Kraken Freezes Monero Deposits Amid Qubic’s Controversial 51% Attack Allegations

Crypto exchange Kraken slams the brakes on Monero deposits—just as Qubic drops a bombshell claim of a 51% attack on the privacy coin. Was it a real threat or just FUD to spook the market? Either way, traders are left scrambling.

Security or Sabotage? The 51% Attack Debate Rages

Qubic's assertion sent shockwaves through crypto circles, but skeptics are already calling it a ploy. Monero’s decentralized ethos makes such attacks notoriously hard to pull off—yet Kraken isn’t taking chances. Cue the irony: a privacy coin facing transparency demands.

Market Fallout: Traders Caught in the Crossfire

With Kraken’s deposit freeze, Monero holders face liquidity headaches. Meanwhile, the usual suspects—speculators—are already pricing in the drama. Because nothing pumps volatility like unverified claims and exchange overreactions. Stay tuned for the next episode of ‘Crypto Soap Opera.’

Monero’s XMR Surges Despite Deposit Freeze and Attack Claims

Kraken added that it is monitoring the situation closely and will restore deposit services once it confirms the network’s stability.

This incident has raised questions about the token’s network resilience and mining decentralization.

Monero is a privacy-focused cryptocurrency that masks key transaction details, including sender, recipient, and amount. Its strong anonymity features make it popular among users seeking secure and untraceable transfers.

On August 14, AI-based crypto protocol Qubic claimed to have gained majority control of Monero’s hashing power, a situation known as a 51% attack.

A 51% attack occurs when a miner or pool gains majority control of a blockchain’s hashing power. This control can let them double-spend coins or rearrange recent transactions.

According to Qubic, this control allowed it to reorganize six blocks and orphan around sixty others. During the alleged two-hour window, Qubic reportedly mined approximately 80% of the network’s blocks, generating around 750 XMR and 7 million XTM.

However, Qubic’s claim has faced significant pushback and a Distributed Denial of Service (DDoS) attack from the Monero community.

Critics argue that the protocol never exceeded 35% of the network’s hashrate and relied on a selfish mining strategy rather than full control.

Nonetheless, Sergey Ivancheglo, founder of Qubic, emphasized that the incident highlights a key risk for the network. According to him, it showed the importance of preventing any single miner from exceeding 25% of the total hashrate.

According to Mining Pool Stats data, Qubic currently ranks as the largest Monero miner, controlling 2.04 GH/s of the total 6.00 GH/s network hashrate as of press time.

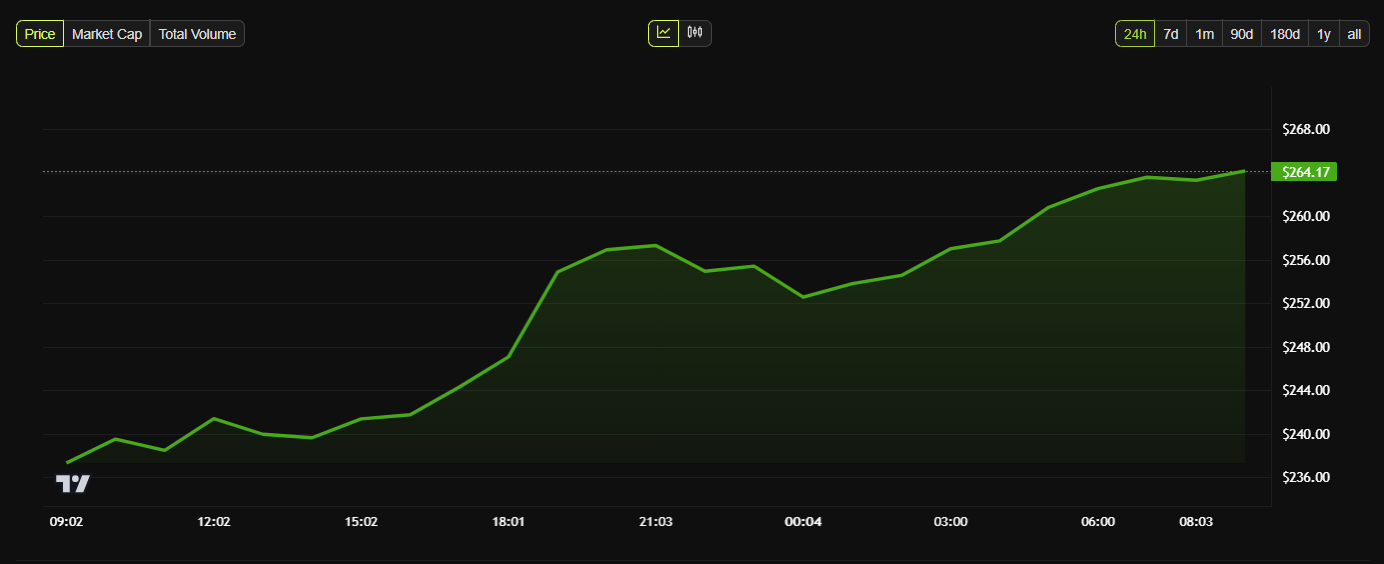

Despite the attack and ongoing debate, Monero’s market performance has shown resilience.

According to BeInCrypto data, XMR price rallied more than 10% over 24 hours, reaching approximately $264 at the time of writing.

The surge brings the token back toward its pre-attack price levels, signaling renewed investor confidence and potential recovery in its market momentum.