HBAR Price Stalls as Outflows Hit 2-Month Peak – Is the Bull Run Over?

Hedera's HBAR grinds through another consolidation phase as investors pull capital at the highest rate since June. The 'enterprise blockchain' darling now faces its toughest liquidity test in months—just as the broader market flirts with new highs.

Whale movements spike while retail sleeps

On-chain data reveals a quiet exodus of large holders, with outflows hitting levels not seen since early summer. Meanwhile, retail traders keep stacking the token like it's 2021—proving once again that bagholders never learn.

The institutional cooling-off period

After a 150% rally earlier this year, HBAR's institutional darling status gets a reality check. The same VCs who hyped its 'patent-protected hashgraph tech' are now discreetly rotating into Solana ETFs. Some things never change in crypto—except the exit strategies.

Price action at a crossroads

The $0.08 support level becomes make-or-break territory. Lose it, and we're back to pre-bull market boredom. Hold it, and HBAR might just live to see another hype cycle—until the next round of VC unlocks, of course.

Hedera Investors Are Selling

The Chaikin Money Flow (CMF) indicator shows that investor sentiment toward HBAR is currently bearish. The CMF has reached a two-month low, signaling that outflows are dominating the asset. This decline in the CMF suggests that many HBAR holders are selling their positions as the price consolidates, pushing investors to secure their gains.

As the price continues to range, the selling pressure has intensified, causing concern among investors. With the outflows continuing to rise, it appears that the bearish sentiment is taking hold.

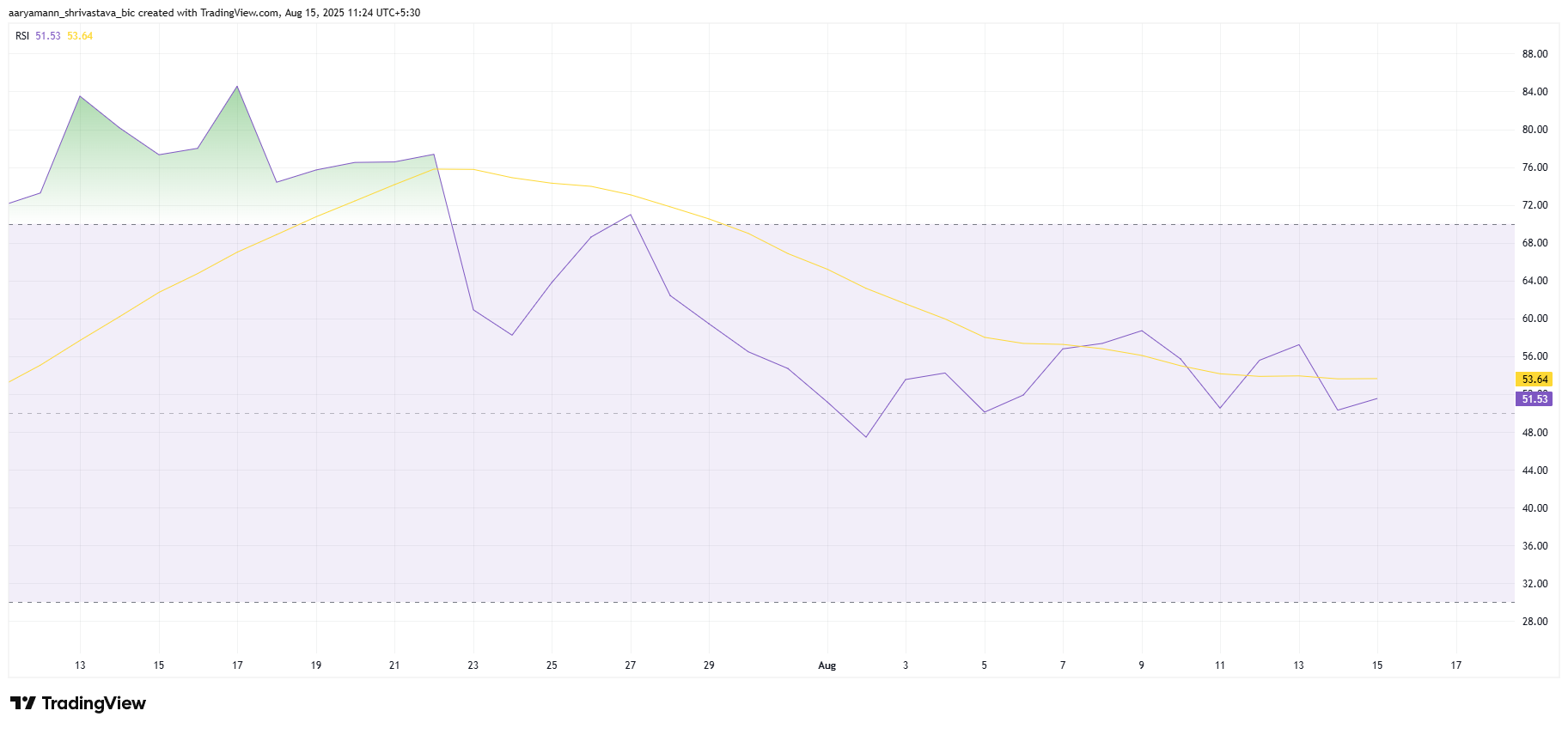

Despite the bearish trend in the CMF, the relative strength index (RSI) for HBAR remains above the neutral 50.0 mark. This indicates that, overall, the market sentiment is still somewhat bullish, with positive broader market cues supporting the altcoin. While investor behavior has been leaning toward selling, the RSI suggests there is still potential for upward movement.

The market momentum for HBAR is largely influenced by external factors, with the altcoin being supported by the overall trend in the cryptocurrency market. As long as the RSI remains above the neutral threshold, there is still a chance for HBAR to break out.

HBAR Price Is Stuck

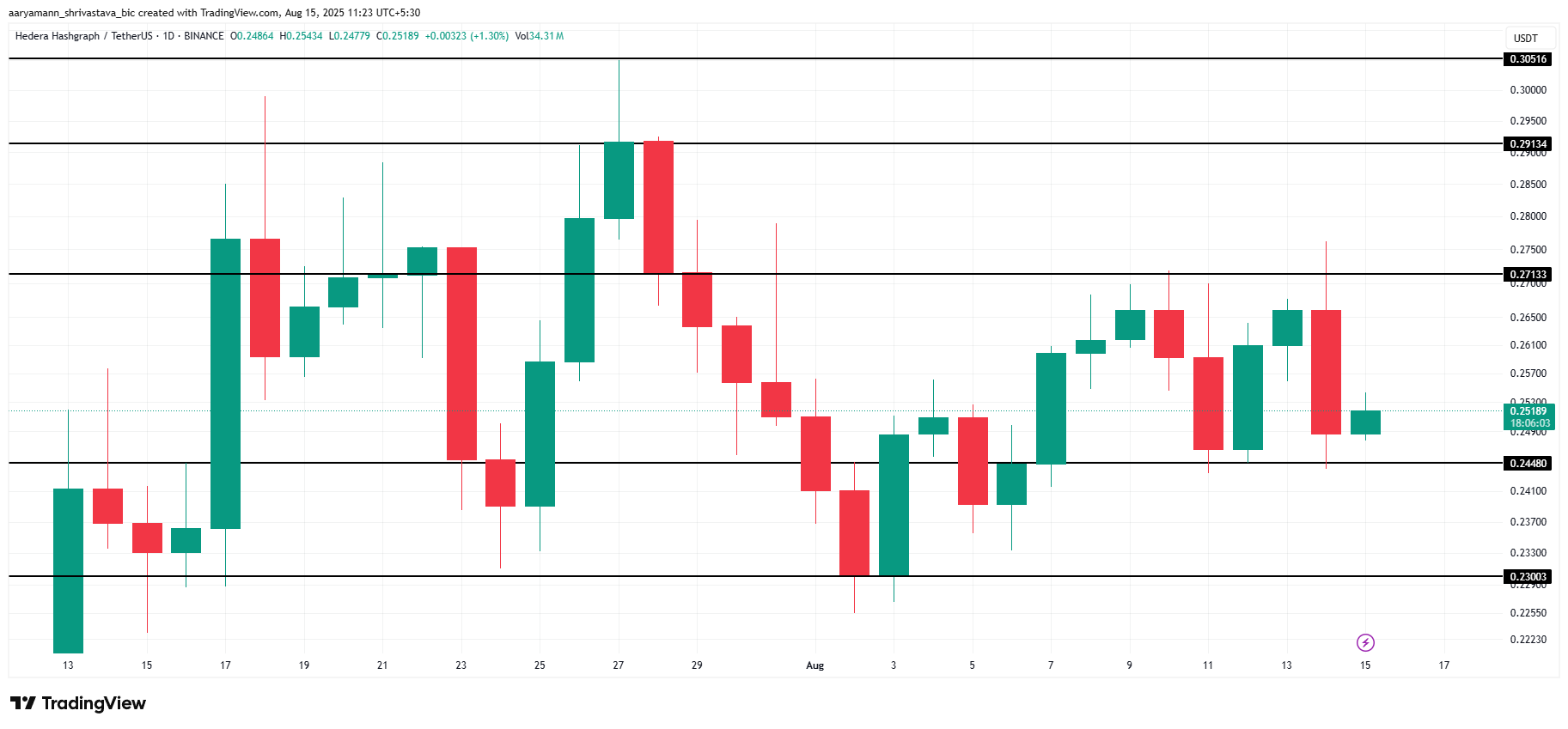

HBAR’s price is currently at $0.251, trapped within the range of $0.244 to $0.271. The mixed market cues, including the bearish CMF and the relatively neutral RSI, suggest that HBAR could continue consolidating.

This sideways movement is expected to persist unless there is a major shift in investor sentiment or a market catalyst that could push the altcoin in either direction.

If outflows intensify and HBAR falls below its $0.244 support level, the bearish case could become more likely. In such a scenario, the price may drop further to $0.230, invalidating the current bullish-neutral outlook and signaling a deeper correction for HBAR.