Is Bitcoin Becoming Too Expensive for Retail Investors? Here’s Why That’s the Wrong Question

Bitcoin's relentless climb has Wall Street sweating—and Main Street wondering if they've missed the boat entirely.

The Real Barrier Isn't Price—It's Mindset

Forget the sticker shock. Bitcoin trades in fractions—sats, not whole coins. The actual hurdle? Traditional finance's fear of decentralization. While institutions pile into ETFs, retail hesitates at the threshold of self-custody.

Financial Advisors Still Don't Get It

Your broker's still pushing 2% yield bonds while Bitcoin's network effect accelerates. They'll call it risky right up until their compliance department greenlights it—then suddenly become 'crypto experts'. Classic.

The Accessibility Paradox

Lightning Network slashes transaction costs to pennies. Mobile wallets beat bank account minimums. Yet the narrative persists: crypto's for the wealthy. Meanwhile, traditional finance charges you $50 for a wire transfer and 3% forex fees—but sure, Bitcoin's the expensive one.

Wake-Up Call: It's Not About Buying Whole Coins

Stack sats. DCA. Use it. The technology doesn't care about your portfolio size—it only cares if you're willing to learn. The real cost? Staying trapped in inflationary systems while digital gold reshapes global finance.

Why Owning 1 Bitcoin Is a Rare Milestone

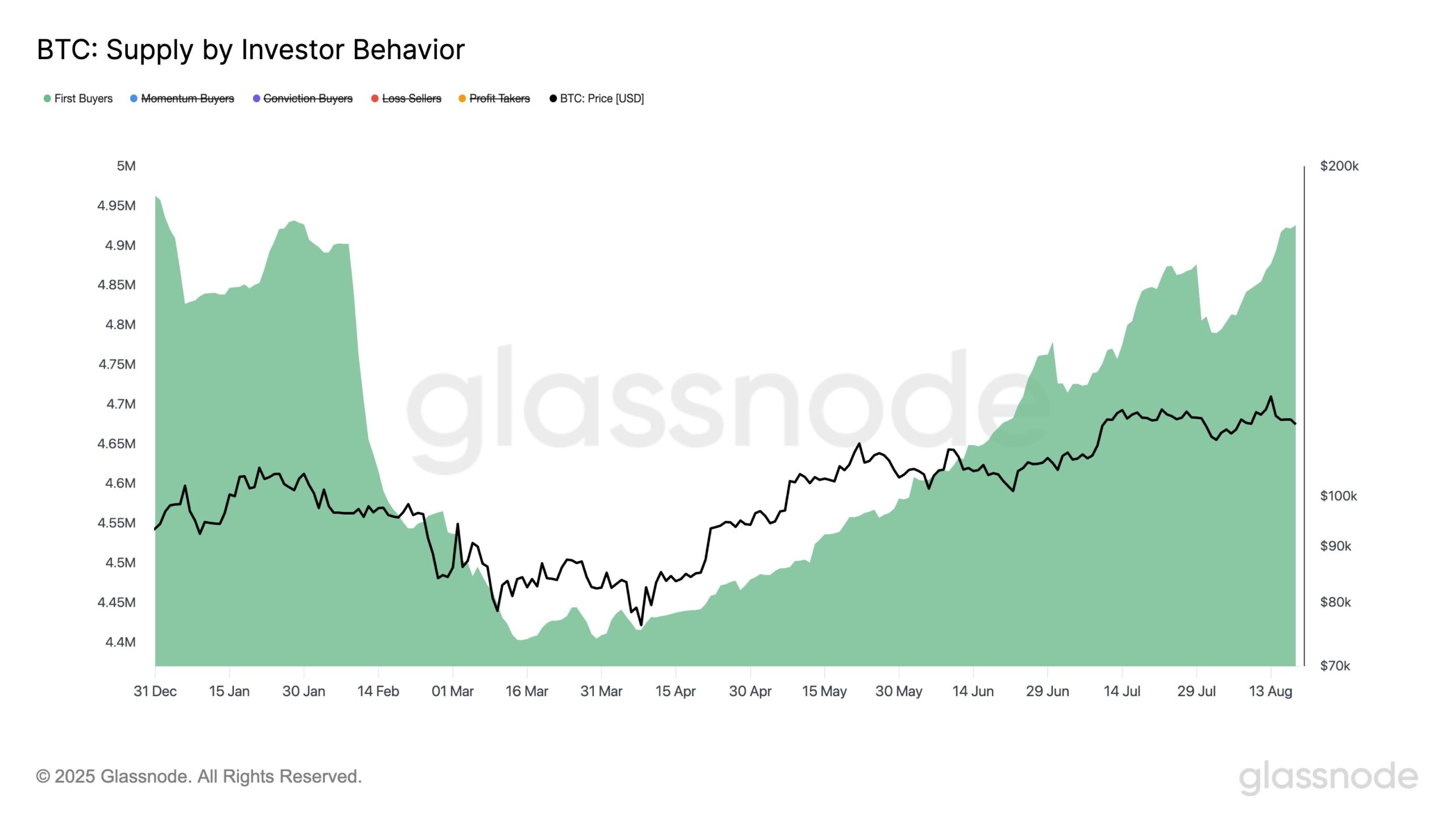

Glassnode, a blockchain data and intelligence platform, reported a 1.0% increase in the supply held by first-time buyers. Over the past five days, it has risen from 4.88 million to 4.93 million BTC, indicating new demand.

While the recent increase in Bitcoin demand is promising, acquiring the asset requires substantial capital at this time, something that many investors may not have. A report from CoinGecko highlighted a decline in the number of wallet addresses holding more than 1 BTC, correlating with the asset’s price surge.

The report revealed that only around 1 million addresses globally hold 1 or more Bitcoins. Most of these holders accumulated their bitcoin before 2018. This is when prices were quite low, especially in early 2017 when Bitcoin traded around $1,000.

CoinGecko noted that from 2010 to 2017, such addresses surged from 50,000 to 700,000. However, from 2018 onward, only an additional 300,000 addresses have been added. This brings the total to just over 1 million today.

“When Bitcoin crossed $100,000, this means it is 100x more expensive to become a whole coiner than in 2017. We also notice that the amount of whole coiners actually decreased after 2024, coinciding with Bitcoin ETF approval and institutional adoption,” the report read.

CoinGecko suggested that the rise of institutional investors has contributed to a greater concentration of Bitcoin wealth among the wealthiest individuals. This trend may explain the reduction in the number of whole coiners, as some early Bitcoin holders, who accumulated their assets before 2018, might be selling their holdings to these institutional buyers for long-term profits.

Furthermore, the report noted that after accounting for lost coins, exchange reserves, and institutional holdings, less than 4 million BTC remain theoretically available for retail acquisition. This scarcity underlines the increasing challenge of achieving ‘whole coiner’ status, a milestone that may now carry more psychological than practical significance.

However, CoinGecko explained that fractional ownership could still represent substantial wealth as Bitcoin’s price rises.

“Bitcoin’s most optimistic price models suggest we’re heading toward a reality where single coins could reach $500,000 or even $1 million. If those projections prove accurate, owning even 0.1 Bitcoin (worth $50,000-$100,000 at those prices) could represent significant wealth,” the report added.

Industry leaders are also redefining the notion of owning a full Bitcoin. Changpeng Zhao (CZ) previously suggested that 0.1 BTC could surpass traditional benchmarks like homeownership, positioning it as a new American Dream. This shift reflects changing perceptions as Bitcoin matures.

“The current American Dream is to own a home. The future American Dream will be to own 0.1 BTC, which will be more than the value of a house in the US,” CZ said.

Meanwhile, another factor influencing investor behavior besides the price could be Bitcoin’s declining volatility. Since 2022, BTC has exhibited less volatility than mega-cap tech stocks like Nvidia.

“And since 2024, despite hitting new highs and going through a significant correction, volatility has kept trending lower. It’s now NEAR a five-year low. That’s exactly what you’d expect from a maturing asset. And the more volatility declines, the more investable Bitcoin becomes for institutional money,” Ecoinometrics revealed.

This stability aligns with expectations for established assets. Still, it contrasts with the high-risk, high-reward allure that attracts many retail investors.