Solana Dips, But Long-Term Holder Accumulation Puts $200 Back in Play

Solana stumbles—but the smart money's buying the dip.

Long-Term Holders Double Down

While paper hands panic, veterans stack SOL. They see this drop as a discount—not a disaster. Accumulation patterns scream confidence, targeting that $200 rebound.

Market Mechanics vs. Emotion

Traders freak on red candles; holders eye the macro. Solana's tech stack hasn't changed—just the weak exits. Typical crypto theater: short-term noise versus long-term signal.

$200 or Bust

The path's clear: volatility now, value later. As one fund manager quipped, 'If you can't handle a 30% drop, you don't deserve a 200% gain—or any gain, really.' Classic finance brains still can't compute that.

Solana Holders Accumulate Despite Price Weakness

Glassnode’s data has shown a steady decline in SOL’s Liveliness since August 16. It started dropping after a peak of 0.7656, confirming the waning selloffs among investors who have held SOL for more than 155 days.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The Liveliness metric tracks the movement of long-held/dormant tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it trends upward, more dormant tokens are being moved, signaling profit-taking by long-term holders.

Converesly, as with SOL, when an asset’s Liveliness falls, its LTHs are moving their assets off exchanges and choosing to hold.

This suggests that despite SOL’s recent price performance, its LTHs remain confident of its mid- to long-term prospects. If the accumulation trend continues, it could trigger a rebound in the near term.

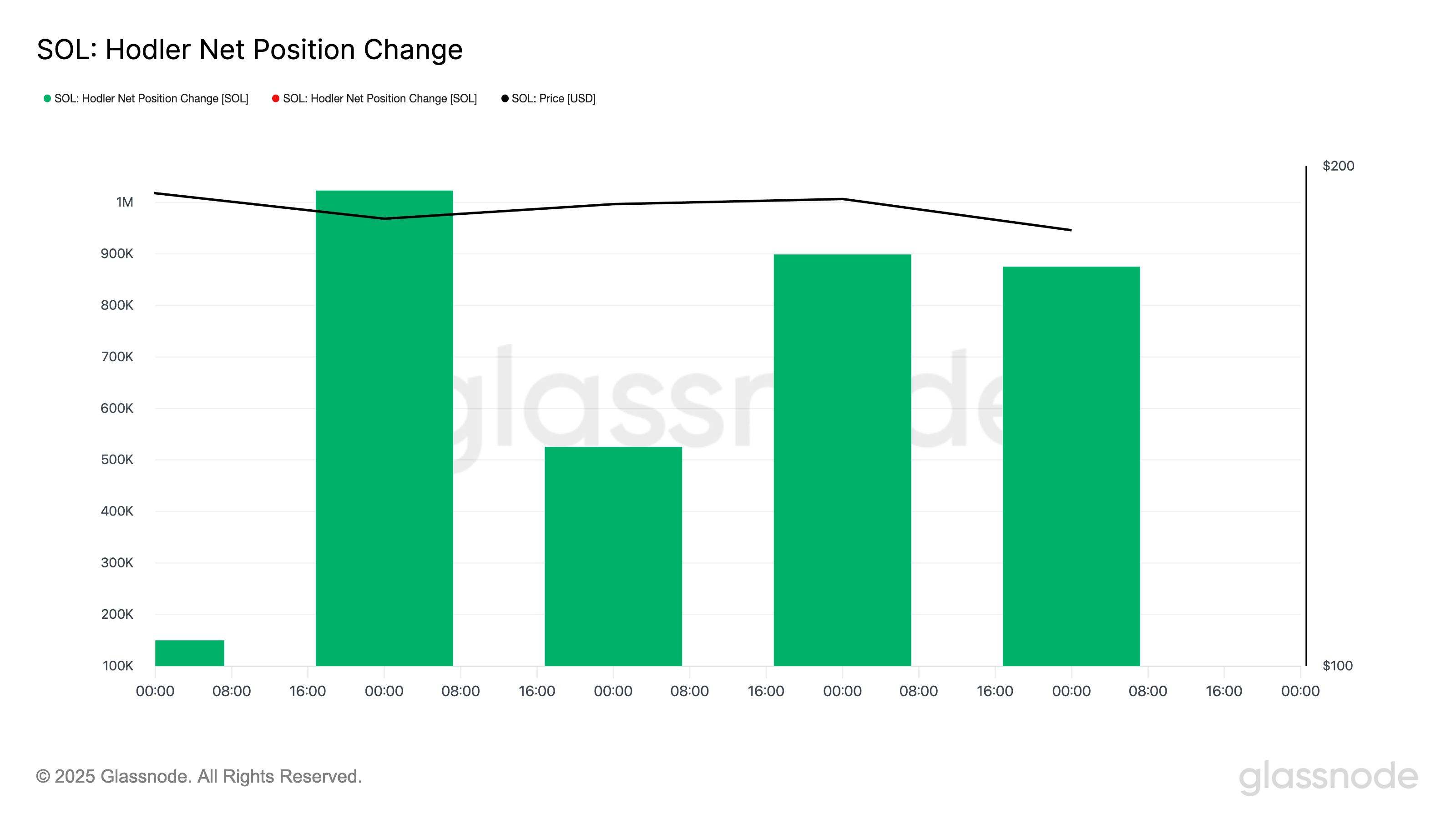

Moreover, readings from SOL’s Hodler Net Position Change confirm the reduced selloffs from these key holders. Per Glassnode, this metric, which measures the 30-day change in the supply held by LTHs, ROSE by 64% between August 16 and 18.

When this metric rises like this, it indicates that LTHs are accumulating more coins than selling them. This means more SOL coins are being moved into long-term storage, despite the asset’s recent price decline.

$200 Solana Back in Sight, If Buyers Can Overcome Fading Inflows

If the accumulation trend continues, SOL could see a swift rebound and attempt to breach the resistance at $195.55. Once this happens, SOL could regain the $200 mark and rally toward the February high of $219.21.

However, risks remain. SOL’s Chaikin Money FLOW (CMF), which measures capital inflows, is trending lower, implying that liquidity is drying up. Without renewed inflows, any rebound led by LTHs could struggle to gain sustained momentum.

In this case, its price could break below $171.81.