Jack Dorsey’s Block Skyrockets 10% Pre-Market—Riding the ’Saylorization’ Wave in Crypto’s Latest Power Play

Bitcoin maximalism goes corporate—again. Block joins MicroStrategy's billion-dollar bitcoin bet, and Wall Street scrambles to keep up.

The 'Saylorization' effect hits overdrive

When Michael Saylor turned MicroStrategy into a bitcoin proxy, critics called it reckless. Now Jack Dorsey's fintech firm is doubling down—and traders are piling in. Pre-market spikes don't lie: 10% gains signal bullish desperation for crypto exposure.

Wall Street's FOMO meets crypto's tribal warfare

Traditional finance still hates bitcoin's volatility... until their algos spot a trend. Block's move proves institutional adoption isn't about ideology—it's about chasing performance while pretending to care about 'decentralization.'

The punchline? Every corporate bitcoin buyer secretly hopes to become the next ETF—without those pesky SEC fees.

Block Increased Its Holdings By 108 Bitcoins In Q2

Filings with the US SEC (Securities and Exchange Commission) show Jack Dorsey’s Block Inc. bought 108 BTC in Q2. At the current rate, with bitcoin trading for $116,554 as of this writing, this BTC buy alone is valued at $12.58 million.

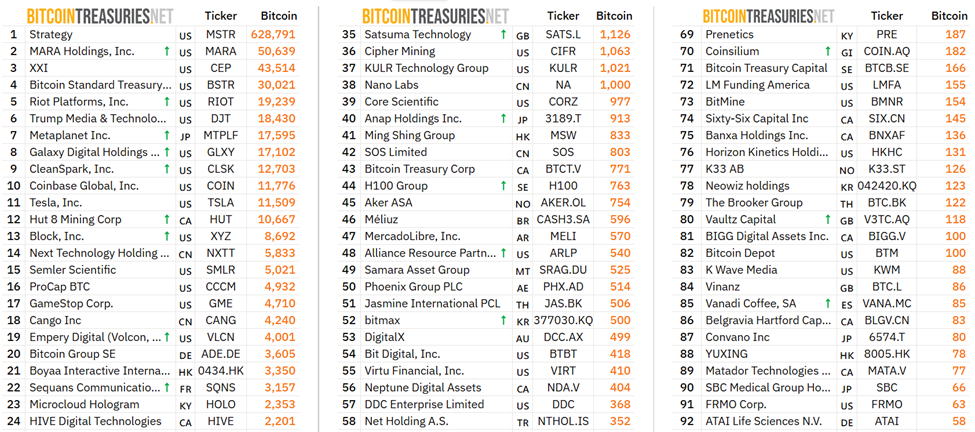

After the purchase, Block holds 8,692 BTC tokens, worth over $1 billion. With this, Block Inc. is effectively the 13th largest public company holding BTC.

The MOVE positions Block Inc. among firms pushing the Saylorization trend, alongside Twenty One Capital and MicroStrategy.

Recently, Bitcoin pioneer Max Keiser told BeInCrypto that corporations must mimic Strategy’s process to accumulate BTC lest they be left behind.

“For corporations to survive, they must mimic the Strategy’s process, they must ‘Saylorize’ or die,” Keiser told BeInCrypto.

According to Max Keiser, corporations adopting this strategy could help drive Bitcoin to $2.2 million per coin.

Meanwhile, in line with investor enthusiasm about firms adopting Bitcoin treasury strategies, Block’s XYZ stock recorded a notable surge, rising almost 10% in pre-market trading.

Block’s Q2 Returns Exceed Wall Street Forecasts

Beyond Optimism around Block acquiring Bitcoin, the surge in XYZ stock price pre-market follows a positive Q2 earnings report.

The report shows Block’s total revenue hit $6.05 billion in Q2, with gross profit rising more sharply. More closely, it climbed by 8.2% to $2.54 billion, attributed to Bitcoin-related revenue from Cash App.

Bloomberg reported that Block boosted its full-year profit outlook after its Q2 earnings exceeded Wall Street predictions.

Based on the report, strong growth in Block’s Cash App lending products and steady payment processing volumes through the firm’s Square merchant network contributed to the strong growth.

Therefore, the turnout points to continued confidence in Block’s fintech ecosystem and Bitcoin’s long-term value.

Meanwhile, though Block’s gross profit ROSE year-on-year (YoY), its Bitcoin holdings saw a revaluation loss of $212.17 million. Analysts ascribe this to a drop in Bitcoin’s fair value.

This means that as Bitcoin’s market price decreased, Block’s BTC holdings became worth less than before.