Meme Coin Market Share Crashes to 18-Month Low – Is the Party Over?

Dogecoin, Shiba Inu, and their meme-driven brethren are getting crushed. The once-dominant sector now holds just a sliver of the crypto market—its smallest slice since early 2024. What’s killing the hype?

Traders ditch jokes for ‘real’ projects

Institutional money’s flooding into Bitcoin ETFs. Layer-2 chains are solving actual problems. Meanwhile, meme coins keep peddling ‘community vibes’ and Elon Musk tweets as utility. Even degens seem tired of the schtick.

Liquidity bleeds out

Volume on top meme tokens has flatlined—no more casino-style pumps to distract from their zero-revenue models. Turns out ‘number go up’ isn’t a sustainable investment thesis (who knew?).

The cynical take

Wall Street always co-opts rebellion. Now that BlackRock’s mining Bitcoin and pension funds dabble in ETH, the crypto old guard needs a new counterculture. Meme coins were perfect… until bankers realized you can’t hedge inflation with Doge memes.

Why is Meme Coin Dominance Dropping?

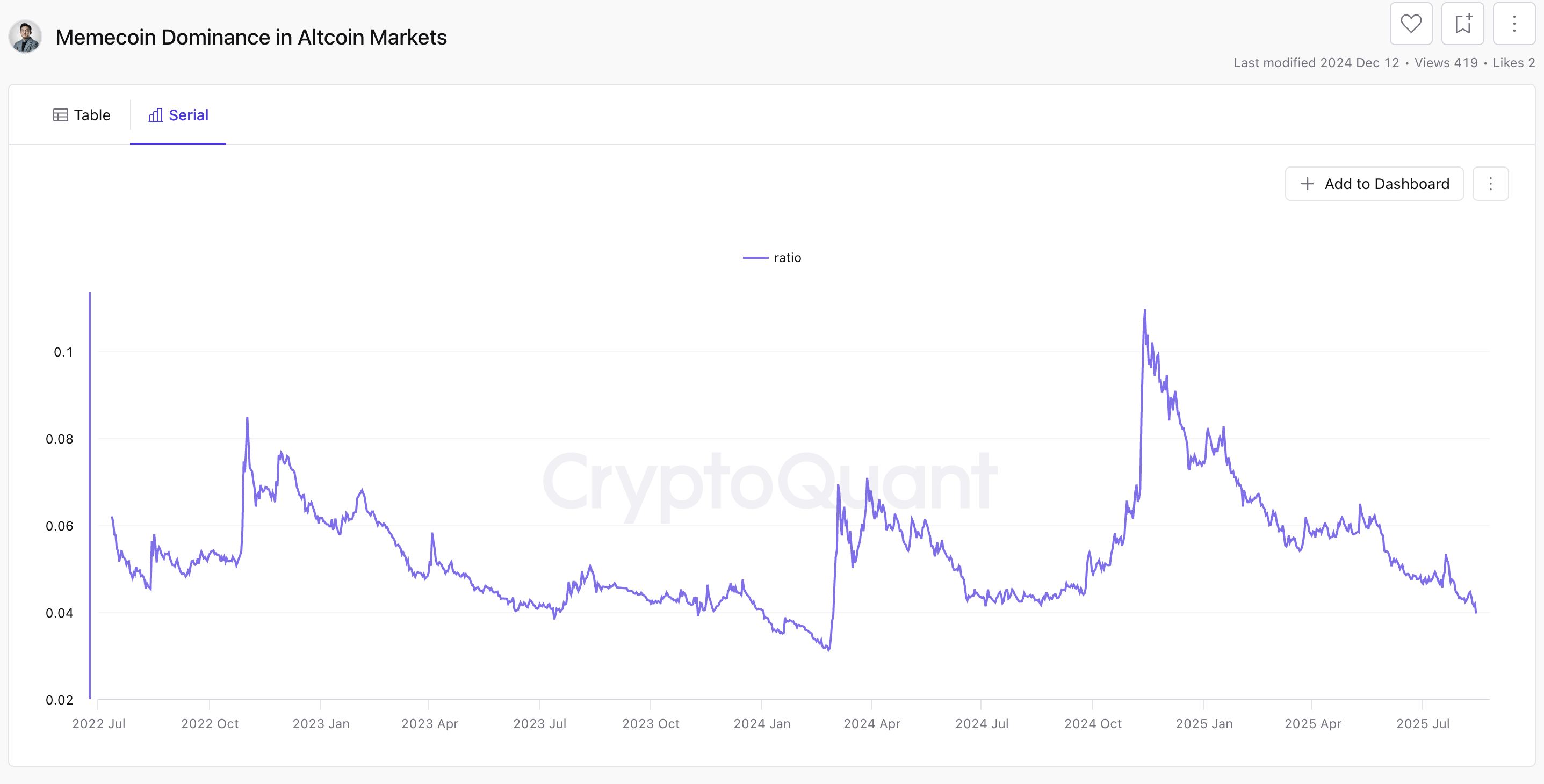

According to the latest data from CryptoQuant, meme coin dominance in the altcoin market dropped to 0.039, a level last seen in February 2024.

In a recent post on X, an analyst pointed to ethereum (ETH) as the key driver behind this dip. The analyst explained that ETH continues to dominate the altcoin market by absorbing a large portion of the liquidity.

This means that a significant amount of investment and capital is flowing into ETH, leaving less available for other altcoins, including meme coins.

“It’s clearly not meme coin season right now, and even though a few manage to perform, it remains very anecdotal,” the post read.

This shift aligns with observations from other market commentators who argue that the current cycle is characterized by an ‘Ethereum season’ rather than a full altcoin season, with Ethereum outperforming Bitcoin (BTC) and overshadowing other altcoin categories.

“We are in the Ethereum Season, as the majority of liquidity is flowing into ETH. For Altseason, we need more retail liquidity which won’t come until ETH hits a new ATH,” Cas Abbé noted.

The data support this narrative. While the meme coin market cap has surged 79.5% from April lows—rising from $39.93 billion to over $71 billion, the gains pale compared to Ethereum’s performance.

The second-largest cryptocurrency’s market value has jumped 215.91% in the same time frame from $177.49 billion to $560.7 billion. A similar trend emerges when comparing the performance of the top three meme coins to Ethereum in August.

So far this month, Ethereum has recorded a 25.41% increase. Meanwhile, Dogecoin (DOGE) has risen by 10.48%, shiba inu (SHIB) by 4.58%, and Pepe (PEPE) by 7.31%.

This disparity suggests that Ethereum’s dominance is siphoning liquidity from meme coins, contributing to their reduced market share.

Meme Coin Season: When Will It Start?

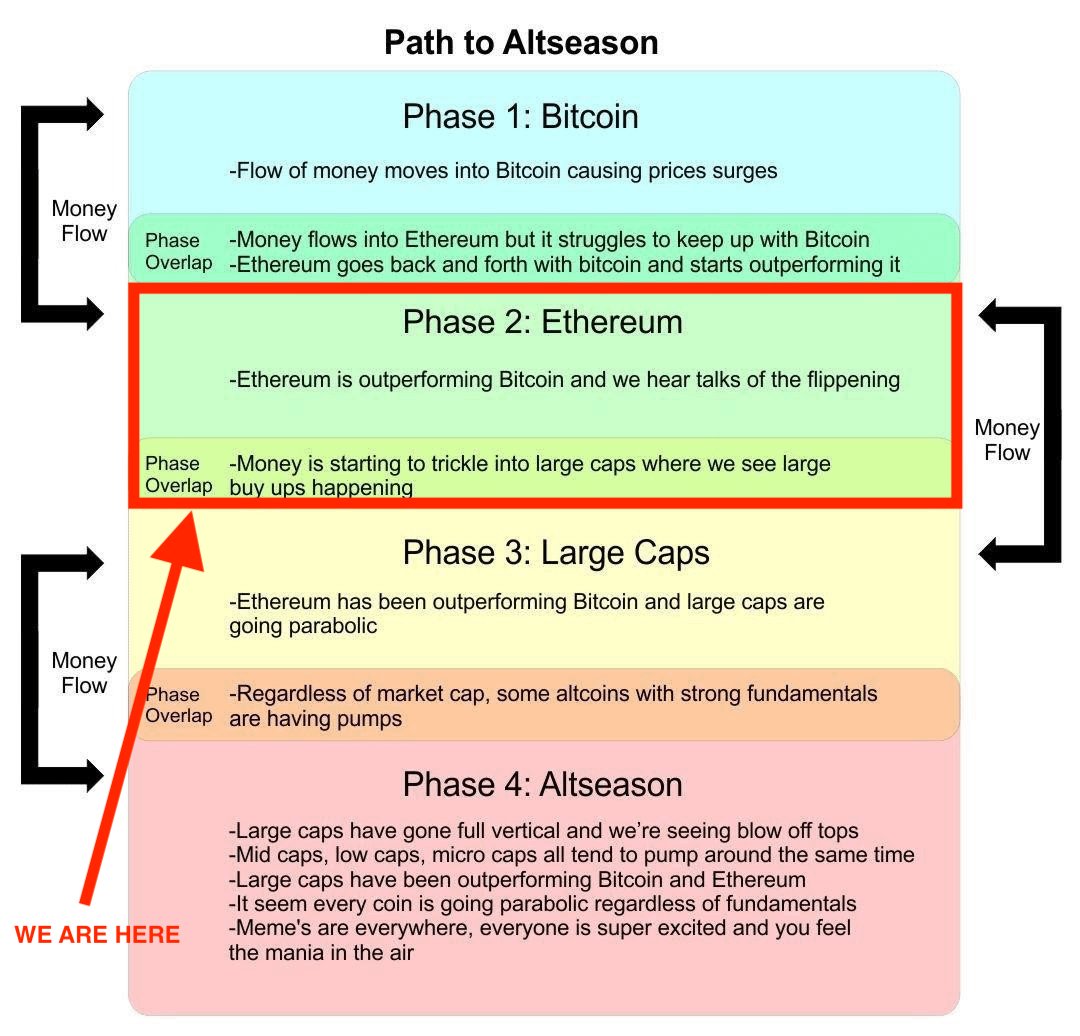

However, the story may not be over for meme coins. Experts have highlighted a four-phase cycle that could signal a future rally. According to them, the market is currently in Phase 2, where Ethereum dominates.

“We waited years for this moment. Now it’s here. ETH just entered Phase 2: Ethereum season. The best runs in history started right here,” Merlijn The Trader posted.

This will be followed by Phase 3, during which Ethereum continues to outperform Bitcoin and large-cap altcoins start to experience significant growth.

Finally, Phase 4, termed ‘altseason,’ represents the peak of the market cycle. This features surges in large-cap altcoins, followed by mid, low, and micro-cap coins, including meme coins, fueled by widespread euphoria.

“Altcoins are just starting to take off, and meme coins always run last,” another analyst added.

Thus, despite the decline in dominance, the growth of the meme coin market and the cyclical nature of altcoin seasons indicate a potential for recovery. Whether this potential will materialize or if institutional involvement has fundamentally altered the market remains to be seen.