DeSci Summer Has Arrived: How BIO Token’s Explosive Rally Signals a New Era

Decentralized science just got its breakout moment—and Wall Street didn’t see it coming.

The BIO token’s parabolic surge isn’t just another crypto pump. It’s a middle finger to slow-moving biotech VCs still writing checks in triplicate. Here’s why DeFi’s lab-coat revolution is heating up.

From Petri Dish to Moon Mission

Peer-reviewed research meets tokenized incentives. Scientists get funded without begging gatekeepers. Retail investors access breakthroughs before IPO bankers slap on 200% markups. Everybody wins—except the usual suspects skimming 30% off taxpayer-funded innovation.

The Fine Print on BIO’s Breakout

No, this isn’t another memecoin circus. The token’s infrastructure actually works: IP-NFTs for research ownership, decentralized clinical trials, and a self-sustaining funding pool that makes NIH grants look like a medieval patronage system.

DeSci’s make-or-break moment? When traditional pharma starts acquiring these projects—not to develop them, but to bury the competition. Place your bets.

Bio Protocol (BIO) Hits 5-Month High as ‘DeSci Summer’ Hopes Revive

Bio Protocol is a decentralized science (DeSci) platform that enables global communities of patients, researchers, and crypto users to collaboratively fund, develop, and own biotech projects. It uses blockchain and decentralized finance (DeFi) principles to create an on-chain scientific economy.

Moreover, DeSci, a movement utilizing decentralized technologies, aims to transform scientific research. It eliminates intermediaries, fosters transparent collaboration, and makes data and findings accessible to all stakeholders.

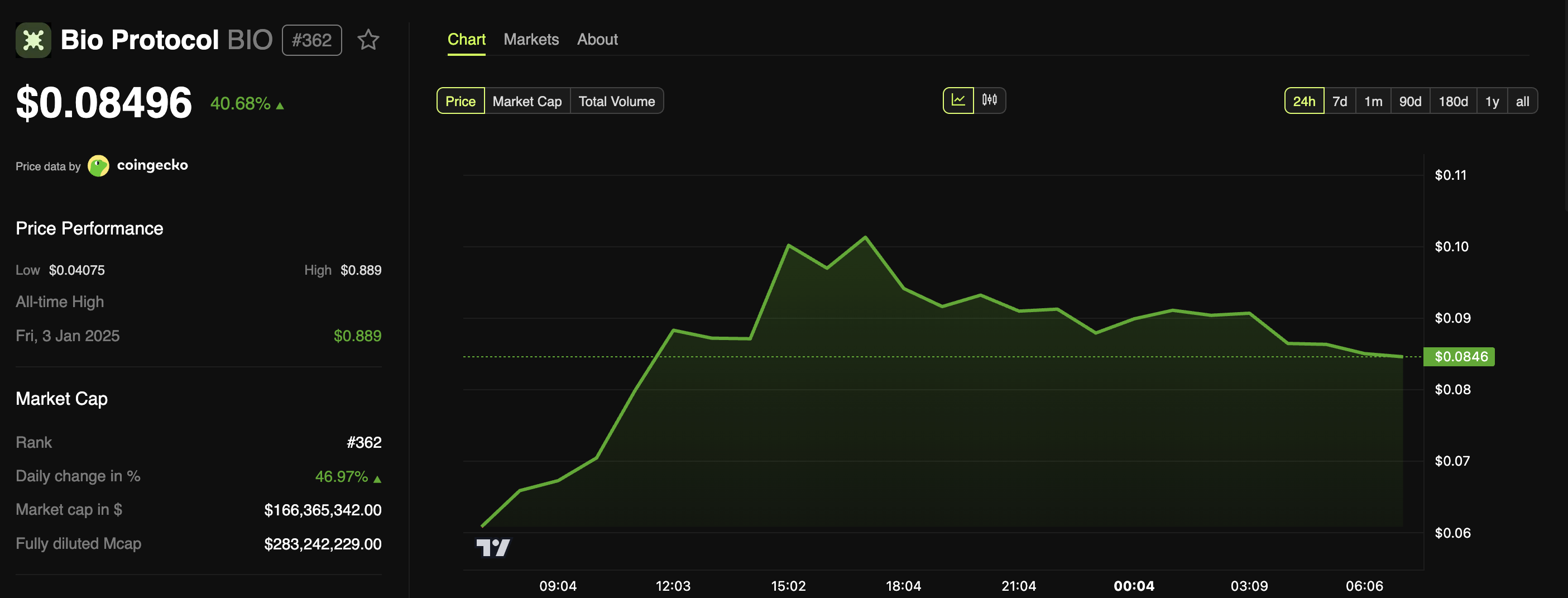

Notably, the BIO token recorded a major milestone on August 7. BeInCrypto Markets data showed that the price jumped nearly 72% from $0.061 to $0.106, a level last seen in early March.

“Finally, one of my long-term bag printed GOD candle, BIO @BioProtocol. Bio is ready to lead DeSci narrative, Bio is like VIRTUAL but for DeSci, Billion,” an analyst posted.

After this, the token faced a correction and settled at $0.084 at press time. Still, this represented an appreciation of 40.68% over the past day.

The trading activity also increased, as evidenced by a 2,239% increase in trading volume. At the time of writing, it stood at $467 million.

The price high came after Bio Protocol activated ethereum mainnet staking yesterday. This allows users to stake BIO and BioDAO tokens to earn BioXP, which provides access to ignition sales.

The network added that over 25 million BIO tokens, valued at approximately $2 million, were staked on the Base chain within days prior to the Ethereum launch.

The staking mechanism is part of its broader V2 upgrade, which introduces several major changes.

“Instead of big one-off raises, it enables small, frequent, and experimental launches. Lower. barriers to entry. Better access for real contributors. Funding that scales with traction, not just narrative,” Bio Protocol added.

Furthermore, BeInCrypto reported that BIO secured a Coinbase listing after the exchange added it to its roadmap. Meanwhile, in addition to BIO’s growth, the broader DeSci sector has also seen growth.

“Looks like DeSci is having a revival?” Tobias Reisner wrote.

CoinGecko data showed that the overall market cap recovered 12.5% in the past 24 hours, reaching $734 million. Many tokens posted double-digit gains, reinforcing the narrative of a sector resurgence.

“DeSci summer is so back,” Moonrock Capital Founder Simon Dedic noted.

DeSci is back pic.twitter.com/QLjFS5J4ds

—![]()

![]()

![]()

The growth of BIO and the DeSci sector suggests a bullish outlook for now, though the actual performance remains to be seen.