Gold & Bitcoin: Decoding the Correlation That Could Dictate BTC’s Next Big Move

When gold sneezes, does Bitcoin catch a cold—or ride the fever higher? The age-old safe haven and the digital disruptor are dancing closer than ever, and the steps they take next could rewrite the rules of wealth preservation.

The Unlikely Tango: Why Traders Are Watching Both Assets

Forget "digital gold"—Bitcoin’s recent price swings mirror bullion’s moves with eerie precision. When inflation fears flare, both assets flex. When the dollar stumbles, they sprint. But here’s the twist: BTC’s volatility amplifies every step, turning a waltz into a mosh pit.

Hedges or High Stakes? The Institutional Playbook

BlackRock’s Bitcoin ETF now gulps inflows faster than a gold fund on margin calls. Meanwhile, sovereign wealth funds quietly accumulate both—because nothing says "hedge against the system" like betting on medieval relics and math-based magic internet money.

The Cynic’s Corner

Let’s be real: if this correlation holds, Wall Street will package it into a structured product so convoluted, even the algo that trades it won’t understand the prospectus.

One thing’s clear: in a world where central banks print trillions but still can’t cure economic vertigo, the gold-BTC duo might just be the only life raft that doesn’t leak.

What’s Next for Bitcoin? Gold-BTC Correlation Hints at More Gains

In a recent post on X (formerly Twitter), Charles Edwards, Founder of Capriole Investments, pointed out the widening gap between Gold and Bitcoin. His analysis suggested that the latter usually tends to close the gap over time.

Edwards observed that the current gap is similar to the one observed in 2020. At the time, this was succeeded by Bitcoin entering a strong bull run.

Moreover, by 2021, bitcoin even outperformed gold. Thus, if history repeats, the flagship coin will likely continue its upward momentum beyond its current record peak, reaching new highs.

Similarly, crypto investor Jelle reinforced this narrative. He highlighted that gold typically leads while Bitcoin follows. Jelle predicted that this dynamic could propel Bitcoin toward $150,000, aligning with this historical precedent.

$GLD and $BTC correlated to each other last 3 years.

Don't fight brothers.

OWN BOTH!

With that said, Gold looks ready again… pic.twitter.com/zk3bSXXFAi

Reasons Why Bitcoin May Continue Surging

It’s worth noting that the expectation for Bitcoin or even gold prices to rise isn’t too far-fetched, especially considering the current market conditions. Charlie Bilello, Chief Market Strategist at Creative Planning, previously revealed that gold and Bitcoin are the top-performing assets in 2025.

“Gold (+29%) and Bitcoin (+25%) are the top-performing major assets so far in 2025,” Bilello stated.

He stressed that gold and Bitcoin have not historically occupied the top two spots in any calendar year, making 2025 a notable outlier. Furthermore, in a detailed thread on X, The Kobeissi Letter explained that BTC and gold are benefiting from many factors.

The market commentator noted that in July 2025, US tariff revenue surged by over 300%, reaching a record $29.6 billion. The Kobeissi Letter projects the revenue to exceed $350 billion annually during President Trump’s term.

Nonetheless, the US deficit also grew by $47 billion (19%) in July, hitting a record $630 billion in government spending. Meanwhile, tariff revenue covered only about 10% of the deficit.

“Despite record tariff revenues, the US spent nearly DOUBLE what it received in July. If we can reduce spending, President Trump’s tariffs could significantly help eliminate the deficit. The gap is simply too big to fill right now,” the post read.

This economic backdrop fuels increased interest in Gold and Bitcoin, as investors seek safe-haven assets amid growing financial instability and inflationary pressures.

“As we have been saying for 12+ months, this is the best possible fundamental backdrop for both Gold and Bitcoin,” The Kobeissi Letter added.

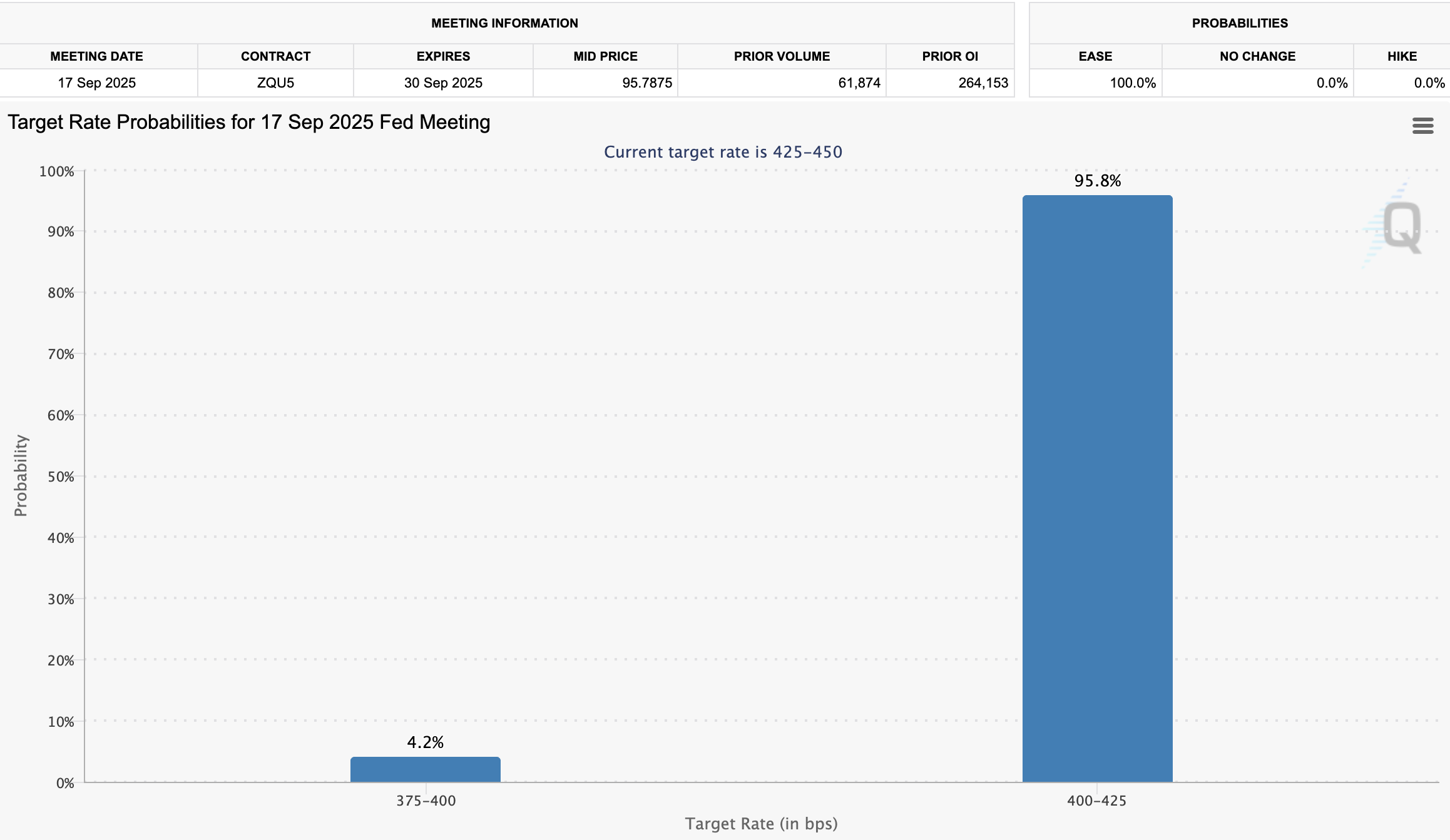

Furthermore, the latest data from the CME FedWatch Tool shows that the odds of the Fed cutting rates in September have surged to 95.8%.

BeInCrypto previously reported that if the Fed slashes interest rates, it could be quite bullish for cryptocurrencies. Thus, the gold-BTC correlation and other supporting macroeconomic factors hint that Bitcoin’s ascent is far from over. The market will be watching closely to see how far the asset will go in the time to come.