Solana Smashes Records—But Whale Dumps $70M SOL on Binance

Solana's network activity just hit an all-time high—so why's a mystery player cashing out $70 million?

Bullish signals meet bearish moves

The chain's firing on all cylinders with record transactions. Meanwhile, someone's making a quiet exit through Binance's backdoor. Classic crypto: everyone's winning until the whales start swimming away.

Timing is everything—or just another Tuesday

Seventy million doesn't vanish without leaving ripples. Whether this is profit-taking or panic-selling, it's a stark reminder: in crypto, even ATHs come with asterisks. (And yes, we see you, 'diamond hands'—keep telling yourself that.)

Solana Surges On-Chain, But Whales Are Quietly Selling SOL

According to SolanaFloor, in July, the network hit a new all-time high in monthly non-voted transactions. True transactions per second (TPS) averaged 1,318, the highest ever recorded.

![]() BREAKING: Monthly non-voted transactions on @Solana hit a new all-time high in July. True TPS also averaged 1,318, the highest ever recorded. pic.twitter.com/MPqnExdcgy

BREAKING: Monthly non-voted transactions on @Solana hit a new all-time high in July. True TPS also averaged 1,318, the highest ever recorded. pic.twitter.com/MPqnExdcgy

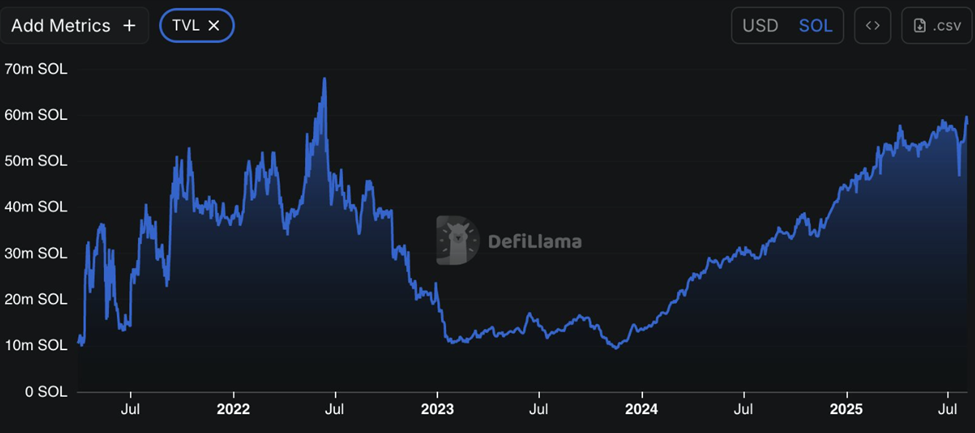

At the same time, DeFiLlama data shows that Solana’s TVL (Total Value Locked) in native SOL terms is now the highest it’s been in over three years. This points to growing stickiness among users and DeFi protocols.

Notwithstanding, behind the scenes, large holders or whales are unstaking millions in SOL and sending them to the Binance exchange.

Lookonchain flagged that Galaxy Digital unstaked 250,000 SOL, worth $40.7 million, and transferred it to Binance on Wednesday, August 6.

Galaxy Digital unstaked 250K $SOL($40.7M) and deposited it into #Binance 3 hours ago.https://t.co/2lK98Kbv6T pic.twitter.com/FzUJy4PBDL

— Lookonchain (@lookonchain) August 6, 2025Another whale, tracked by Onchain Lens, unstaked $4.9 million worth of SOL after two months of inactivity.

After four years of staking, that same address has quietly moved over $30 million in SOL to Binance in recent months. The whale still holds a massive $179 million in staked SOL, but the sell pressure is mounting.

The whale has unstaked 30,010 $SOL worth $4.9M and deposited 30,050 $SOL to #Binance, after 2 months of inactivity.

In the past 4 months, the whale has unstaked 205,072 $SOL, worth $30.07M, after 4 years of staking.

The whale still holds 1,108,368 $SOL worth $179M in staking.… pic.twitter.com/bPKfwywrNg

So, What Gives? Whales Rotate Out as Hyperliquid Steals Solana’s Spotlight

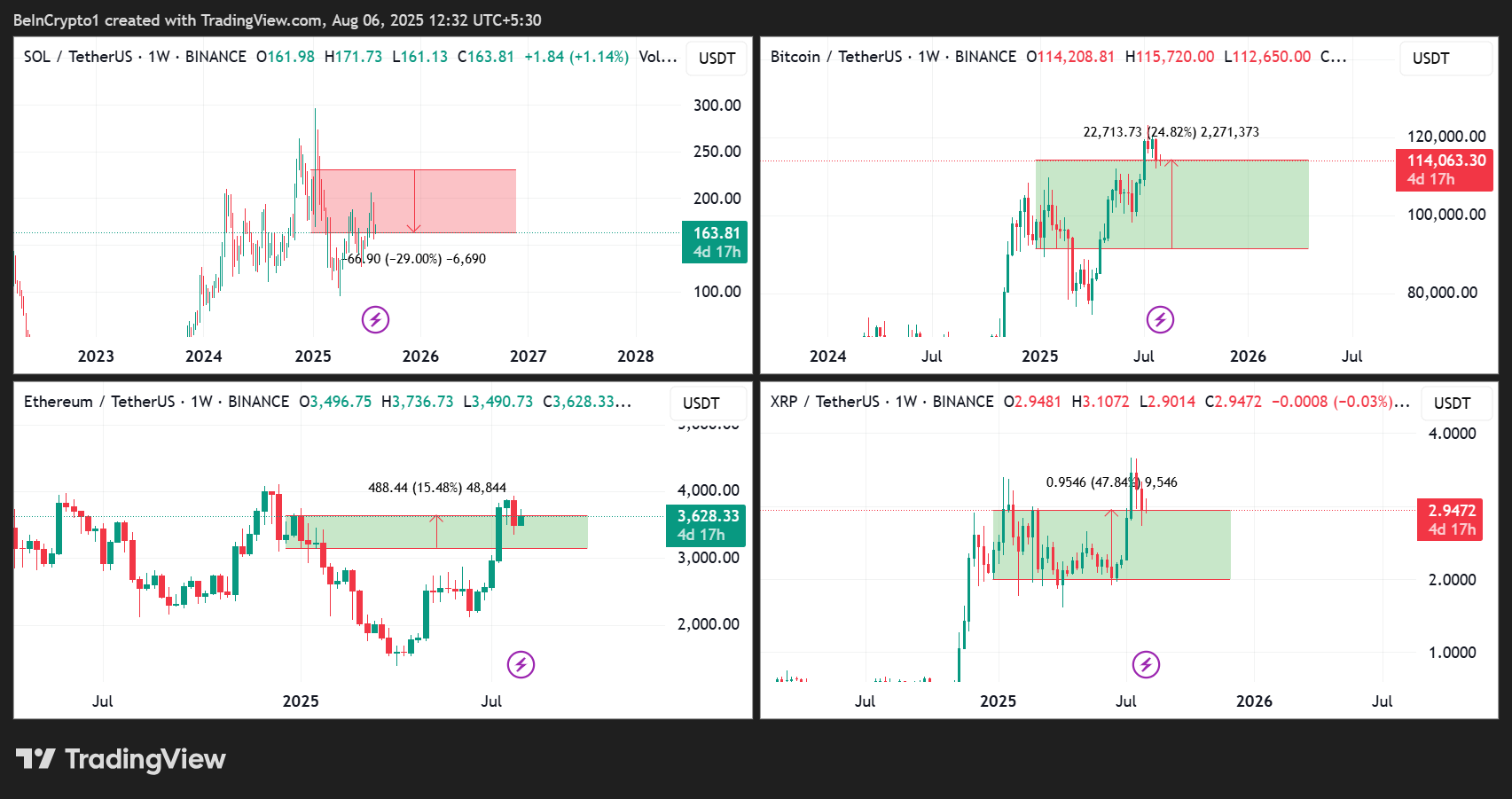

Despite the impressive activity on-chain, SOL’s price action has underwhelmed. Year-to-date (YTD), the Solana price is down nearly 30%, while BTC is up 26%, ETH 15%, and XRP 48%.

The biggest drag on Solana’s narrative has been Hyperliquid DEX. After a significant period as the undisputed hub for on-chain trading, Solana has lost ground to Hyperliquid’s perpetuals product, especially among power users.

“Hyperliquid was able to capture much of Solana’s momentum… because it offers a simple, highly functional product,” said Matthew Sigel, head of digital assets research at VanEck.

Meanwhile, Solana’s tech roadmap hit turbulence. Firedancer, the high-performance client meant to transform throughput and reliability, failed to deliver on deadlines.

Its internal drama, developer departures, and public disputes have dented confidence. According to Sigel, that uncertainty could be why whales rotate out, even as on-chain data flash bullish.

Still, not every big wallet is exiting. Analyst Ted highlighted a massive $12 million SOL buy on Binance that was restaked to Kamino Finance, suggesting some whales are buying the dip.

Meanwhile, Solana still boasts unmatched speed, and the ecosystem has matured beyond meme coins. However, institutions and serious capital need stability and trust, two things Solana’s engineering roadmap has not fully secured.

“Solana should focus on messaging not only around its capabilities, but also its long-term stability,” Sigel said.

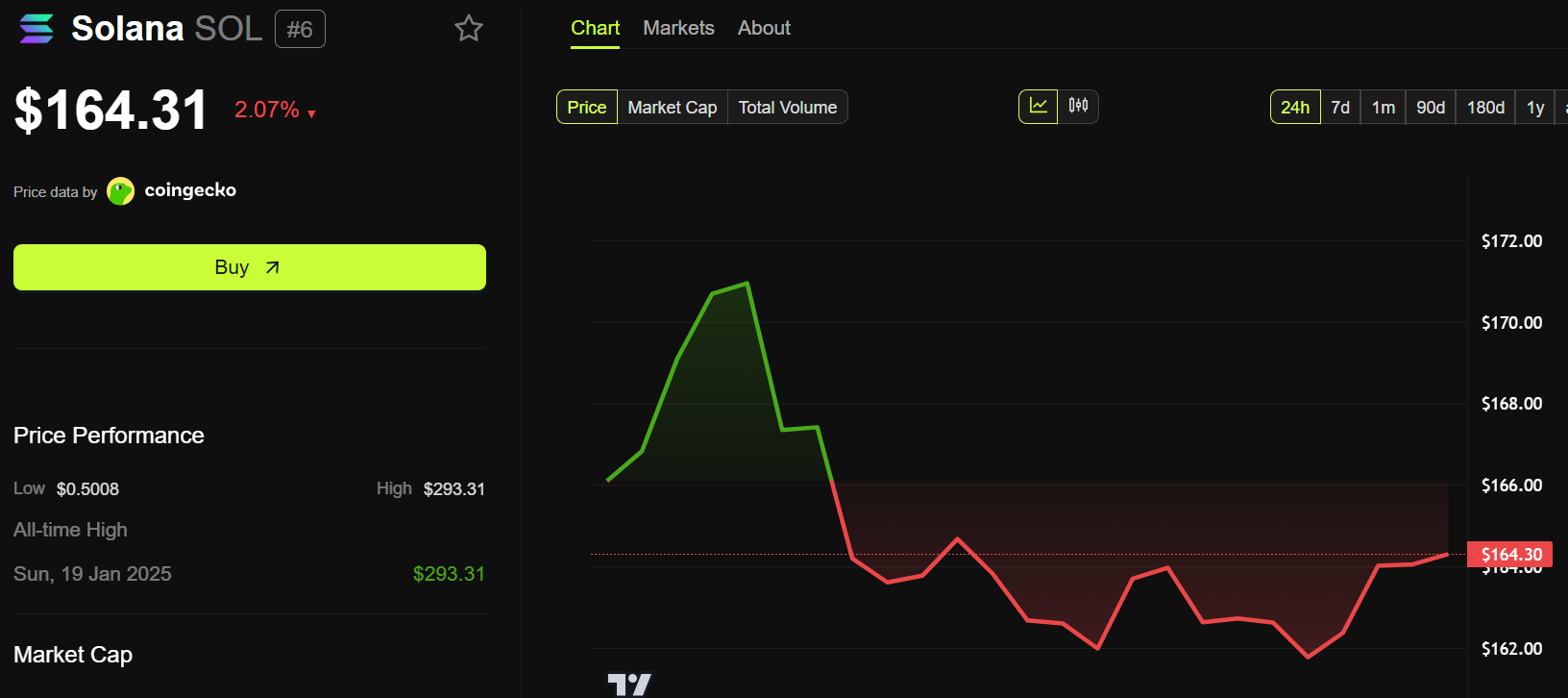

As of this writing, Solana was trading for $164.31, down by over 2% in the last 24 hours.