Chainlink Whales Go on Buying Spree—But This Hidden Metric Threatens the Party

Chainlink's price rockets as crypto whales pile in—yet the rally hangs by a thread.

Whale alert: Big money bets flood LINK

The oracle token surged double-digits after a series of eight-figure purchases hit the books. On-chain data shows institutional-sized accumulation—but one red flag looms.

Divergence danger: Network activity lags behind price

Despite the price pump, daily active addresses flatlined. Historically, such divergence precedes corrections. 'When price outpaces utility, gravity eventually wins,' quips one trader.

Make or break: The $20 level holds the key

Technical analysts eye the psychological resistance level. A clean breakout could trigger FOMO; rejection here would confirm the bearish divergence. Either way, someone's getting liquidated—probably the retail traders chasing the pump.

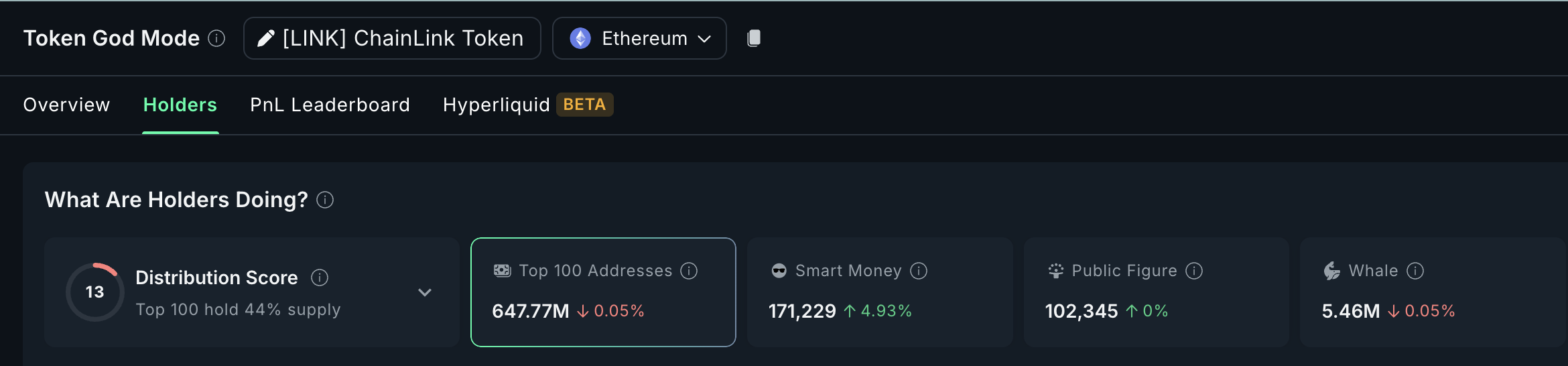

Whale Activity Explains the Chainlink Price Rally

In the past seven days, whale wallets have added over 1.1 million LINK to their positions. At the current price of $24.80, this equals around $27.2 million in inflows. That kind of capital is rarely random; it usually reflects conviction. And it shows in the chainlink price action.

Smart money wallets, which usually track market entries well, have also increased their holdings by 12.6% over the week.

Meanwhile, the top 100 LINK addresses have resumed accumulation, even though slightly. The fact that all three segments are moving together is a clear reason why the LINK price has broken away from broader market weakness.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

The Missing Link? Exchange Reserves Tell a Different Story

Despite this strong whale support, one metric suggests the Chainlink price might cool off in the short term: exchange reserves.

On August 16, LINK’s exchange balance dropped to a monthly low of 162.59 million LINK, right as the rally picked up speed. That was a good sign. It meant fewer LINK tokens were sitting on exchanges, so selling pressure was likely low.

But that has changed at press time.

As of today, reserves have increased to 162.90 million LINK; a rise of more than 300,000 LINK, or around $7.4 million at current prices. That tells us some traders are moving LINK back to exchanges, possibly preparing to book profits.

Moreover, in the last 24 hours, whale wallet balances have dipped slightly, meaning that some whales are no longer buying into strength. The top 100 LINK addresses have also shown mild distribution; not huge, but enough to support the idea that profit-taking may be close.

Do note that Smart Money continues to accumulate, hinting at mid-term price conviction.

So while the broader accumulation explains the recent gains, this shift in reserves and wallet behavior is the missing link that might interrupt the rally and cause a quick consolidation.

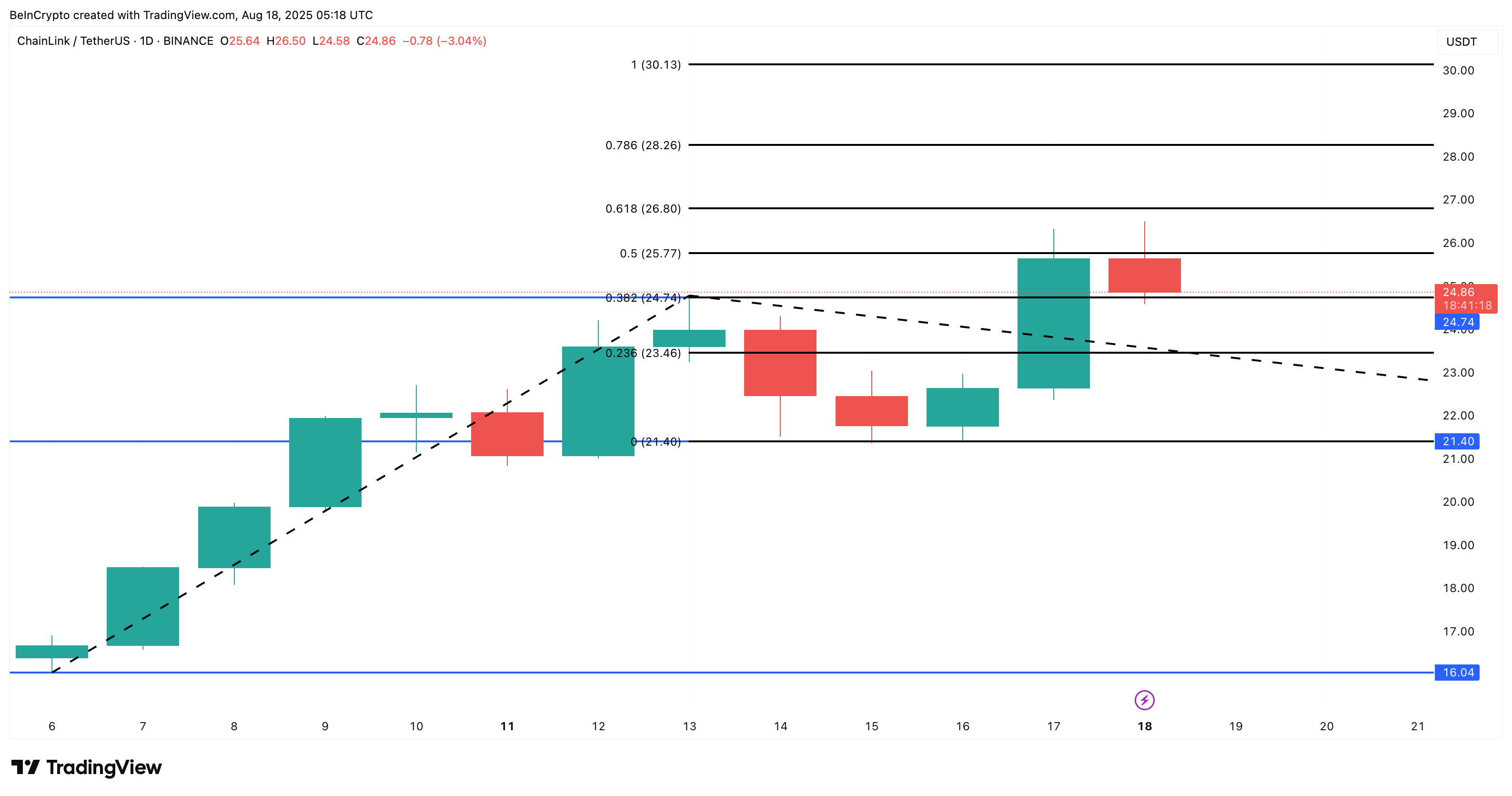

Chainlink Price Stuck Between Two Key Levels

The chainlink price is currently trading around $24.80, caught between key zones. The nearest resistance is at $25.70, and a break above that could send LINK toward $28.20 and even $30.10; a level mapped by Fibonacci projections.

But there are key zones on the downside too.

If short-term selling builds, the first two support levels are at $24.70 and $23.40, followed by $21.40. These levels could hold if the exchange reserves stabilize or start dropping again.

So far, the bullish case still holds, provided the Smart Money accumulation continues and whales resume buying. But if reserves continue to climb, the LINK price might cool off before trying for new highs again. A dip under $21.40 could defeat the existing uptrend and turn the Chainlink price structure bearish in the short term.