Ethena (ENA): Why Top Analysts Are Betting Big on This Altcoin for 2025

Move over, Bitcoin—Ethena (ENA) is stealing the spotlight as the altcoin to watch this cycle. Analysts are doubling down on its potential, calling it the most explosive play in crypto right now.

Here's why the smart money's flooding in.

The Synthetic Dollar Game-Changer

Ethena’s pioneering synthetic dollar protocol cuts through traditional stablecoin flaws—no banks, no middlemen, just pure algorithmic efficiency. Traders are piling in as its yield mechanisms outpace legacy finance’s pathetic 0.5% savings accounts.

Institutional FOMO Hits Critical Mass

Hedge funds that once scoffed at 'DeFi degens' are now quietly accumulating ENA positions. Why? Because nothing screams 'alpha' like an asset that’s up 300% while Wall Street still tries to figure out what a wallet is.

The Verdict: High Risk, Higher Reward

This isn’t your grandma’s bond ETF—ENA’s volatility could vaporize weak hands. But for those who stomach the swings? It might just be the trade that defines the 2025 bull run. Just don’t cry when your banker friend asks for tips after the ATH.

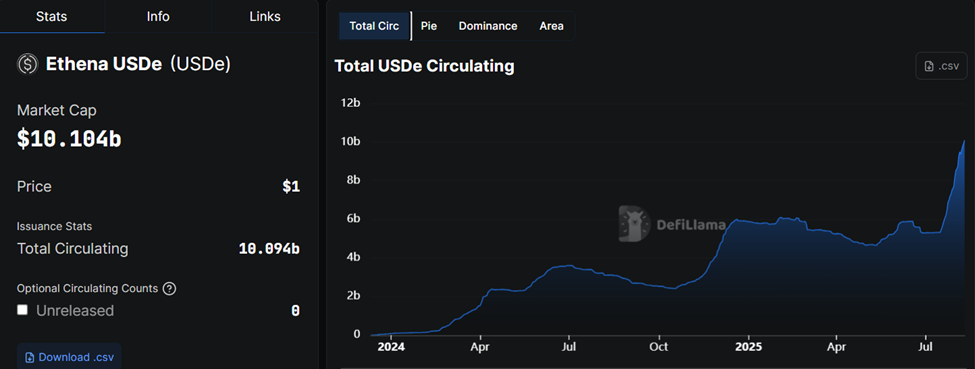

Ethena and USDe Stablecoin’s $10 Billion Milestone Sets Stage for Next Growth Phase

Ethena broke $10 billion in TVL (Total Value Locked) on Sunday, nearly doubling in less than a month. The past week marked one of Ethena’s highest fee-generating weeks to date, and the protocol has generated over $475 million in fees.

The supply has doubled in the past month alone, a trajectory that has investors eyeing a potentially explosive next phase.

According to analyst crypto Stream, ENA, Ethena’s governance and protocol token, may be on the verge of unlocking a powerful new revenue engine. Four of five governance-mandated conditions for activating Ethena’s fee switch have already been met.

Ethena’s governance framework outlines strict thresholds for fee distribution activation:

- USDe supply above $8 billion — met.

- Protocol revenue above $25 million — met, now over $43 million.

- Reserve Fund at least 1% of supply — met.

- sUSDe APY spread within the 5.0-7.5% range — met, currently around 10%.

- USDe integration on three of the top five derivatives exchanges — not yet met.

The analyst says this paves the way for protocol revenue to be distributed to ENA holders. The final hurdle is a listing on either the Binance or the OKX exchange.

“Fee switch turned on: Ethena is a revenue monster. At some point, revenue will be funneled into ENA,” Crypto Stream posted, calling ENA their largest spot position.

OKX and the Binance exchange remain the missing integrations. Regulatory issues under the EU’s MiCA (Markets in Crypto Assets) framework initially blocked Binance from listing USDe.

Details on the missing Binance integration:

USDE was not integrated into Binance due to a regulatory issue in Germany regarding MICA compliance.

The bad news is that: It seems the issue cannot be resolved, so USDE will not be able to operate in the EU market in the foreseeable…

Still, off-boarding EU users earlier this month may clear the path for a global USDe listing on popular exchanges.

Converge Could Transform Ethena Into a Yield Powerhouse

While the fee switch WOULD mark a major milestone, some see an even bigger prize ahead. Analyst Jacob Canfield pointed to Ethena’s long-term plan to launch its blockchain, Converge, with ENA as the protocol token.

Introducing @convergeonchain: The settlement network for traditional finance and digital dollars, powered by @ethena_labs and @Securitize

Our vision is to provide the first purpose built settlement LAYER where TradFi will merge with DeFi, centered on USDe & USDtb and secured by… https://t.co/BdOMMflqNl pic.twitter.com/sYxS6p9T8W

In this model, ENA holders could stake tokens to validators and earn a percentage of transaction value. This would turn ENA into a yield-bearing asset tied to the network’s economic activity.

Meanwhile, Ethena’s roadmap goes beyond crypto-native growth. Crypto Stream highlighted the planned Nasdaq listing of StablecoinX (TCO) in Q4, potentially giving institutional investors direct exposure to Ethena’s ecosystem.

StablecoinX Inc. @stablecoin_x has announced a $360 million capital raise to purchase $ENA and will seek to list its Class A common shares on the Nasdaq Global Market under the ticker symbol "USDE", which includes a $60 million contribution of ENA from the Ethena Foundation… pic.twitter.com/sgfD8P9m05

— Ethena Labs (@ethena_labs) July 21, 2025Circle’s past success with USDC demonstrates significant demand for regulated stablecoin vehicles from traditional finance (TradFi).

Meanwhile, Arthur Cheong, founder of DeFiance Capital, believes that large funds have underestimated Ethena due to its token unlock schedule.

“You guys simply have no idea how many funds… casually dismissed $ENA with one simple reason of ‘too many unlocks’ and ignored the potential growth ahead and the tier S execution of the team,” Cheong said.

However, despite all that, Ethena’s meteoric rise has drawn comparisons to Terra’s ill-fated UST, which collapsed in 2022.

It follows USDe becoming the third-largest stablecoin following the passage of the GENIUS Act. Critics warn that synthetic stablecoins face inherent fragility, especially in stressed market conditions.

However, Ethena’s founder, Guy Young, has countered by pointing to integrated risk controls and diversified DeFi collateral designed to mitigate de-pegging risks.

If Binance or OKX integration of USDe stablecoin occurs and the fee switch activates, Ethena could see protocol revenue redirected to ENA holders just as macro tailwinds align.

In such a scenario, lower Federal Reserve (Fed) rates, historically inversely correlated with crypto funding costs, could boost Ethena’s profitability.

The pieces may fall into place amid growing USDe adoption, a growing reserve, and the looming Converge chain.

As of this writing, Ethena was trading for $0.7759, up by over 3% in the last 24 hours.