Ethereum Exchange Reserves Plummet—Is ATH Just Around the Corner?

Ethereum's exchange reserves are bleeding out—and the market's buzzing with bullish whispers. Could this be the setup for a historic rally?

Supply crunch incoming?

With ETH fleeing exchanges faster than traders fleeing leverage after a 10% dip, the stage might be set for a supply shock. Fewer coins on exchanges mean fewer sell orders waiting to cap the price—classic rocket fuel.

But here's the kicker: Wall Street's still trying to short ETH with 2017 playbooks. Good luck with that.

Spot Buyers Keep Ethereum Supply Tight

One of the most important indicators to watch during a strong uptrend is exchange reserves, the total amount of ETH held on centralized exchanges. When reserves are high, there’s more potential selling pressure. When they’re low, supply is tight, and any surge in demand can push prices up quickly.

On July 31, Ethereum’s exchange reserves hit an all-time low of 18.72 million ETH. As of August 12, they remain near that level at 18.85 million ETH, despite ETH’s sharp climb. That tells us something critical: even with ethereum price pushing toward multi-month highs, the buyer-seller tussle is skewed towards the former.

Do note that aggressive selling is happening, but low exchange reserves mean that buyers are fast outpacing the sellers.

An #Ethereum ICO participant who received 20,000 $ETH( cost $6,200, now $86.6M) just sold another 2,300 $ETH($9.91M) 20 minutes ago, leaving him with 1,623 $ETH($6.99M).https://t.co/Rv0RcDPtgH pic.twitter.com/ffxwgXUDEg

— Lookonchain (@lookonchain) August 11, 2025Historically, the ETH price has struggled to sustain rallies when reserves spike. The fact that reserves are holding near record lows while the price is close to breaking its final major resistance suggests sustained buying interest from the spot market.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

Derivative Traders Stack Positions

If the spot market is the foundation, derivatives are the accelerant. Open interest, the total value of outstanding futures and perpetual contracts, reached an all-time high of $29.17 billion on August 9 and is still hovering NEAR that level.

Why does this matter? High open interest increases the potential for cascading moves. If the Ethereum price breaks an important resistance, leveraged short positions could be forced to cover, triggering a short squeeze that amplifies upward momentum.

Conversely, if bulls lose control, heavy leverage could also accelerate the downside. But right now, with spot supply tight, the setup favors an upside squeeze.

The combination of record-low reserves and record-high open interest means both cohorts, spot buyers and derivatives traders, are aligned in a way that could fuel a sharp upside move.

Key Ethereum Price Levels to Watch: One Stop Could Trigger A New Peak

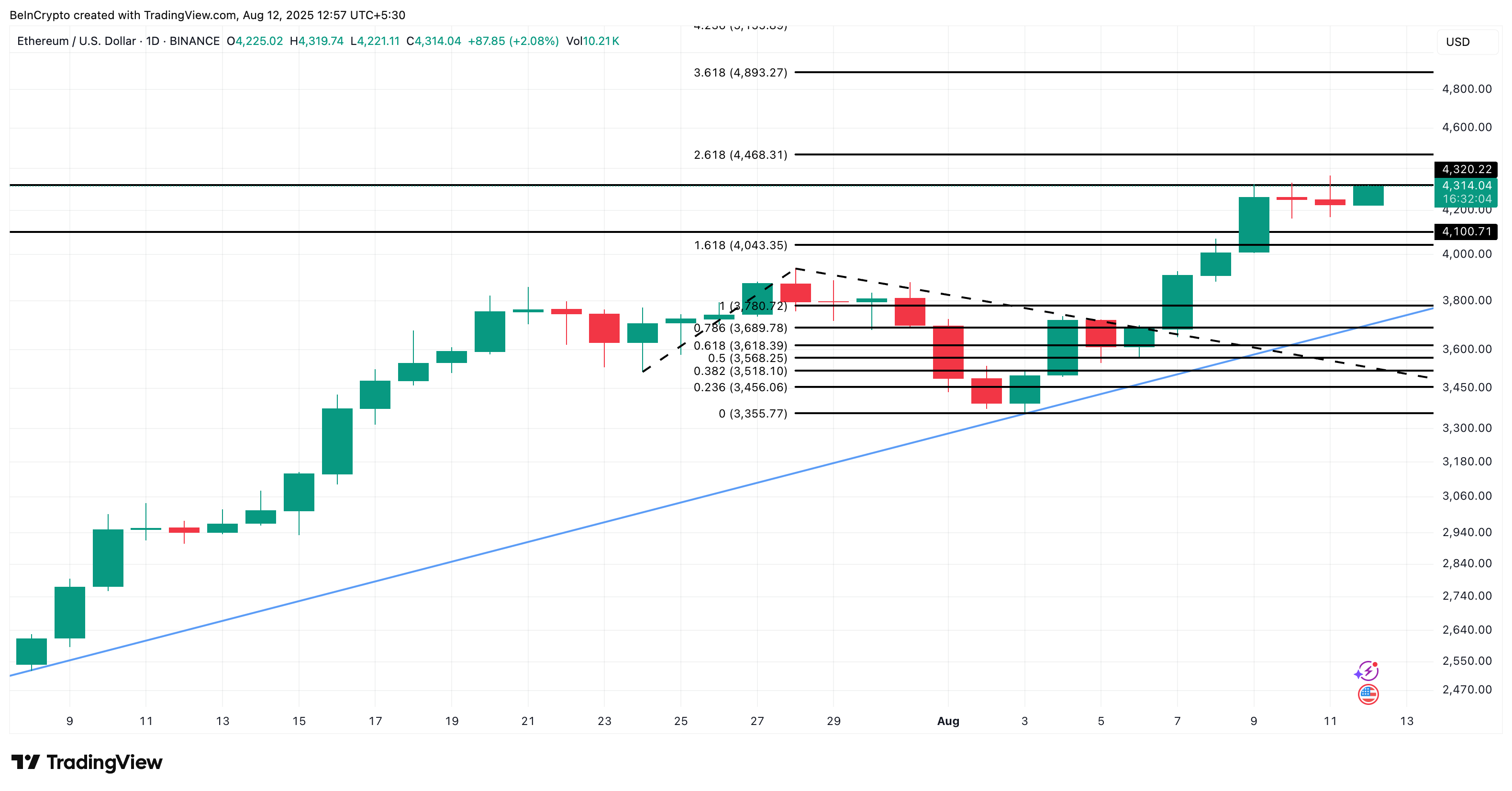

From a technical perspective, ethereum is trading inside a bullish continuation pattern (an ascending triangle), with the key resistance at $4,468, the 2.618 Fibonacci extension from its recent rally.

A clean break above this level WOULD put the previous all-time high of $4,878 within easy reach.

With the Fibonacci levels acting as resistance bases to the ascending trendline, the Ethereum price managed to break out of the bullish triangle on several occasions, on its way to the multi-month high.

If bulls clear $4,468, another breakout zone, the next Fibonacci target sits near $4,893, essentially marking a fresh record high. On the downside, immediate support lies at $4,043; losing that could open a deeper pullback risk.