🚨 Bitcoin’s Historic Volatility Signal Flashes Red – Brace for a Wild Ride Ahead!

Bitcoin's price is gearing up for a seismic shift as a legendary volatility indicator screams warning signs. The crypto king hasn't seen this kind of setup since its last earth-shaking rally—or crash.

Buckle up, traders. The Bollinger Bands are tighter than a Wall Street banker's grip on their bonus. When this pattern last appeared, BTC either skyrocketed or nosedived within weeks. No middle ground.

Technical analysts are split: some see a breakout toward new all-time highs, others predict a 30% correction. The only consensus? Big moves coming—fast.

Meanwhile, institutional investors are quietly accumulating while retail traders panic-sell every 5% dip. Same old story—the smart money eats while the herd gets slaughtered.

One thing's certain: when Bitcoin wakes up, it moves like a caffeinated cheetah. And right now, it's been sleeping way too long.

Bitcoin is Facing The Calm Before The Storm

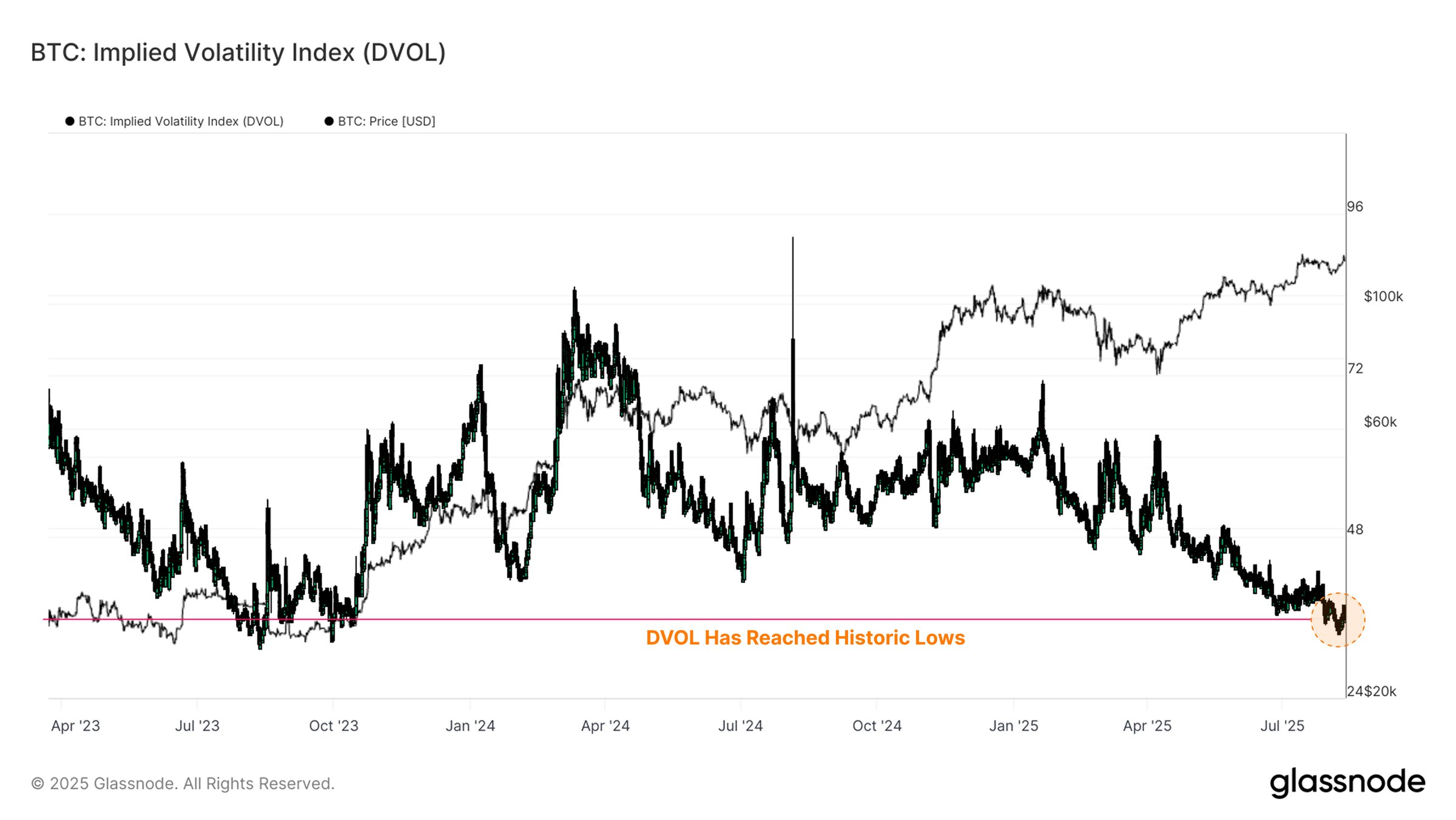

The Bitcoin DVOL index, which tracks the volatility of the asset, is at historically low levels. Only 2.6% of days have experienced lower values, indicating extreme complacency in the market. This suggests that investors are not hedging against potential downturns, which could lead to significant price movements if unforeseen events trigger volatility.

DVOL measures expected price fluctuations over the coming month, and the current low levels indicate a relaxed outlook from traders. However, this calm could be fleeting, as volatility shocks often follow periods of complacency. If an unexpected market event occurs, bitcoin could see rapid price swings, potentially catching investors off guard.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

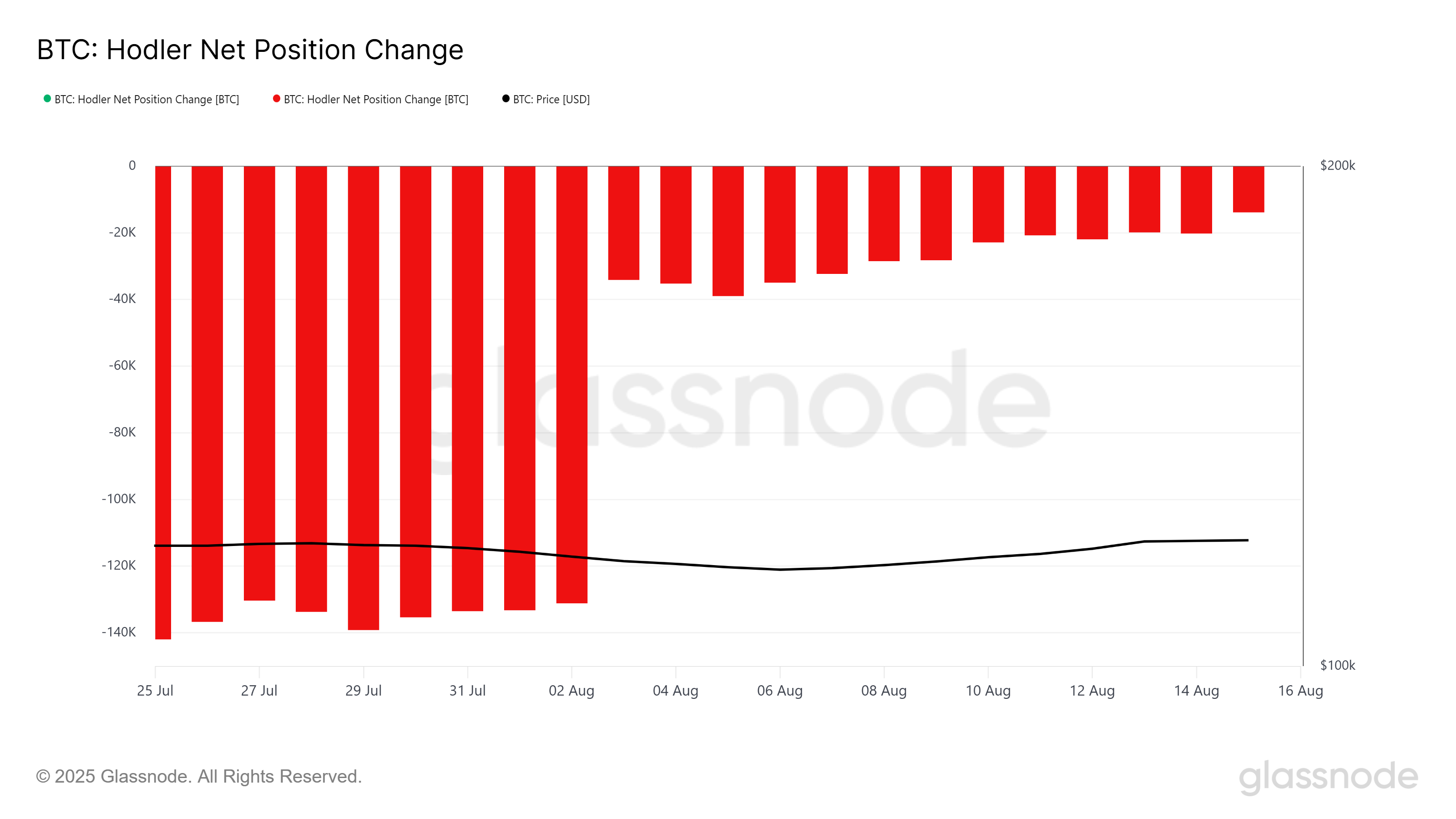

The overall macro momentum of Bitcoin shows a marked shift in investor behavior. The HODLer Net position change has slowed, signaling reduced activity from long-term holders (LTHs). Although LTHs had begun accumulating at the beginning of the month, this buying trend paused, likely due to the prevailing uncertainty in the market.

Despite the lack of new buying activity, the absence of selling suggests a degree of Optimism among these holders. They appear to be waiting for a clearer market direction before making their next move. This suggests that LTHs are cautious but expect that any volatility spike could eventually lead to a price increase, keeping their positions intact for now.

BTC Price Can Hold Its Support

Bitcoin’s price had shown an upward trend throughout the month, but this momentum faltered in the last 24 hours, with BTC falling to $117,305. This decline occurred as the price slipped below the established uptrend line, signaling a shift in market sentiment.

If investors maintain their positions during the expected volatility surge, Bitcoin could stabilize above $117,000. This WOULD open the door for a potential push toward $120,000, turning it into support and allowing further upside movement.

However, if investor sentiment turns bearish and selling increases in response to volatility, Bitcoin could face a significant drop. In this case, the price may fall through the $115,000 support level, potentially reaching as low as $112,526. This would wipe out the gains seen in August, invalidating the bullish outlook.