Monero (XMR) Surges Amid Qubic’s Bold Control Claims and Kraken Freeze Drama

Monero (XMR) defies market jitters with a sudden price spike—just as Qubic drops a bombshell about 'controlling' the privacy coin's network. Meanwhile, Kraken freezes XMR withdrawals, sparking fury among traders who thought crypto was supposed to be 'unstoppable.'

Qubic's power play: The obscure protocol claims it can now 'influence' Monero's mining process—a move that's either a breakthrough or a PR stunt wrapped in blockchain jargon. No technical proof yet, but the market's reacting like it's 2021 all over again.

Kraken's cold storage: The exchange blames 'routine maintenance' for frozen XMR withdrawals, though cynics note it coincides perfectly with regulators' latest anti-privacy coin crusade. Traders joke they'll need Monero's signature anonymity just to hide their frustration.

Privacy coins under pressure: With XMR up 18% since the news broke, the rally smells like speculative FOMO—the kind that usually ends with bagholders and a stern SEC tweet. But for now, the dark horse of crypto is galloping while regulators sharpen their knives.

XMR Network Turmoil: Qubic Claims Majority Control, Kraken Responds

On August 14, Qubic, an AI-driven crypto mining protocol, claimed it had gained majority control of Monero’s hashing power, an event commonly referred to as a 51% attack.

Following this, Kraken confirmed that it paused deposits for the altcoin. The exchange described the MOVE as a precautionary measure to protect users, while stressing that XMR’s trading and withdrawals remained fully operational.

The suspension was lifted hours later, though deposits now require 720 confirmations before crediting.

XMR Defies Centralization Fears, Records Gains

XMR’s performance has remained strong despite concerns over mining centralization within the Monero network. Readings from the XMR/USD daily chart show that the altcoin has closed at a new high since August 16, indicating that the current drama has fueled a resurgence in new demand for XMR.

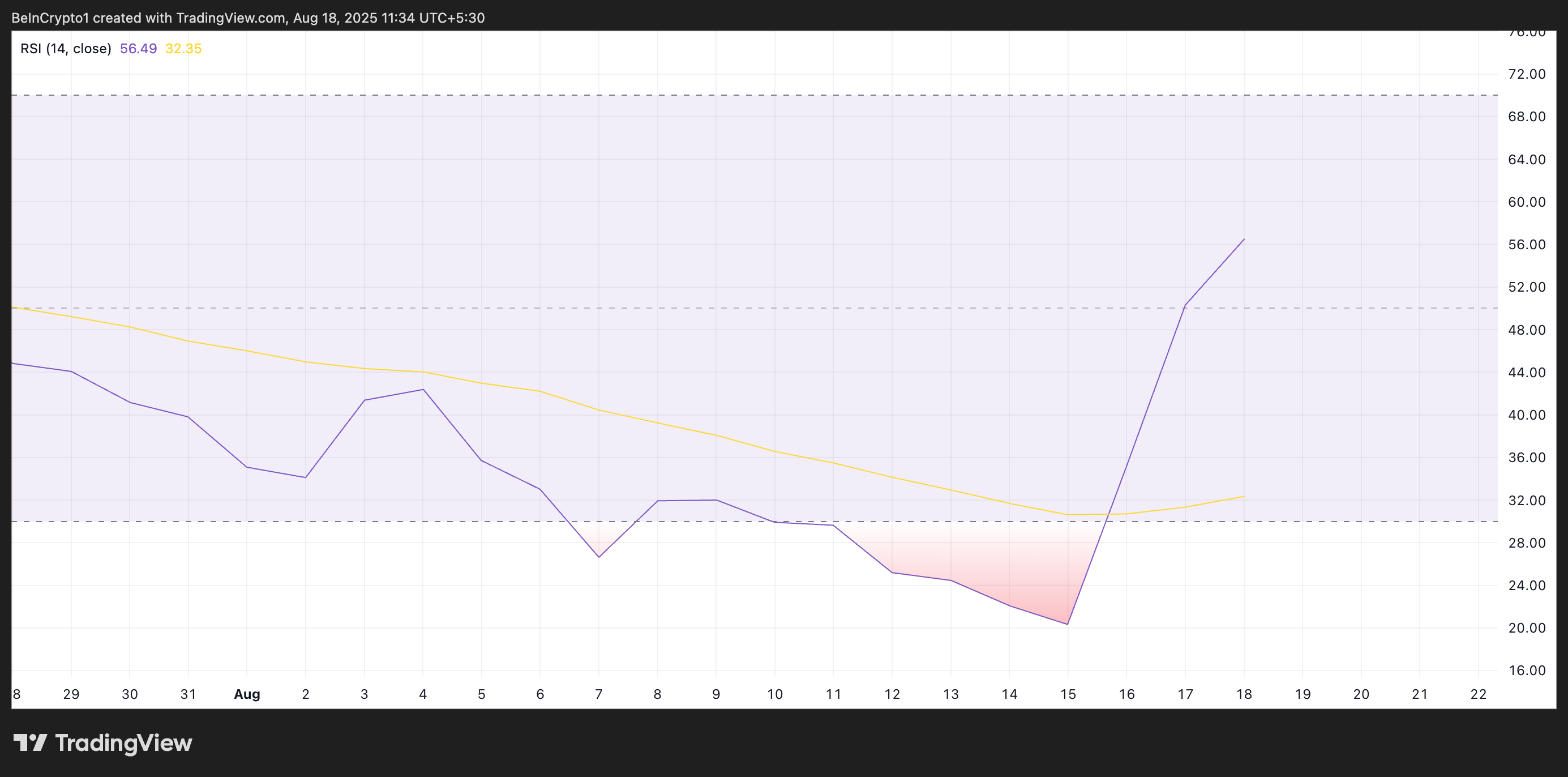

XMR’s climbing Relative Strength Index (RSI) reflects this uptick in buy-side pressure. As of this writing, this key momentum indicator is at 56.49 and in an upward trend.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

XMR’s RSI reading signals that accumulation is strengthening among market participants, which could drive further price rallies if the trend persists.

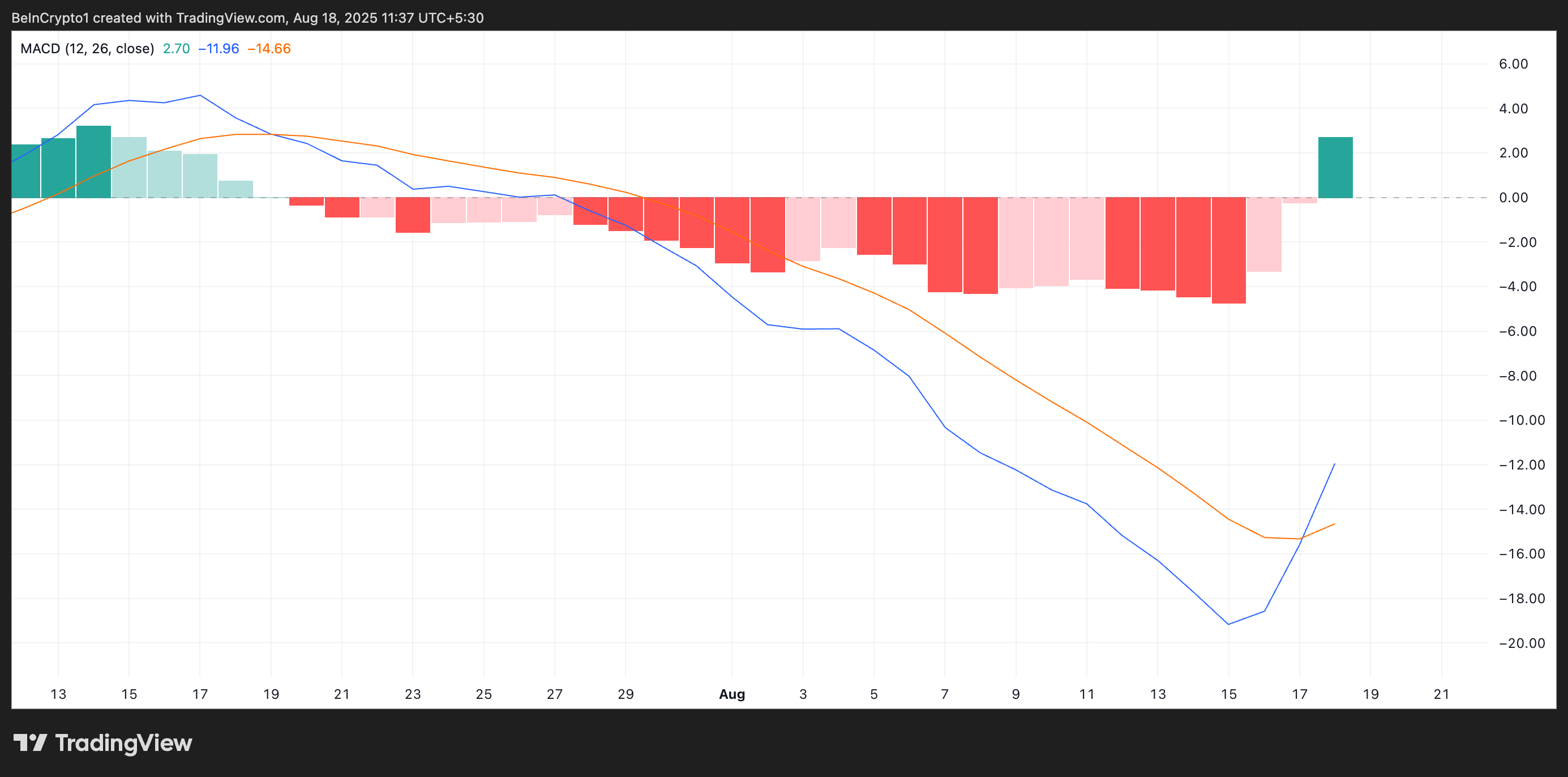

Furthermore, the recent positive crossover in Monero’s Moving Average Convergence Divergence (MACD) supports this bullish outlook. Daily chart readings show the MACD line (blue) crossing above the signal line (orange) for the first time since July 19, a shift that signals the beginning of an uptrend.

This crossover indicates that XMR’s short-term momentum has flipped in favor of buyers, suggesting growing strength in the current trend. Historically, such moves precede sustained rallies, as traders interpret them as confirmation that bullish demand is returning after a period of consolidation or decline.

XMR Climbs in Confidence—Next Stop $325 or Back to $270?

These indicators suggest that XMR is entering a renewed phase of market confidence despite Monero’s network centralization concerns. If this continues, it could push the token’s price past the $302.74 resistance mark and toward $325.13.

However, XMR risks shedding recent gains and falling to $270.86 if demand craters.