3 Altcoins Bleeding Exchange Reserves: August’s First Week Signals Big Moves

Crypto's quiet exodus begins. Three major altcoins just flashed a critical supply squeeze—exchange reserves tanking hard in early August. No coins left on the sidelines means one thing: volatility incoming.

Whales are circling. When liquidity gets sucked out of trading platforms, price explosions (or implosions) follow. These aren't your grandma's 'diamond hands'—this is the big leagues.

Meanwhile, traditional finance still thinks 'stablecoins' are about risk management. Cute.

1. Ethereum (ETH)

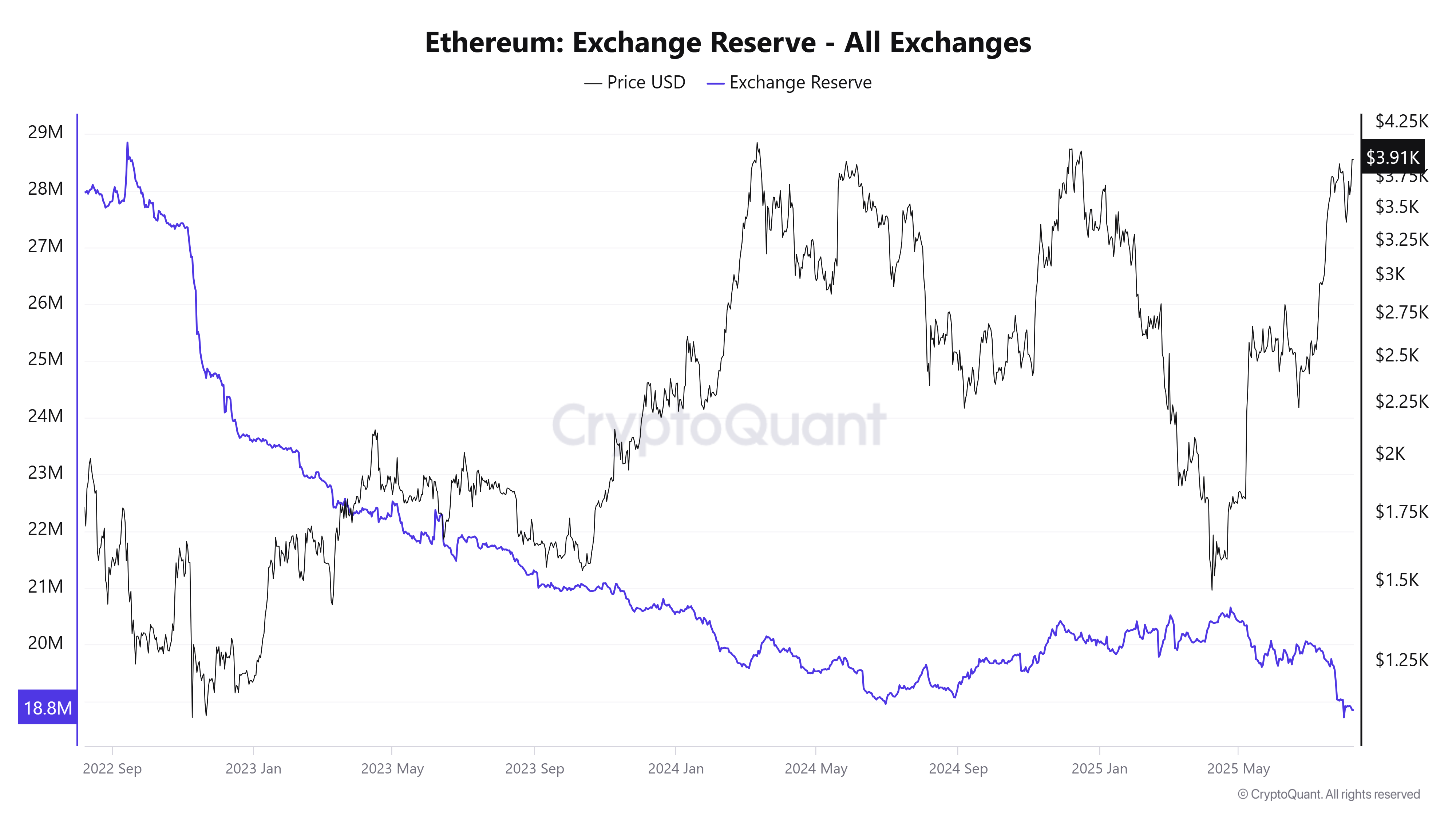

CryptoQuant data shows that Ethereum’s exchange reserves hit a new three-year low in early August, falling below 19 million ETH.

On August 8, ETH’s price approached $4,000. Yet, this price increase did not drive more investors to MOVE ETH onto exchanges, suggesting that holders are not rushing to take profits.

ETH’s strongest driver at the moment appears to be institutional demand. Strategic ETH Reserve statistics indicate that by the end of July, the total value of strategic ethereum reserves had exceeded $10 billion, with 2.7 million ETH. In just the first week of August, that figure jumped to $11.8 billion with over 3 million ETH.

This demand has helped ETH withstand potential selling pressures such as large amounts of unstaked ETH and selling from the Ethereum Foundation.

“As ETH price rises, exchange reserves are dropping. This shows more people are holding their ETH off exchanges, which is usually a sign of confidence in the long-term price,” investor BullishBanter said.

2. Chainlink (LINK)

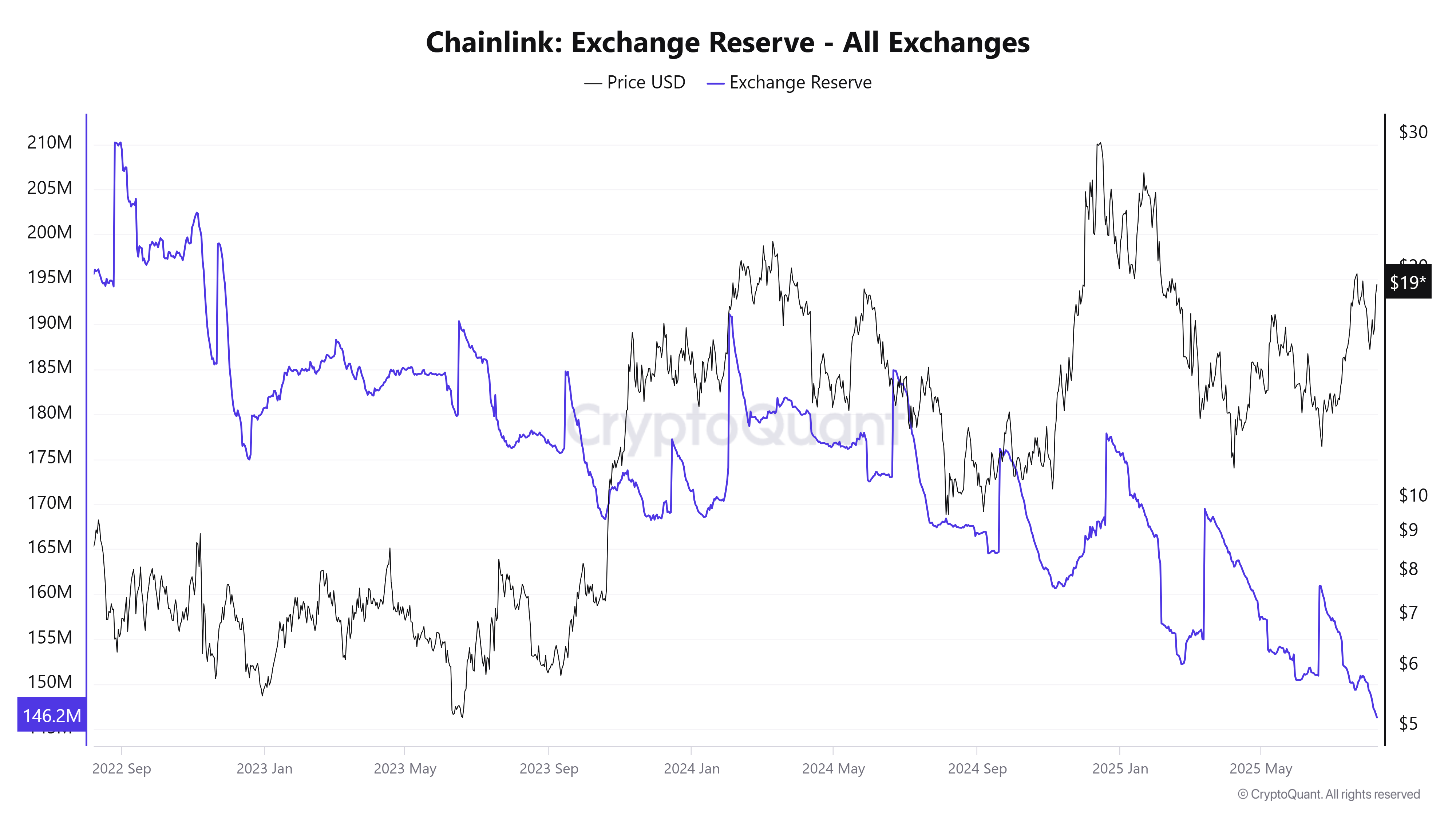

CryptoQuant data also shows that Chainlink’s (LINK) exchange reserves hit a new low in the first week of August. About 146.2 million LINK are available on exchanges, down 16% from the beginning of the year.

This decline in LINK supply on exchanges came as its price rebounded 15%, from $15.5 to over $19. This reflects a return of long-term accumulation sentiment for the altcoin.

“Now, think about the chainlink Reserve. Massive LINK supply shock incoming,” investor Quinten said.

In addition, recent Santiment data shows that when LINK’s price ROSE above $18.40, on-chain data recorded a 4.2% increase in wallets holding between $100,000 and $1 million worth of LINK. Accumulated supply also grew by 0.67% in August alone.

This coincided with Chainlink’s launch of Data Streams (real-time US stock/ETF data) on August 4 and the introduction of the Chainlink Reserve on August 7, which converts protocol revenue into LINK purchases.

3. Pi Network (PI)

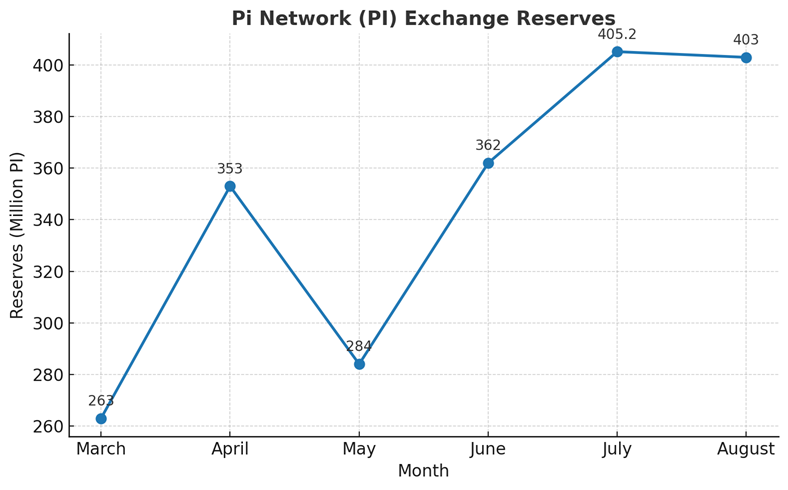

A late-July report from BeInCrypto warned that Pi Network (PI) holdings on exchanges had climbed above 405 million PI. However, according to Piscan data, that figure dipped slightly to 403 million PI after the first week of August.

Although the drop is small, it is still a positive sign after months of continuous increases in Pi’s exchange supply.

Notably, this early-August decline in PI on exchanges occurred while its price fell sharply by 10% to $0.366 in the first week of August. This suggests that Pi accumulation may return, as investors start seeing an opportunity to buy at significantly lower prices than during the open network phase.

However, exchange data should be monitored closely, as the decline is not strong enough to draw firm conclusions.