Tether and Circle Outpace Nations: Stablecoin Giants Now Hold More US Debt Than Entire Countries

Forget sovereign treasuries—stablecoin issuers are swallowing US debt whole.

How two crypto companies became bigger players than nations

Tether and Circle didn’t just enter the bond market—they bulldozed it. The duo now holds more US government debt than multiple G20 members combined. No bailouts needed, just pure dollar-pegged demand.

The irony? These ‘unregulated’ crypto firms now prop up the very system that scorns them. Treasury yields would weep without their billions. Meanwhile, traditional banks still charge $25 for wire transfers like it’s 1995.

Next stop: monetary policy by stablecoin committee? Don’t bet against it.

Circle and Tether Quietly Amass More US Debt Than Germany, South Korea, and the UAE

Stablecoins are digital tokens pegged to the US dollar and backed by reserves, often in US Treasury bills (T-bills). The structure ensures that one token can reliably be redeemed for one dollar.

This stability makes them attractive for cross-border payments and as a settlement layer for the crypto ecosystem.

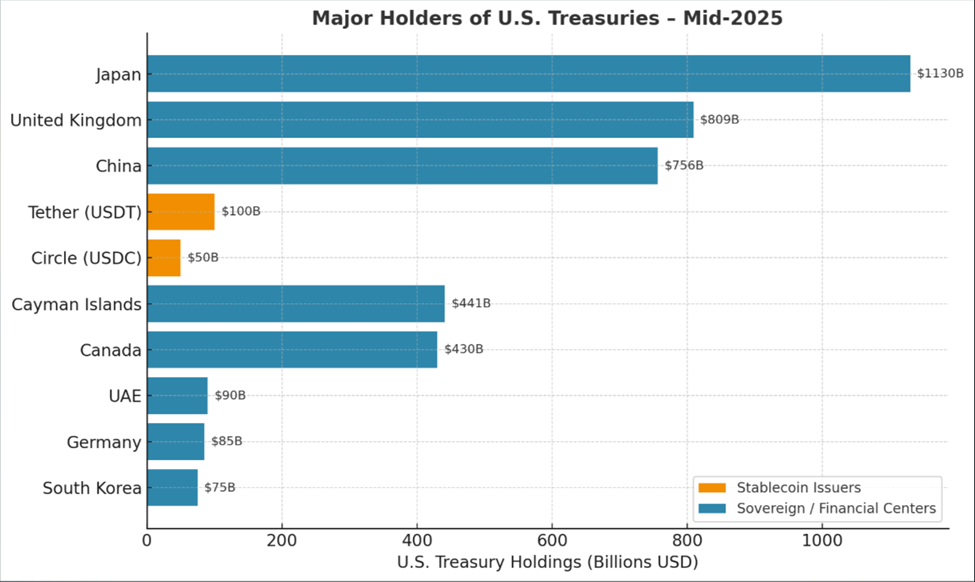

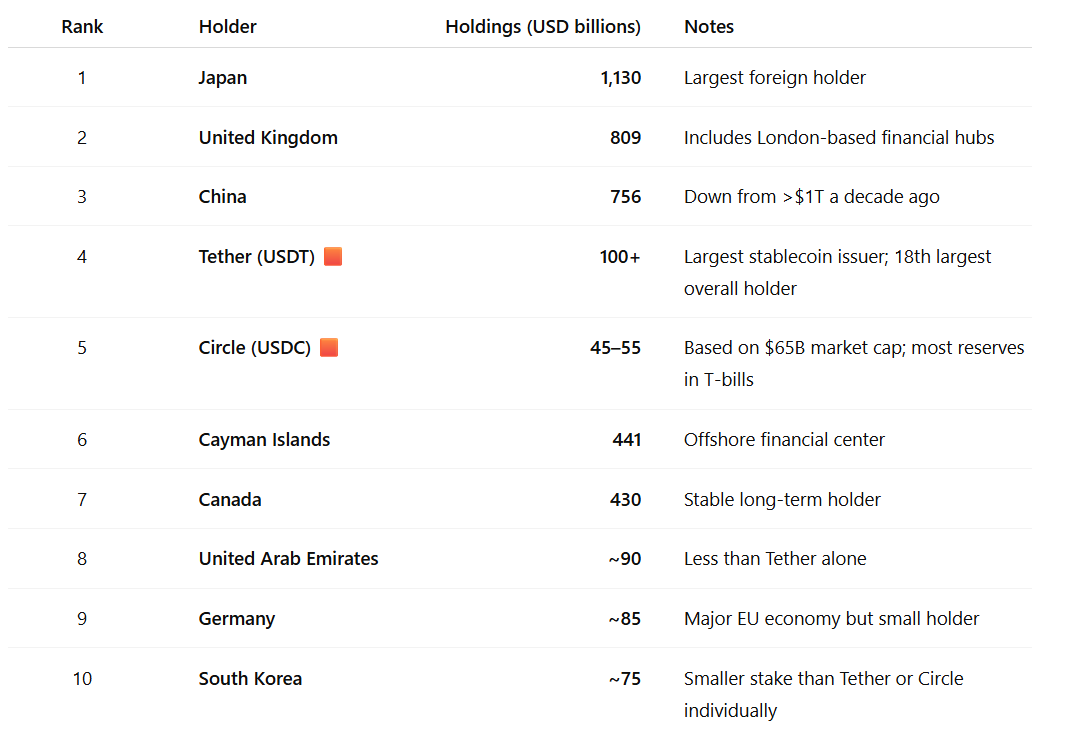

Two leading stablecoin issuers, Tether (USDT) and Circle (USDC), hold more US government debt than several major national economies. This includes Germany, South Korea, and the United Arab Emirates.

Tether, the largest stablecoin issuer, now holds over $100 billion in T-bills. According to data from the Treasury Department, it ranks as the 18th-largest overall holder of US debt, above the UAE ($85 billion).

Circle, the issuer of USDC, holds between $45 billion and $55 billion in T-bills, putting it ahead of South Korea (approximately $75 billion) if measured individually.

Combined, the two companies surpass all three countries, with a recent Apollo report highlighting just how quickly the sector is rising.

“Almost 90% of stablecoin use is crypto trading, which will likely continue to grow. The big breakthrough will be if US dollar stablecoins are used for global retail payments. If the US dollar stablecoin market grows into the trillions, demand for US T-bills will significantly increase. There are financial stability risks because money will be moved around quickly if depositors lose confidence in a stablecoin issuer,” read an excerpt in the Apollo report.

The stablecoin industry is now the 18th largest external holder of Treasuries, with projections suggesting it could grow from its current $270 billion market cap to $2 trillion by 2028.

The market cap of USDC alone has surged 90% in the past year to $65 billion. It was fueled by institutional adoption and Circle’s high-profile IPO in June.

Transaction Volumes Rival Traditional Payment Giants

Meanwhile, the adoption story goes beyond reserves. In early 2024, stablecoin transaction volumes exceeded Visa’s, largely due to their use in crypto trading. Increasing use in global money transfers also contributed to the traction, with a BeInCrypto report indicating 49% of institutions use stablecoins.

With near-instant settlement and low fees, stablecoins are being pitched as a faster, cheaper alternative to SWIFT and other legacy payment rails. Stripe’s $1.1 billion acquisition of the stablecoin startup Bridge in October marked one of the first major fintech bets on the technology.

The rise of stablecoin issuers as major T-bill buyers comes when traditional foreign holders are scaling back. China’s holdings have dropped from over $1 trillion a decade ago to $756 billion.

While still the largest foreign holder at $1.13 trillion, Japan has also signaled a more cautious approach. This creates an opening for stablecoin issuers to serve as a consistent source of demand for US debt.

“Having stablecoin issuers always be there is a massive boost in terms of giving confidence to the Treasury [Department] about where to place debt,” Fortune reported, citing Yesha Yadav, a Vanderbilt Law School professor who studies the intersection of crypto and the bond market.

Proponents argue that stablecoins could help cement the dollar’s dominance globally, much like the offshore “Eurodollar” market did in the 20th century.

They also suggest a growing demand for T-bills from stablecoin firms could help lower long-term interest rates and strengthen US sanctions enforcement abroad.

13/ Looming Dollar Risks

• US debt now exceeds $36.2 trillion, or 122% of GDP, growing by $1 trillion every quarter.

• All three major credit agencies have downgraded US credit from AAA.

Citi forecasts places Stablecoins amongst the top holders of US T-Bills, if US debt…

Skeptics, however, caution against overhyping the numbers, with the US money market fund (MMF) sector, for example, dwarfing stablecoin holdings at roughly $7 trillion.

Meanwhile, banking lobbyists warn that stablecoins could drain deposits from banks, potentially reducing lending capacity.

“Citi forecasts places Stablecoins amongst the top holders of US T-Bills, if US debt climbs and T-Bills wobble, so does the trust in digital dollar. Creating a temporary shift to other currencies,” one user wrote, citing Citibank.

Industry executives counter that similar fears about MMFs decades ago proved unfounded.

Still, if stablecoins keep absorbing large amounts of short-term Treasuries, it could disrupt how Wall Street manages liquidity and risk.

Nevertheless, the growth of Circle and Tether signals that the US debt market has a new class of heavyweight buyers born in the volatile crypto arena rather than in traditional banking halls.