Chainlink’s Reserve Launch & Surging Accumulation Signal Major Bull Run Ahead

Chainlink just flipped the script. With its new Reserve launch and whales quietly stacking LINK, the oracle giant's gearing up for a potential price explosion.

Smart money's betting big—while retail still sleeps.

Here's why the bulls are circling:

The Reserve launch isn't just another feature drop—it's a liquidity fortress for cross-chain collateral. DeFi's plumbing just got bulletproof.

Meanwhile, accumulation patterns mirror early 2024's breakout setup. History doesn't repeat, but it sure rhymes (especially when VCs need an exit).

Active addresses spiking? Check. Exchange reserves draining? Double-check. The only thing missing? Your bag.

Chainlink's playing 4D chess while shitcoins fight for CEX listings. The Oracle Wars have a clear winner—don't be the last to notice.

Chainlink Reserve Launched

According to the official announcement, Chainlink Reserve is a decentralized accumulation mechanism for Chainlink (LINK).

The LINK tokens allocated to the Reserve are not expected to be withdrawn for several years. This sends a strong message about the project’s long-term strategy and reflects its commitment to maintaining a stable resource pool for incentive programs, development, and integration efforts.

“No withdrawals are expected from the Reserve for multiple years, meaning the strategic $LINK stockpile becomes an accumulation machine driven by adoption,” a user on X noted.

The absence of any short-term withdrawal plans for LINK from Chainlink Reserve may help ease sell pressure in the market. It acts as a “blackhole” that absorbs liquidity, setting the stage for the next bullish cycle.

Accumulation from Whales and Institutions

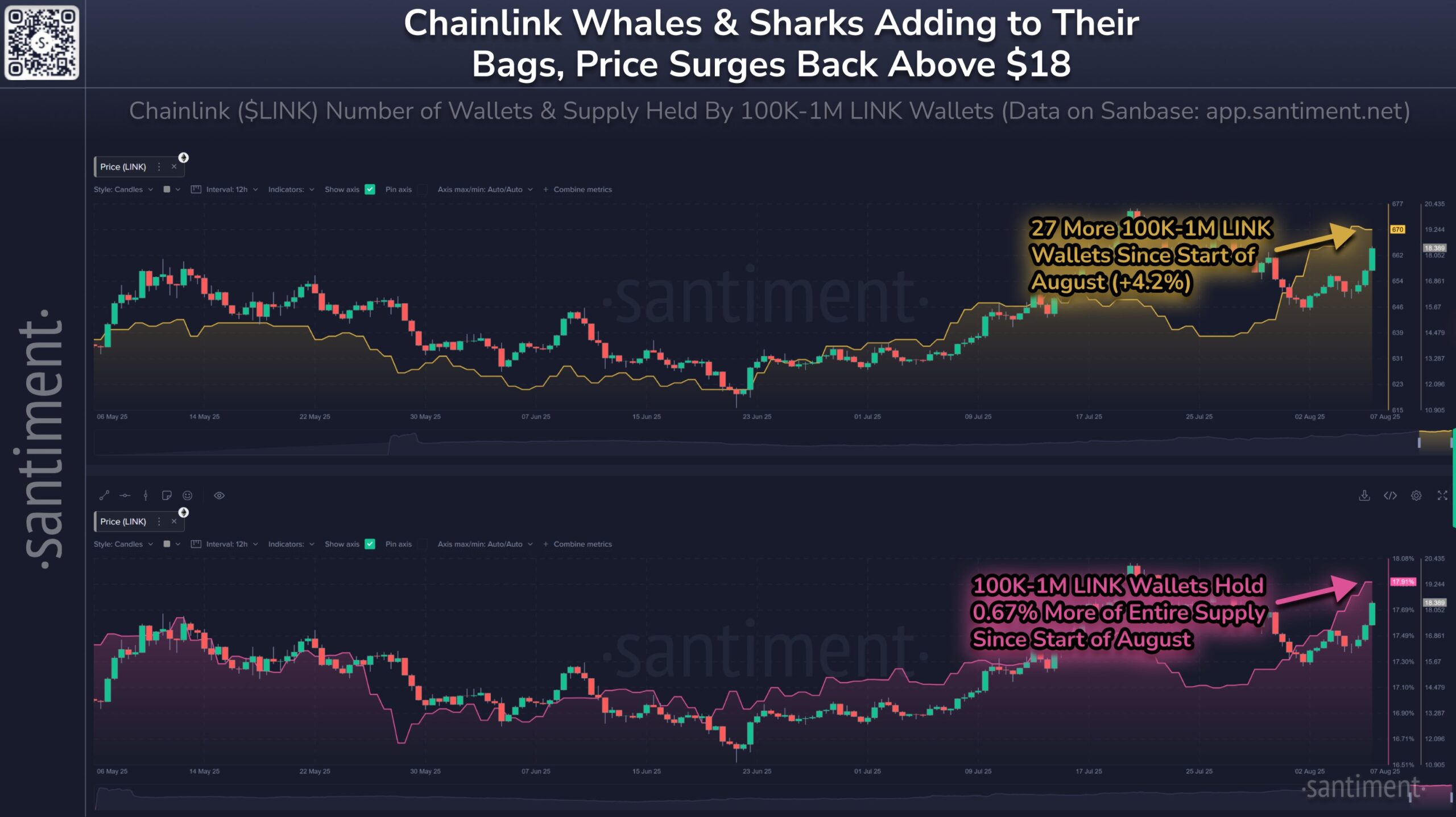

Data from Santiment reveals that in August, the number of wallets holding between 100,000 and 1 million LINK increased by 4.2%. Additionally, 0.67% of LINK’s total supply was accumulated in just a few days.

This indicates that whales and institutions are accelerating accumulation despite the market not entering a bullish phase.

Typically, accumulation behavior from large wallets occurs during periods of uncertainty or low liquidity. If this trend continues, LINK’s price could receive strong foundational support from major investors’ DEEP buying levels.

Moreover, according to an analyst on X, the key support level at $13 is holding firmly. LINK could MOVE toward the $46 target zone if the bullish scenario continues. However, this needs to be confirmed by actual price action and trading volume in the coming weeks.

Some technical analysts have pointed out that LINK is repeating a pattern previously seen during the growth cycles of 2023 and 2024. Specifically, the formation of a “Higher Low” (where each dip is higher than the last) along with a price breakout is a common precursor to major upward moves.

While it’s too early to confirm, the similarities in chart patterns and on-chain behavior raise investor expectations for a fresh bullish run.

At the press time, LINK is trading at $19.35, up 15.3% over the past 24 hours. LINK’s strong recovery is part of today’s overall market recovery.