Aave Outpaces Traditional US Banks—But Short-Term Volatility Looms

DeFi's sleeping giant just woke up hungry. Aave—the liquidity protocol that's been quietly eating traditional finance's lunch—has officially flipped US banks in key metrics. But before you pop the champagne, there's a catch.

Short-term turbulence ahead? While Aave's growth is undeniable, the protocol isn't immune to crypto's signature price swings. Recent on-chain data shows leveraged positions creeping up—a classic precursor to volatility.

The irony? Banks are now watching Aave's charts more closely than their own balance sheets. (Some things never change—finance will always chase yield, even if it means staring into the DeFi abyss.)

One thing's clear: The future of lending isn't in marble lobbies. It's in code.

Taking The Spotlight Away From Traditional Banks

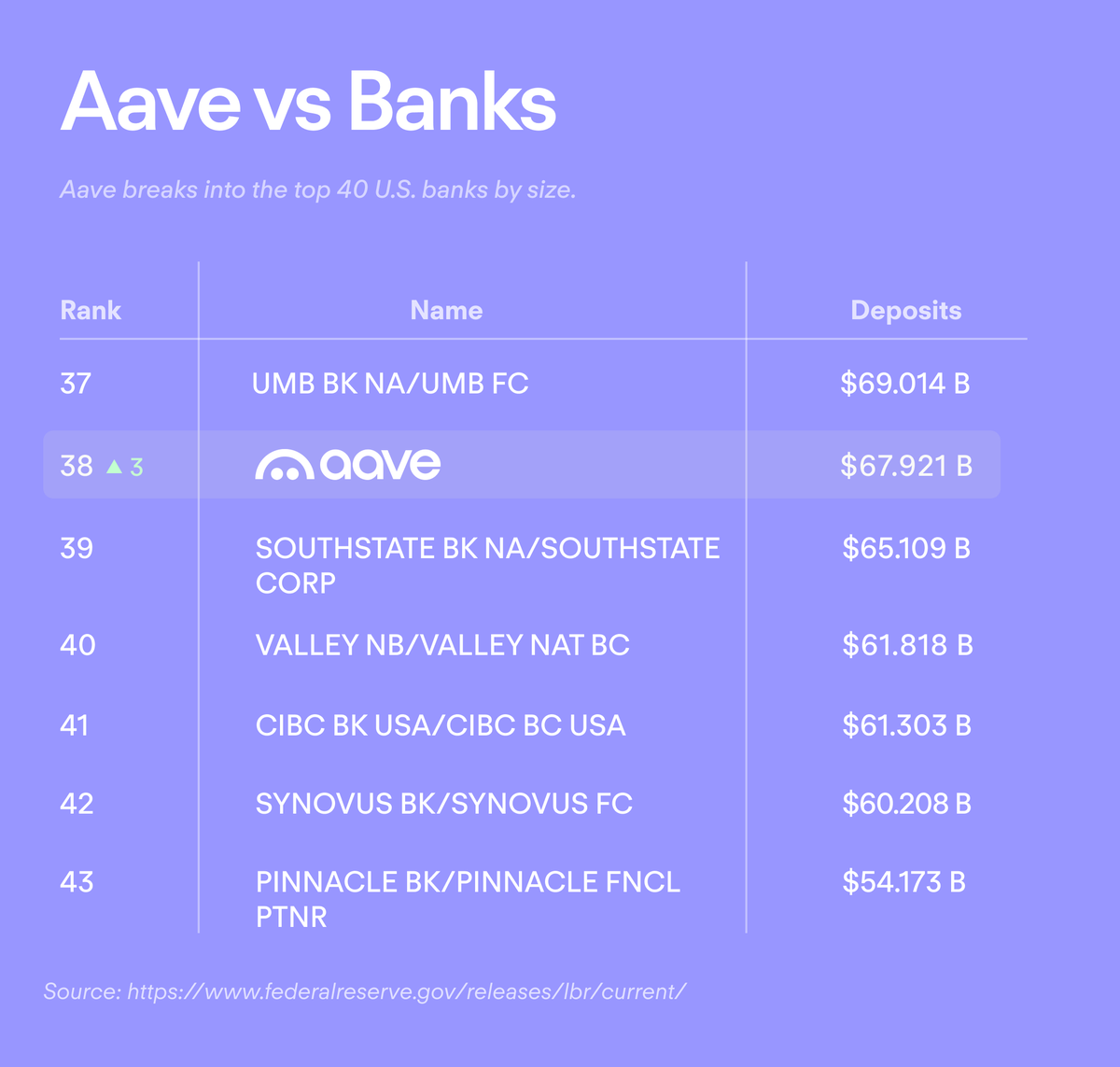

According to data from Kolten, AAVE has surpassed three other major US banks to become one of the country’s top 40 largest banks in terms of equivalent asset size. This is a remarkable achievement for a decentralized lending platform launched in 2017. This development not only demonstrates the strength of DeFi but also reflects a strong capital shift from traditional finance to digital finance.

Currently, Aave records over $25 billion in active loans — the highest level ever. The total outstanding loan balance has reached $26 billion, up fourfold compared to the same period last year, highlighting the growing demand for DeFi lending services.

Notably, Aave’s revenue has grown for four consecutive months, now accounting for 71% of the total revenue of the entire lending market.

“With market momentum and the Aavethena effect, growth is likely to continue,” an X account commented.

Beyond leading the lending sector, Aave has also surpassed Circle to become the world’s second-largest crypto company by total value locked (TVL). In addition, Coinbase’s announcement of relaunching the Bootstrap Fund to enhance stablecoin liquidity for Aave, Morpho, Kamino, and Jupiter is expected to boost capital inflows, improve liquidity, and expand the platform’s user base. Support from a major exchange like Coinbase further reinforces Aave’s position in the DeFi ecosystem.

From a technical analysis perspective, some traders believe AAVE’s price could reach “crazy” levels by the end of the year. However, short-term signals are leaning toward a correction.

According to ValeriyBreakout, the market structure broke after forming a horizontal bottom, accompanied by a Change of Character (CHoCH) signal. The expected price may recover slightly before declining toward the $269–272 target range. This suggests that investors should be cautious in the short term, especially those trading with leverage.