Ethereum ETFs Smash $1B Barrier as Wall Street Shifts from FOMO to Full Adoption

Wall Street's crypto flirtation just got serious. Ethereum ETFs—once a speculative sideshow—have bulldozed past $1 billion in assets as institutional players ditch 'wait-and-see' for 'get-me-in'.

The tipping point? Old money finally waking up to smart contracts' potential—while still charging 2% management fees for the privilege.

Watch the suits pivot from Bitcoin maximalism to ETH evangelism now that there's a regulated cash grab on the table. The blockchain doesn't lie—even if their 'long-term conviction' started last Tuesday.

Ethereum ETFs Have Their Bitcoin Moment With $1 Billion Inflows

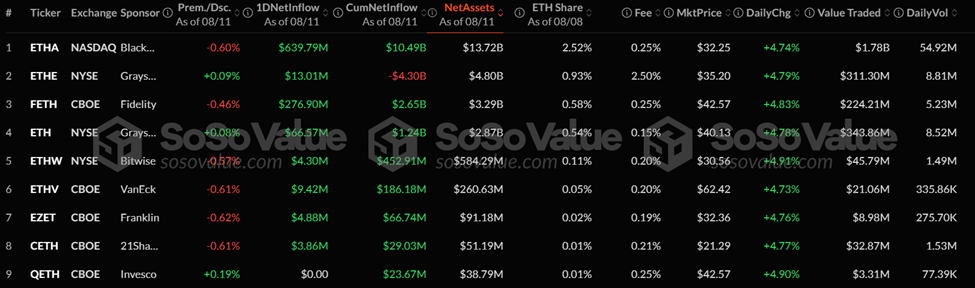

Data on SoSoValue shows BlackRock’s ETHA recorded $640 million in net inflows on Monday, while Fidelity’s product also hit new highs.

By comparison, spot Bitcoin ETFs brought in $178 million on the same day, with BlackRock’s IBIT contributing $138 million.

The data marks Ethereum’s first daily inflow over the billion-dollar mark, setting fresh records for both iShares and Fidelity Ethereum ETFs.

According to Nate Geraci, president of the ETF Store, the surge reflects a fundamental shift in traditional finance’s (TradFi’s) understanding of Ethereum’s value proposition.

“Feel like spot ETH ETFs were severely underestimated simply because TradFi investors didn’t understand ETH… BTC had a nice, clean narrative: ‘digital gold’. ETH takes more time for investors to understand. Now they’re hearing ‘backbone of future financial markets’ & it’s resonating,” he wrote on X.

The inflows come as the Ethereum’s price shatters past $4,300, nearly 13% below its all-time high of $4,868, recorded on November 8, 2021.

Open interest in Binance ETH’s futures has surged to $10 billion, up 46% in the past month, while short positions have jumped 500% year-on-year (YoY).

Meanwhile, 30% of the ETH supply is staked, and exchange reserves hover NEAR record lows. According to analysts, this supply dynamic could amplify volatility.

According to crypto Patel, a renowned KOL, sustained price action above $4,400 could trigger a major short squeeze, with whale accumulation and ETF-driven demand as key catalysts.

“Spot + Derivatives + Supply crunch = Parabolic risk,” Patel wrote.

The institutional appetite is also unfolding against a backdrop of legacy ETF industry changes.

The narrative appears to be maturing for Ethereum, seen with a seemingly obsessed Wall Street and as corporate players joining the fold.

Where a straightforward digital Gold pitch fueled Bitcoin’s ETF success, Ethereum’s complexity as a programmable blockchain powering decentralized finance (DeFi), tokenization, and Web3 applications took longer for traditional investors to digest.

However, Geraci’s comments suggest that this learning curve is now paying off, with the billion-dollar inflow day signaling growing institutional conviction.

It also positions Ethereum ETFs as a potential growth engine for the broader market.