BNB Chain & XRP Ledger Surge Ahead: How They’re Dominating Ethereum and Solana in Real-World Asset Adoption

The race for real-world asset (RWA) tokenization just got hotter—and the underdogs are winning. While Ethereum struggles with gas fees and Solana wrestles with network stability, BNB Chain and XRP Ledger are quietly eating their lunch.

Here's how they're doing it.

BNB Chain: The Efficiency Play

Low fees. High throughput. A developer ecosystem that actually ships. BNB Chain's pragmatic approach is winning over institutions tired of Ethereum's 'pay-to-play' model.

XRP Ledger: The Compliance Ace

Built for payments, perfected for compliance. XRP Ledger's native regulatory hooks make it the go-to for asset issuers who'd rather not get subpoenaed.

The Bottom Line

While ETH maximalists argue about layer-2 solutions and Solana fans pray for another bull run, these two chains are onboarding actual assets. Funny how that works when you prioritize utility over hype.

(And no, your NFT monkey jpeg doesn't count as a 'real-world asset.')

BNB Chain and XRPL Lead RWA Growth Amid Broader Sector Decline

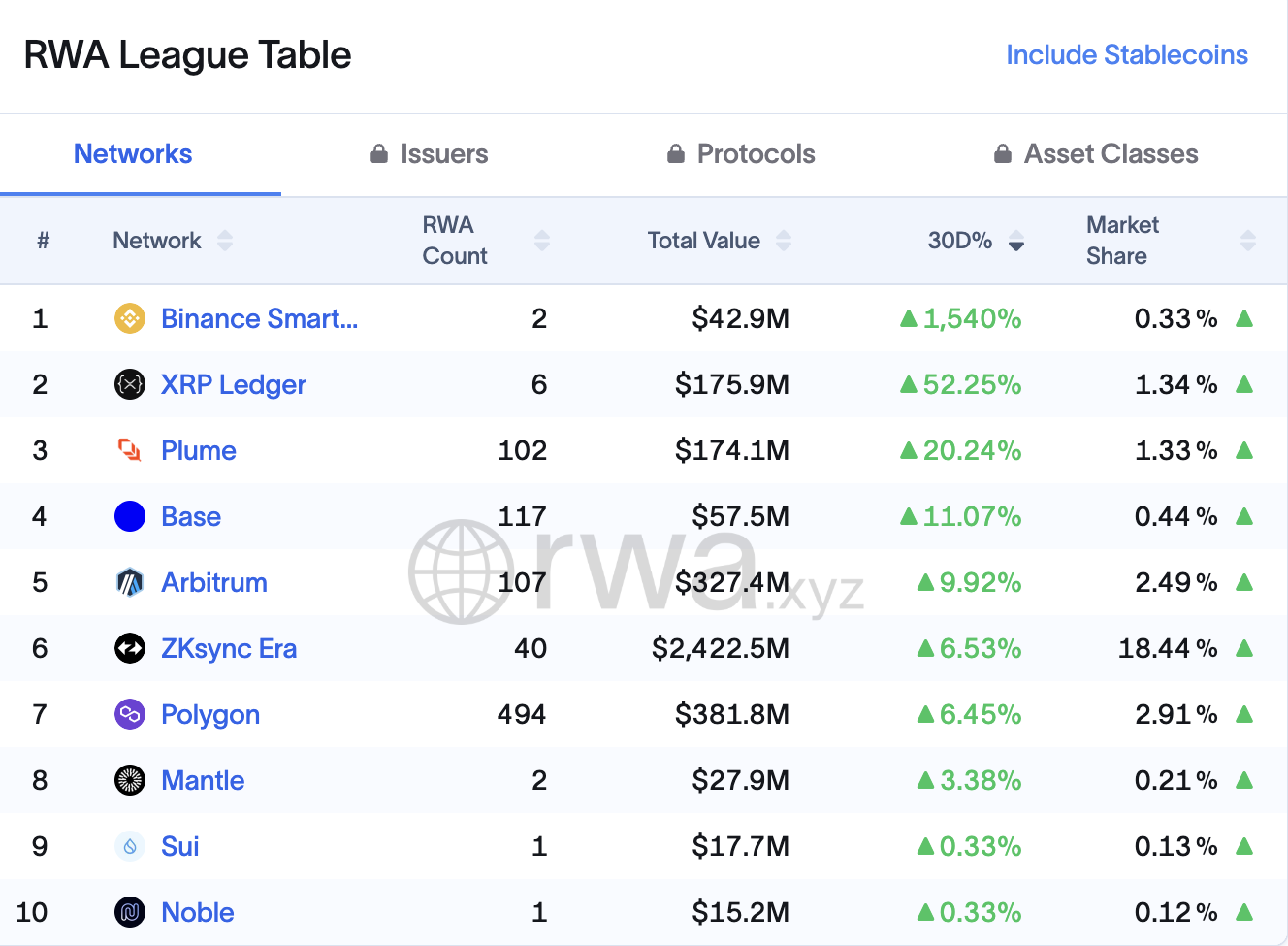

According to data from RWA.xyz, over the past 30 days, the value of RWAs on the BNB Chain has surged 1,540%, making it the highest gainer. Following the network was the XRPL, which has seen a 52.2% rise.

In contrast, the top protocols by value, including Ethereum, Aptos, Solana, Stellar, and others, have all lost value in the same time frame.

BNB Chain now holds 0.33% of the market share. Furthermore, the primary catalyst for its growth is the VanEck Treasury Fund (VBILL).

VBILL is VanEck’s first tokenized fund. It is available on multiple blockchains, including BNB Chain, Avalanche, Ethereum, and Solana. It offers on-chain access to short-term US Treasury bills.

![]()

![]() The onchain AUM for @vaneck_us is up by ~50% over the past two weeks.

The onchain AUM for @vaneck_us is up by ~50% over the past two weeks.

The VBILL fund is currently available on four different networks: @ethereum @BNBCHAIN @solana @avax pic.twitter.com/IXrRnBFYB3

![]()

Similarly, XRPL’s RWA growth was led by the OpenEden TBILL Vault.

“@OpenEden_X offers a smart contract vault managed by a regulated entity, providing 24/7 access to US Treasury Bills (T-Bills) through the OpenEden TBILL Vault. This on-chain liquid pool allows stablecoin holders to earn sustainable yields by investing in T-Bills, which are backed 1:1 by T-Bills, USD Coin (USDC), and US dollar reserves,” an analyst explained.

Meanwhile, Phil Kwok, co-founder of EasyA, also attributed the growth to Ripple’s RLUSD stablecoin. BeInCrypto reported previously that the stablecoin has been one of the fastest-growing assets in the market.

“Very impressive growth of the XRP ledger. Fastest increase in real world assets compared to any other blockchain,” Kwok posted.

It is worth noting that XRPL has made notable strides in tokenization recently. Previously, Ripple teamed up with Ctrl Alt to support the Dubai Land Department’s Real Estate Tokenization Project on the XRPL. Moreover, in June, Circle’s USDC stablecoin went live on the network.

Notably, Ripple itself is quite optimistic about the entire sector’s growth. In a report, the firm predicted that the real-world assets sector could go as high as $18.9 trillion by 2033.

However, not everyone shares this positive view. Recently, financial giant JP Morgan stated that the overall market for tokenized assets remains ‘rather insignificant.’

“This rather disappointing picture on tokenization reflects traditional investors not seeing a need for it thus far. There is also little evidence so far of banks or customers moving from traditional bank deposits to tokenized bank deposits on blockchains,” Nikolaos Panigirtzoglou, a JPMorgan strategist, wrote.

Furthermore, the sector is primarily dominated by crypto-native firms, with a total market capitalization of around $25.7 billion. In fact, its growth has been relatively slow.

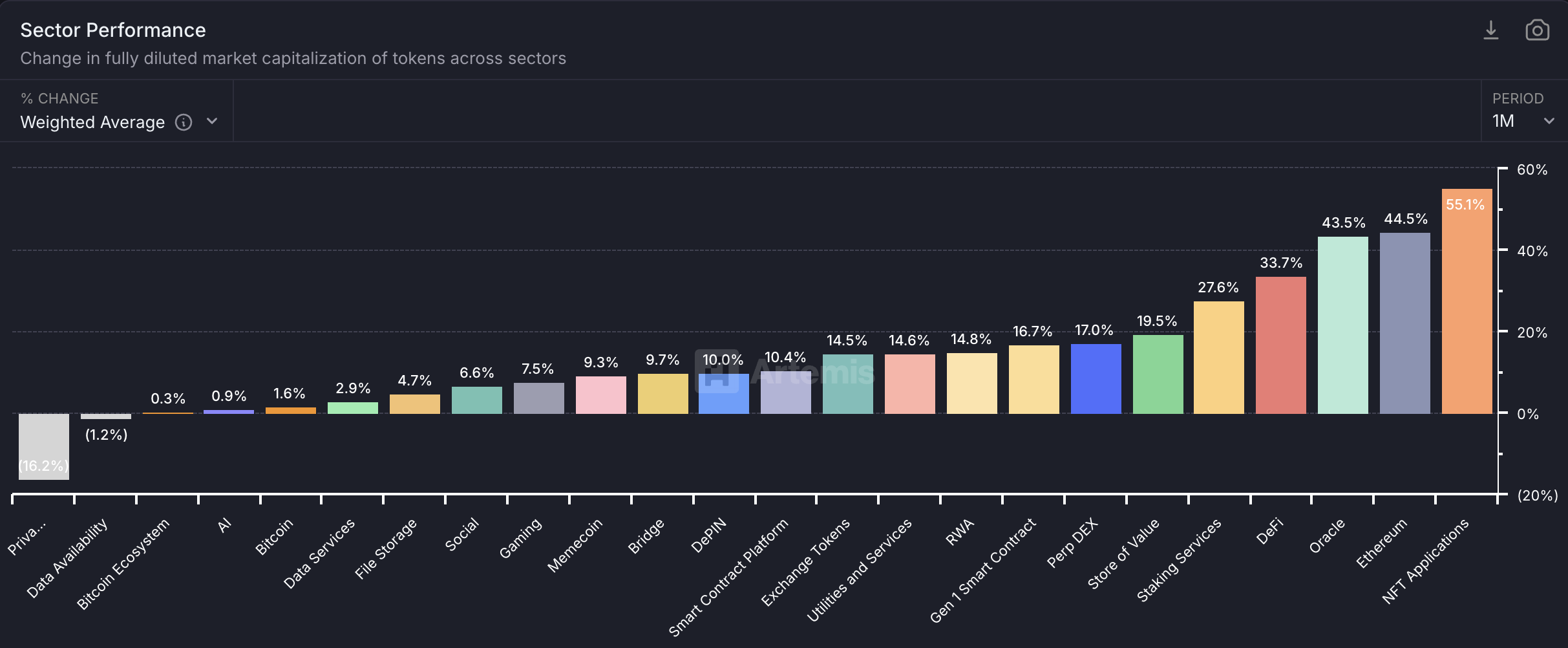

Data from Artemis revealed that RWAs grew by only 14.8% in the past month. This figure is quite underwhelming, especially when compared to the massive growth seen in non-fungible tokens (NFTs), Ethereum, decentralized finance (DeFi), and other sectors.