Crypto Whales Double Down: Ethereum’s Rally Sparks ATH Frenzy and Big Money Moves

Crypto's big players aren't just watching Ethereum's surge—they're diving in headfirst. As ETH flirts with all-time highs, whale wallets are shifting millions like poker chips on a hot streak. Here's how the smart money plays the rally.

Whale Watching 101: Tracking the Titans

Blockchain sleuths spot telltale signs: dormant wallets waking up, OTC desks buzzing, and derivatives markets overheating. When whales move, they don't splash—they create tsunamis.

The Optimism Paradox: Greed vs. Gravity

Every ATH brings two reactions: FOMO from retail traders and cold calculus from institutions. Some whales take profits while others stack more—because nothing says 'bull market' like leveraged bets on imaginary internet money.

What's Next? The Whale Playbook

Watch for accumulation patterns before major resistance breaks and sudden sell-offs at round numbers. Pro tip: When whales start 'HODLing' instead of trading, even Wall Street hedgies pay attention (before quietly copying their moves).

Remember: In crypto, the house always wins—it just happens to be a decentralized house this time.

Crypto Whales Flip Bullish as Ethereum Closes in on Record Price

Yesterday, BeInCrypto reported that ETH broke past $4,000 after 8 months. Since this milestone, the uptrend has continued to accelerate.

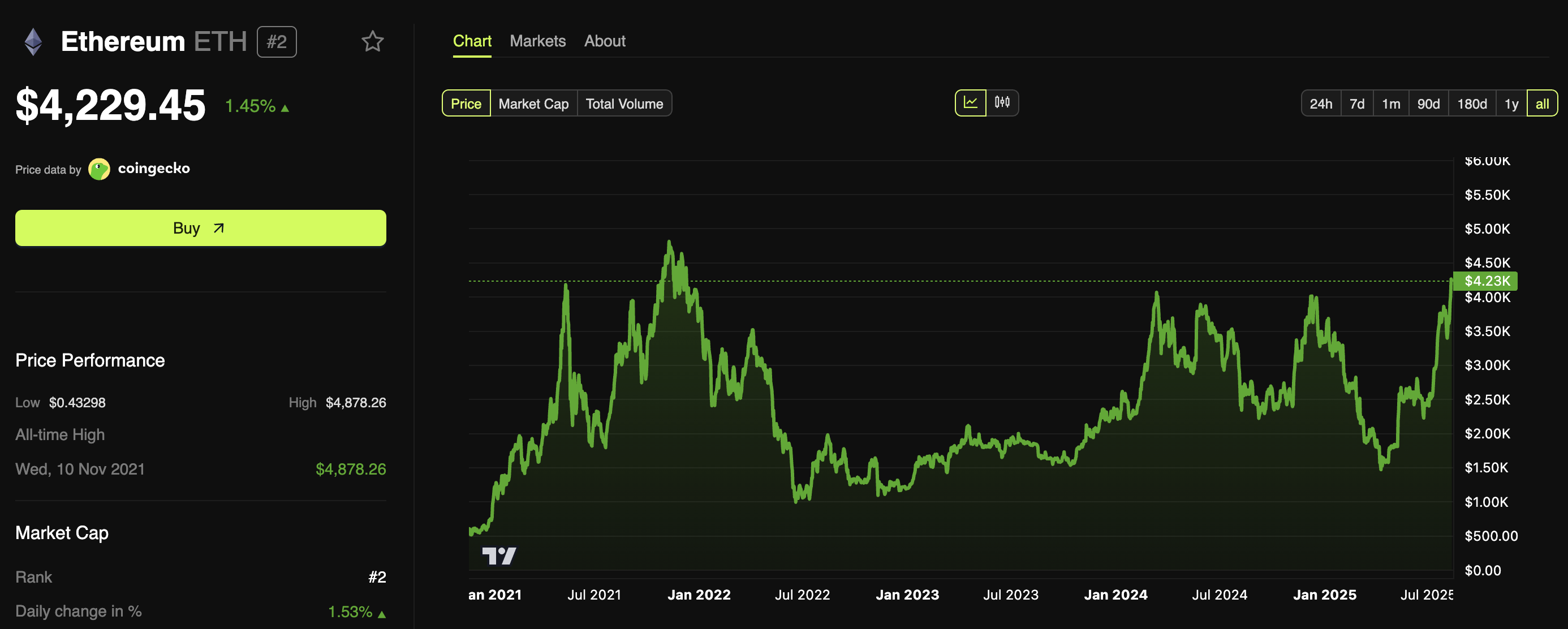

The second-largest cryptocurrency reached $4,331 during early Asian trading hours today, a level last seen in December 2021. At press time, the price had adjusted to $4,229.45, representing an appreciation of 1.45% over the past day.

With the price only $648 shy of the November 2021 record peak of $4,878, ethereum whales are adjusting their positions. On-chain data indicates a mixed response among whales.

In an X (formerly Twitter) post, Lookonchain highlighted that some big players are moving large amounts of capital into Ethereum.

A whale with wallet address 0xF436 withdrew 17,655 ETH worth $72.7 million from exchanges. The blockchain analytics firm added that the whale might be acting on behalf of SharpLink Gaming.

Another whale, wallet 0x3684, spent 34 million Tether (USDT) to buy 8,109 ETH at $4,193 each. What’s noteworthy is that Ethereum’s latest rally has drawn back players who had previously sold their holdings, prompting them to switch sides.

Lookonchain noted that in early August, Arthur Hayes, Maelstrom’s Chief Investment Officer (CIO), sold 2,373 ETH worth $8.32 million. At the time, ETH was priced around $3,507.

Yesterday, he transferred 10.5 million USDC (USDC) to repurchase ETH, this time at a higher price.

“Had to buy it all back, do you forgive me @fundstrat? I pinky swear, I’ll never take profit again,” Hayes said.

Hayes isn’t alone. An unidentified whale sold 38,582 ETH during the price dip to $3,548, only to buy back at $4,010.

“That’s a loss of over $17 million just from selling low and buying higher. Market swings can trigger fear, but history shows that strong hands often win in Crypto,” a crypto market watcher wrote.

This whale panic sold $19,810,000 $ETH after the drop.

Today, he bought back $12,580,000 Ethereum after the bounce.![]()

![]() pic.twitter.com/ESOrsmJj6G

pic.twitter.com/ESOrsmJj6G

Key ETH Whales Trim Holdings Despite Positive Momentum

Nonetheless, the whale’s behavior has not been uniformly optimistic. According to Lookonchain, Erik Voorhees, an early Bitcoin advocate and founder of ShapeShift, sold 6,581 ETH worth $27.38 million at a price of $4,161.

Despite the recent transaction, he still retains 556.68 ETH, worth approximately $2.3 million.

“We were founded before Ethereum existed. Still bullish ETH,” ShapeShift posted.

Another notable MOVE came from Ethereum co-founder Jeffrey Wilcke. He recently deposited 9,840 ETH (about $9.22 million) into Kraken.

Just three months ago, Wilcke transferred 105,737 ETH to eight newly created wallets. He now holds 95,897 ETH, valued at around $401 million.

In a separate case, OnChain Lens observed that a long-dormant whale moved funds after five years of inactivity. The crypto whale deposited 5,000 ETH worth $21.14 million into Binance. The move netted a profit of roughly $45.38 million.

“The whale initially received 55,001 ETH worth $6.73 million from BitZ, 7 years ago. The whale still holds 5,001 ETH worth $21.07 million,” OnChain Lens added.

The contrasting moves, from large-scale accumulation to substantial profit-taking, reveal a split in sentiment among major ETH holders.