🚀 Crypto’s Most Explosive Bull Run Yet? Top Analyst Unveils Key Catalysts for 2025

Brace for impact—the crypto markets might be gearing up for their most violent rally yet. Here's what's fueling the fire.

The institutional domino effect

BlackRock's ETF approval was just the appetizer. Now sovereign wealth funds are quietly accumulating—while retail still sleeps.

DeFi's nuclear winter thaws

Protocols that survived the bloodbath now sport bulletproof balance sheets. The smart money's rotating out of 'safe' tech stocks into high-octane altcoins.

The halving nobody's talking about

Miners have been hoarding since January. When the supply shock hits, even goldbugs might defect to Bitcoin.

Of course, Wall Street will take credit when prices moon—after spending years calling crypto a fraud. The game hasn't changed; just the players dumb enough to say the quiet part out loud.

Analyst Forecasts Unprecedented Crypto Bull Run

Against this backdrop, analyst Miles Deutscher shared his perspective on the current market.

“The stage is set for crypto’s biggest bull run ever. The industry has never experienced such a bullish set of tailwinds/rate of change,” the analyst stated.

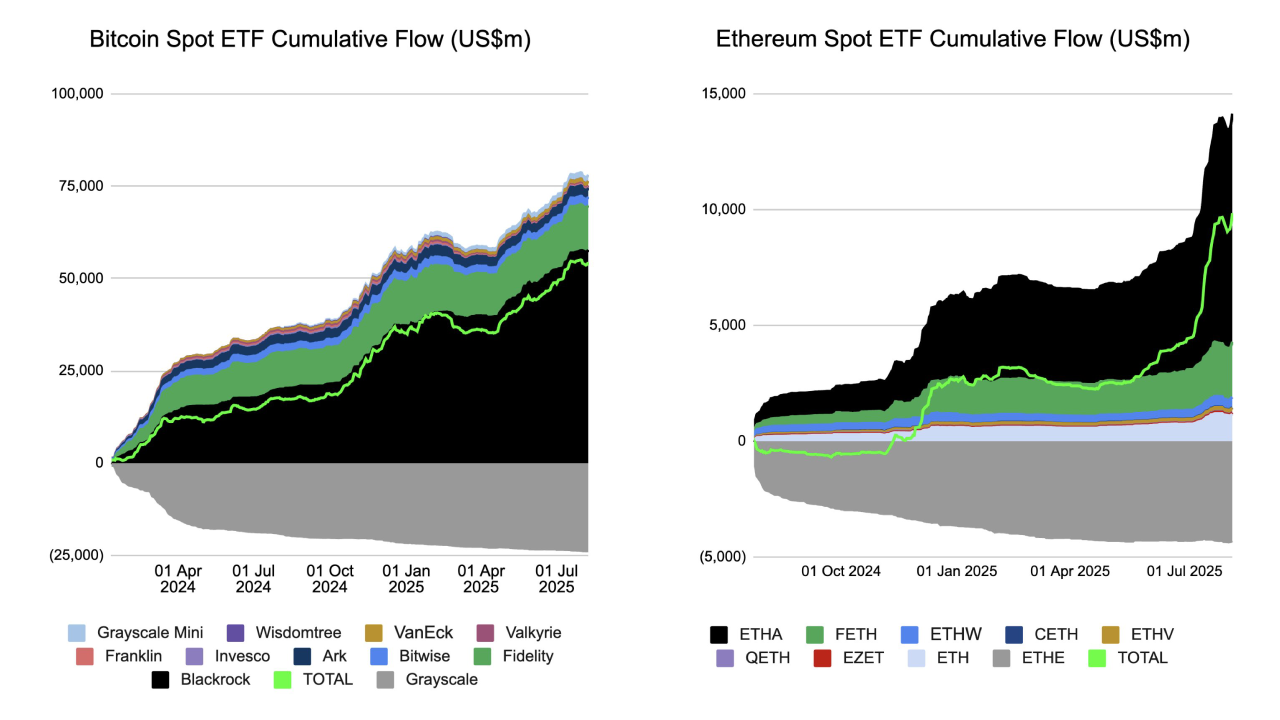

First, data showed that total inflows into US-listed crypto ETFs reached approximately $12.8 billion in July. Miles also highlighted that “spot BTC & ETH ETFs alone” have attracted around $17 billion in net inflows over the past 60 days. This has significantly impacted liquidity and the valuation of these assets.

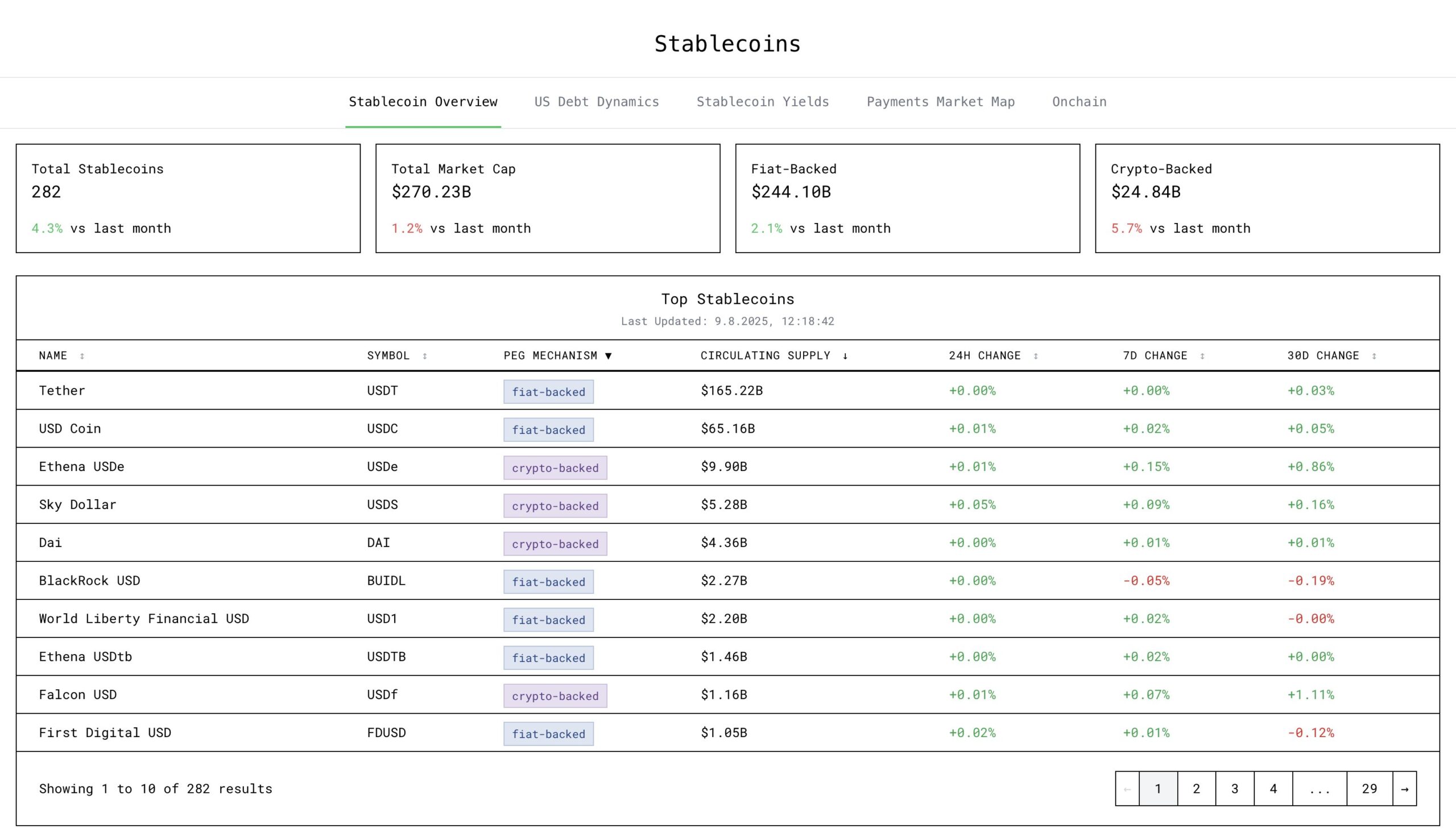

Second, the US Congress and the WHITE House have passed/enacted key legislation and policies related to stablecoins (GENIUS Act) and initiatives to expand access to alternative assets for 401(k) plans. This opens the door for a potentially massive amount of capital to flow into crypto in 2025.

Third, data indicates that the total stablecoin market capitalization is approximately $270–$282 billion. This reflects the growing on-chain money supply, which enhances market liquidity for trading and facilitates tokenization.

Fourth, SEC filings reveal major institutional interest in crypto. For instance, recent reports show Harvard University disclosed a significant position in BlackRock’s IBIT fund, about $116–$117 million. This is evidence that ETFs will become a primary channel for institutional capital entering crypto in 2025.

Fifth, political support from President TRUMP and his family. As the market environment becomes more “breathable,” it could reach a broader audience, especially traditional investors.

According to Miles, another factor is ETH reclaiming the $4,000 level—a multi-year high—which provides strong momentum toward its 2021 all-time high. Both BTC and ETH refuse to break down, even with heavy FUD. This suggests seller exhaustion alongside steady market demand.

Additionally, Miles noted that Bitcoin Dominance appears extremely weak for the first time since 2024. Liquidity is becoming more concentrated in major coins/CEXs, making the BTC/ETH trend more apparent.

“This is important to help shape the current phase of the cycle—creating more favorable conditions for altcoin rotation later,” Miles observed.