Ark Invest Doubles Down: $172 Million Bullish Bet Sparks Crypto Market Frenzy

Cathie Wood's Ark Invest just placed a monster wager on crypto's future—and Wall Street's scrambling to keep up.

The $172 million splash into Bullish signals institutional FOMO is alive and well. Forget 'measured approaches'—this is capital on a warpath.

Market debut? More like a declaration. While traditional finance pundits clutch their pearls over 'volatility,' the smart money's busy printing new ATHs. Just another day in the decentralized revolution.

Bonus jab: Meanwhile, your bank still charges $35 for overdrafts.

Cathie Wood’s Ark Invest Picks Up 2.53 Million Bullish (BLSH) Shares

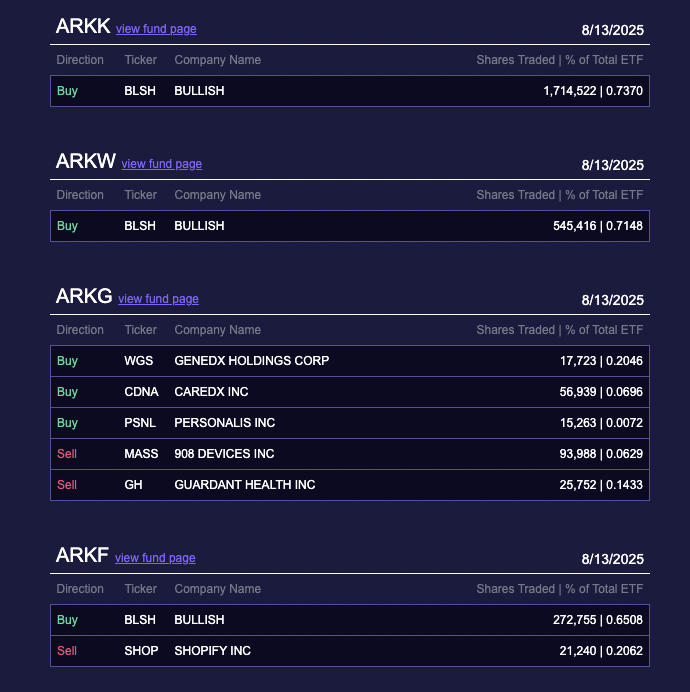

According to the official disclosure on X (formerly Twitter), Ark executed the purchase on August 13. The investment was distributed across the firm’s three exchange-traded funds (ETFs).

ARK Innovation ETF (ARKK) added 1.71 million Bullish shares, and ARK Next Generation Internet ETF (ARKW) acquired 545,416 shares. Lastly, ARK Fintech Innovation ETF (ARKF) bought 272,755 shares.

This acquisition was valued at approximately $172.2 million based on Bullish’s closing price of $68 per share. Besides BLSH, Ark Invest also picked up shares of GeneDx Holdings Corp, CareDx Inc, and Personalis.

At the same time, the company offloaded shares of 908 Devices, Guardant Health, and Shopify.

Meanwhile, Ark Invest’s acquisition of BLSH shares follows the company’s successful initial public offering (IPO). On August 11, Bullish, backed by prominent investors including Peter Thiel, increased its offering from 20.3 million to 30 million ordinary shares and adjusted its price range from $28–$31 to $32–$33 per share.

“Bullish intends to use the proceeds of this offering for general corporate and working capital purposes, including funding potential future acquisitions,” the announcement read.

However, BeInCrypto reported that the firm priced its IPO above this range at $37 per share, raising $1.1 billion. The stock debuted on the New York Stock Exchange on August 13 with a strong market performance.

According to data from Yahoo Finance, the stock was valued at $68 at market close, up 83.78% from its IPO price. The rise continued in pre-market trading as BLSH shares further appreciated by 12.84%.

Bullish’s move is part of a broader trend, with other crypto firms also dipping their toes into the public market. Circle went public in June and raised over $1.1 billion.

Additionally, firms like Figma, Grayscale, BitGo, and Gemini have filed with the US Securities and Exchange Commission (SEC) for a public offering. The surge in the filings comes amid a favorable regulatory environment under President Trump’s presidency, who has vowed to make the country the ‘crypto capital of the world.’