Bitcoin Smashes All-Time High – Where Do Bulls Charge Next?

Bitcoin just bulldozed through its previous record—again. The king of crypto isn’t just rallying; it’s rewriting the playbook. So, what’s fueling the frenzy, and where’s the next logical target?

The psychological battleground

Traders love round numbers, and BTC’s breach of its ATH has everyone eyeing the next big milestone. Institutional inflows? Retail FOMO? Either way, the momentum’s too loud to ignore.

Short sellers in shambles

Liquidation maps look like a bloodbath for bears. Every dip gets swallowed faster than a Wall Street banker’s third martini at lunch. Classic.

What’s next? A reality check—or another leg up?

Technical charts scream overbought, but since when did crypto care about ‘overbought’? Buckle up.

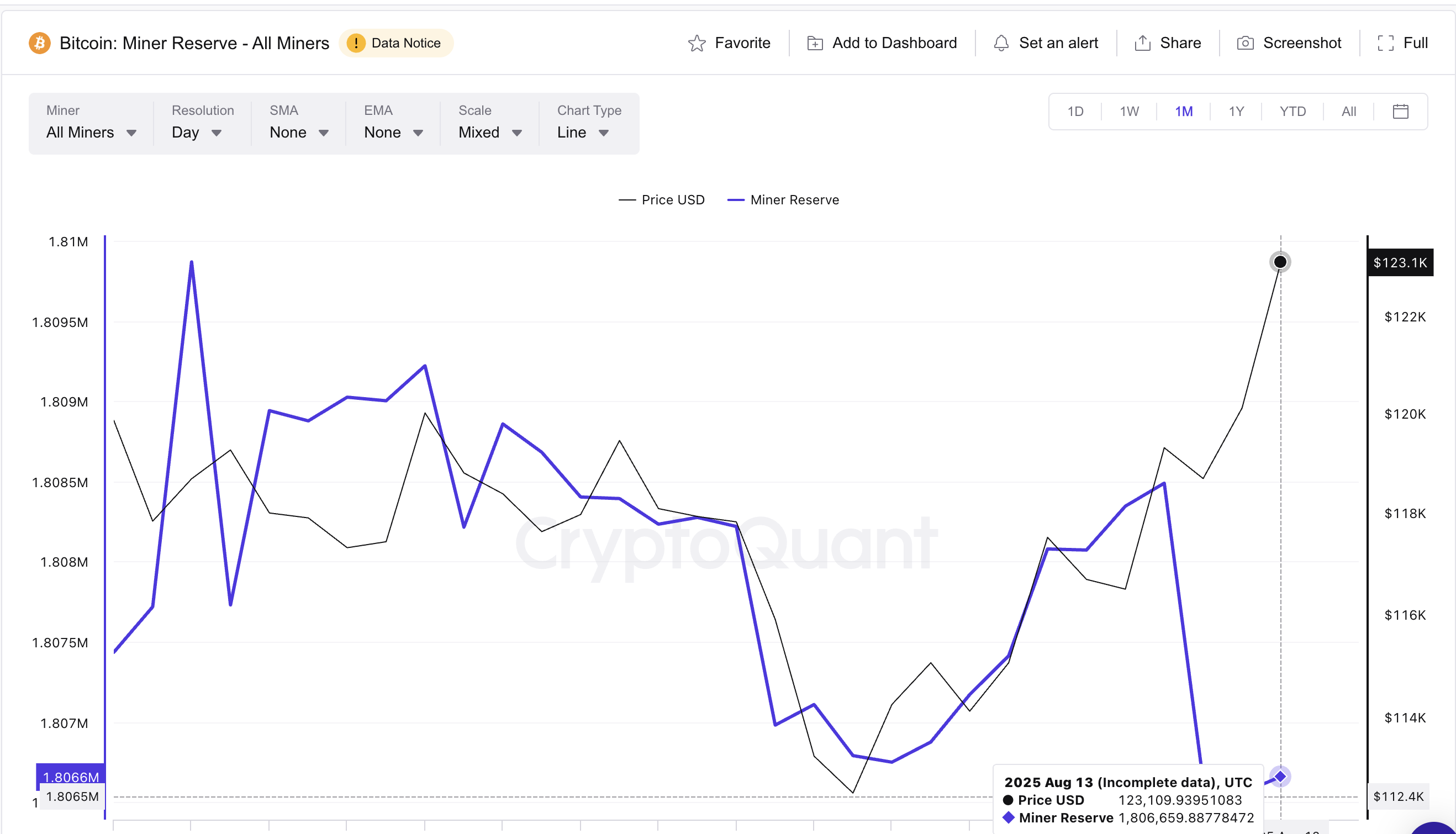

Miner Reserves Retreat As Sell Pressure Eases

Earlier this month, miner reserves swelled from 1,806,790 BTC on August 2 to 1,808,488 BTC on August 10. This raised the risk of a supply wave hitting the market. This uptick reflected higher sell-side pressure from miners—a MOVE often seen as a headwind for rallies.

Over 2,000 Bitcoin $BTC sold by miners in 3 days! pic.twitter.com/2DZdu3YaZ3

— Ali (@ali_charts) August 12, 2025But as the bitcoin price tried breaking out, reserves fell to 1,806,630 BTC and have since held steady, signaling that the immediate selling risk has eased. This plot twist retreat has cleared the runway for buyers to push the market higher without heavy miner liquidation overhead.

Miner Reserves: The total BTC held by miners. Rising reserves can signal incoming sell pressure; falling reserves often remove a major supply-side threat.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

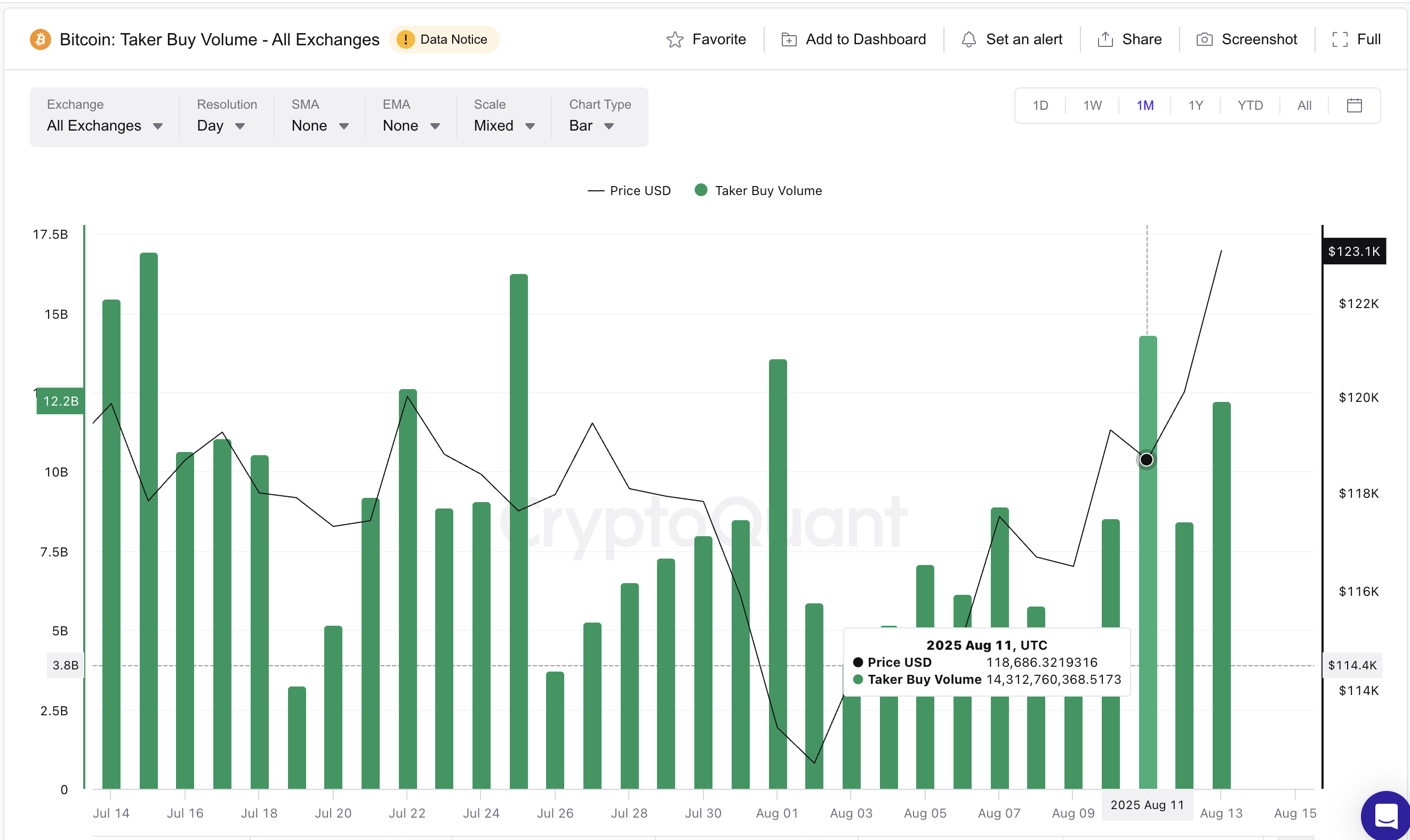

Taker Buy Volume Shows Bulls Were Ready

Taker Buy Volume; the total notional value of market buy orders lifting sell-side liquidity, surged to $14.31 billion on August 11 during a failed breakout attempt.

Here’s the key part — in order for a market buy order to get filled, it has to “hit” the sell orders already sitting on the order book. So even though they’re buying, they’re doing it immediately at the seller’s price, not waiting for a dip or a better deal.

In other words, high Taker Buy Volume means aggressive buyers are removing liquidity from the sell side of the order book — they’re clearing out sellers quickly, which can drive the price higher if the pressure keeps up.

This metric has remained elevated at $12.24 billion, showing traders are still chasing price at the ask instead of waiting for dips.

Historically, such sustained buy-side aggression often precedes successful breakouts. In this case, it was less a question of if the rally WOULD break to new highs and more a question of when.

Key Bitcoin Price Levels to Watch

With momentum now tilted heavily toward the bulls, the immediate test lies at $124,300, which stands as the last significant barrier before higher targets come into play.

A clean break and daily close above this level could open the bitcoin price path toward $127,600, aligning with the 1.0 Fibonacci extension and representing the next major upside objective.

On the flip side, if Bitcoin fails to hold above $121,600, especially in combination with a rebound in miner reserves, the bullish setup could face a sharper pullback.