Solana’s Alpenglow Upgrade: The Nasdaq-Scale Breakthrough Crypto Has Been Waiting For

Solana's gearing up for its most ambitious leap yet—Alpenglow could catapult the network into Nasdaq-tier scalability. Forget 'fast lanes'—this is a full autobahn rebuild.

Why Wall Street should care (but won’t admit it)

The upgrade tackles Solana’s notorious congestion issues head-on, implementing state compression that makes current throughput look dial-up. Early tests suggest the network could handle 100K TPS—putting Visa’s 65K in the rearview.

Validator backlash? What validator backlash?

Despite grumbling about hardware requirements, over 85% of nodes have already upgraded testnet clients. The secret sauce? A new scheduler that lets consumer-grade hardware process transactions like institutional rigs.

The cynical take: TradFi won’t care until their coffee orders settle faster

Solana’s playing chess while others play checkers—building infrastructure for the next 100M users while hedge funds still think ‘blockchain’ is a spreadsheet plugin. Alpenglow isn’t just an upgrade—it’s a shot across the bow of finance’s old guard.

Solana Governance to Vote on Alpenglow for Faster Finality

According to the proposal, Alpenglow aims to replace Solana’s current system, which relies on proof-of-history combined with TowerBFT.

The upgrade introduces Votor, a streamlined voting protocol that can finalize blocks in one or two rounds depending on network conditions. Developers behind the proposal cite limitations in TowerBFT, including long confirmation times and gaps in formal safety guarantees.

Alpenglow is expected to cut block finality from 12.8 seconds to 100–150 milliseconds and reduce network congestion by eliminating excessive gossip messaging.

“Solana’s validator incentives are currently asymmetric: all validators perform the same work, but leadership (and rewards) are proportional to stake. Alpenglow fixes this- validators now do work proportional to their stake, aligning cost with reward,” Raye Hadi, a blockchain analyst with Ark Invest, said.

The plan is now in the community governance stage. Voting for the proposal is scheduled to take place between Epochs 840 and 420.

The protocol upgrade will move forward if it secures two-thirds of the votes in favor. This WOULD mark a major step in Solana’s network evolution and address long-standing performance bottlenecks.

Solana Wants to Flip Nasdaq

This development comes as solana recently hit a major milestone of processing 35 million transactions. This exceeds the daily combined volume of most major regional stock exchanges.

For context, the Tokyo Stock Exchange averages 5 million trades per day, the NSE sees 3 million, the Hong Kong Exchange sees 2.5 million, Shenzhen 1.7 million, Shanghai 1.5 million, Toronto 1.2 million, and London 600,000.

The network is now eyeing the US-based Nasdaq, which still outpaces Solana in both trade frequency and volume.

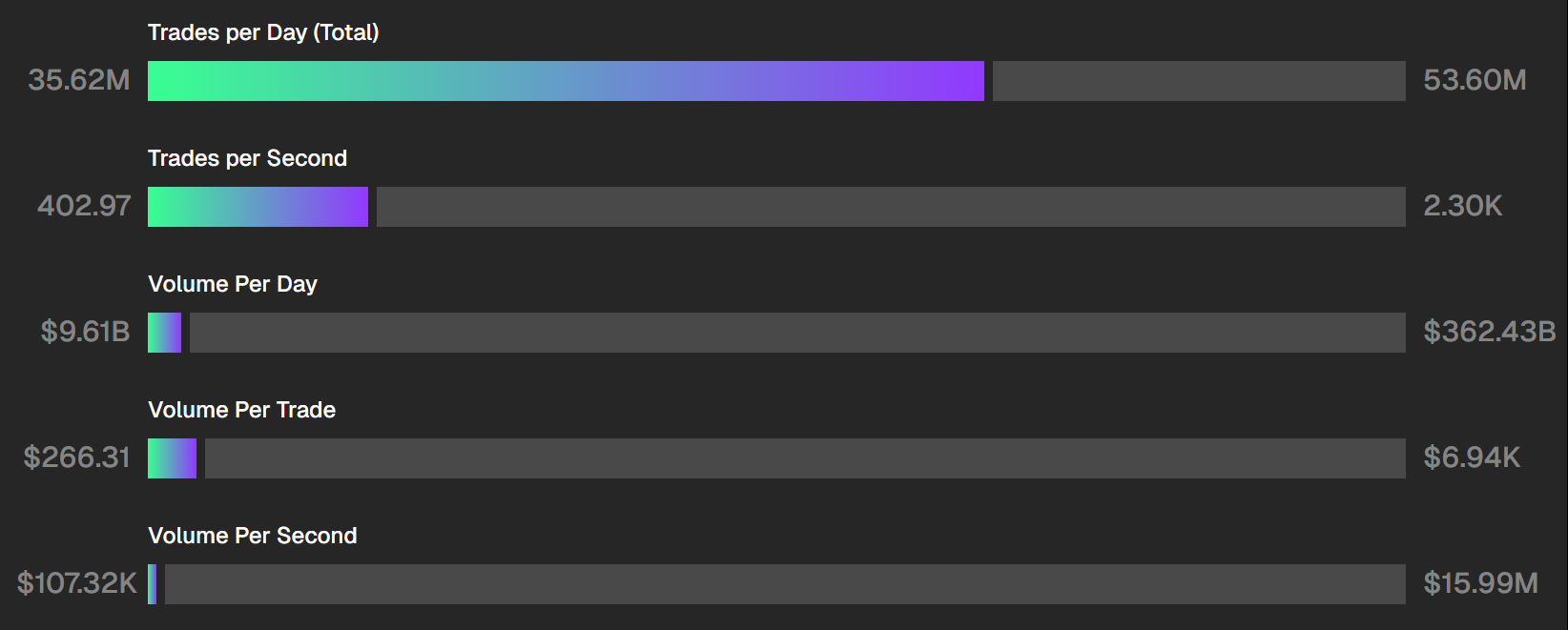

Nasdaq executes roughly 2,290 trades per second, while Solana averages 402. In terms of daily trading value, Nasdaq hits $362.43 billion, compared with Solana’s $9.61 billion.

Despite the gap, Solana remains confident in its roadmap, aiming to match the scale of Nasdaq through continued network upgrades and expanding influence in capital markets.

Market observers believe the combination of Alpenglow and growing adoption positions Solana to strengthen its competitive edge among traditional financial infrastructures.