RWA projects, with Nansen data indicating increasing levels of engagement.

These figures highlight that Avalanche is closing on Ethereum’s position across multiple sectors. However, AVAX’s market valuation is still considered low. Many experts even argue that AVAX is one of the most “undervalued” major blockchains.

“It’s actually embarrassingly cheap considering the developments the last 12 months,” an X user shared.

With all these factors converging, there is reason to believe that AVAX is undervalued and could represent a promising investment opportunity. Given the pace of ecosystem expansion and growing institutional recognition, Avalanche will likely continue attracting new capital inflows, restoring AVAX to a more deserving position in the crypto market.

Of course, risks remain. The crypto market is in a sensitive phase, marked by high volatility and influenced by macroeconomic factors. While Avalanche is expanding, it still faces fierce competition from Ethereum and other layer-1 blockchains such as Solana.